What is invoice data capture?

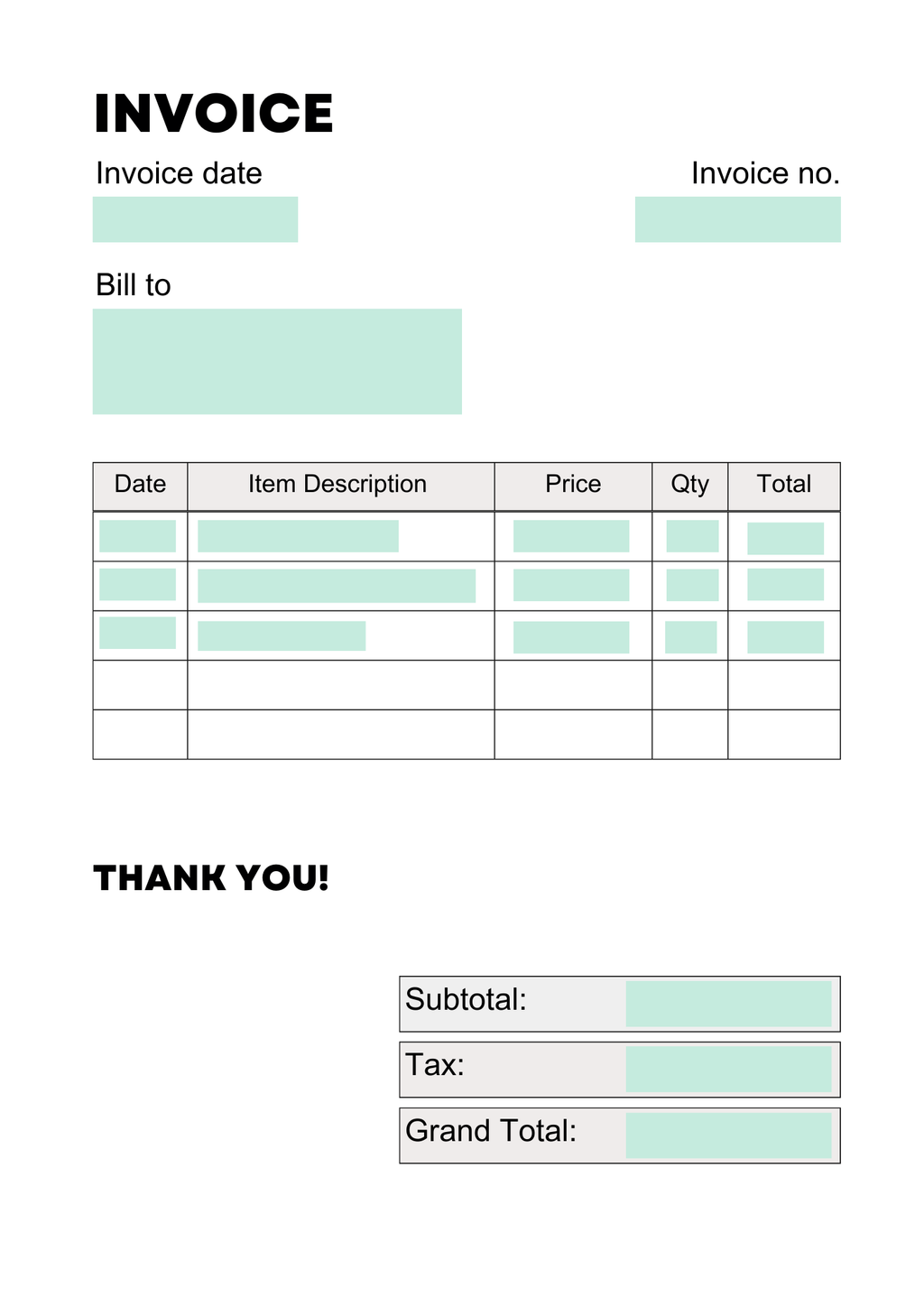

Invoice data capture refers to the process of extracting specific pieces of information from invoices. These invoices, which are typically in formats like PDF, paper, or electronic forms, contain crucial data for accounting and financial processes, such as the date of issue, invoice number, supplier details, items purchased, quantities, unit prices, and total amounts due.

Key takeaways

- It takes 11 days to process a single invoice.

- Manual invoice data capture leads to typos and missed entries.

- Automated invoice processing benefits organizations in terms of cost and efficiency.

Invoice data capture, also known as invoice processing is the process of extracting information from invoices and receipts such as invoice numbers, dates, payment amounts, and line items.

As technology continues to evolve and businesses increasingly rely on digital tools, invoice data capture has emerged as a critical area of focus for organizations looking to improve their efficiency.

In this article, we'll explore invoice data capture, its evolution over time, the technologies around it, and how it can transform your business operations in 2026.

Challenges of manual invoice processing

Back in the early days, businesses used to manually record their financial transactions, but this was a time-consuming and error-prone process.

According to a report "The State of ePayables in 2022" published by Ardent Partners, accounts payable (AP) teams spend over $10 to process a single invoice, and it takes nearly 11 days to do that.

- Even in 2026, there are still quotations and invoices that are processed on paper. Information can get lost while manually processing them. The manual process of keying in data from paper or digital invoices is laborious and can take a lot of time, which can delay payment processing.

- Manually going through invoices leads to human errors such as typos or missed entries. These errors can lead to incorrect payment amounts, which can have a negative impact on vendor relationships.

- Businesses may need to hire additional staff to handle the volume of invoices, leading to increased overhead costs.

Overall, manual invoice processing presents several challenges for businesses that can be addressed by implementing automated invoice data capture solutions that can streamline the process and reduce errors.

Benefits of using an invoice data capture software

An invoice processing software is an automation tool that uses algorithms such as machine learning (ML) or natural language processing (NLP) to read, scan, and extract invoice data.

"The accounts payable invoice automation market is quickly evolving as government regulations push organizations to digitize." - Gartner, 2021.

Here are some of the benefits of using an invoice automation tool:

- Increased data accuracy

Invoice parsers can highly limit the number of errors and duplicates while processing invoices. This reduces the need for manual data entry - the automation tool can also cross-check invoices by matching data from its database.

- Faster processing time

An invoice processing tool can process invoices faster than manual processing, enabling businesses to process invoices and make payments more quickly. This can free up staff time and resources, allowing businesses to focus on more strategic activities.

- Seamless integration with ERP tools

The account payable software can easily be integrated with ERPs (enterprise resource planning) or QuickBooks. You can create an automated workflow from data extraction to exporting data to accounting software, for example.

- Reduce cost of processing

Compared to manual processing, using automated solutions to process your receipts can reduce your cost up to a 1000 times!

Choosing the right invoice data capture software

When choosing an AP automation software solution for your business, it's important to look for features and capabilities that will help streamline your invoice processing and improve efficiency.

Here are some key factors to consider when evaluating AP automation software options:

- How much volume of invoice data are you generating?

- Do you have coding knowledge? If not, then a tool without parsing rules would be better.

- Are you looking for a cloud-based solution?

- Do you need specific technologies such as AI or deep learning?

- Can the invoice tool integrate with other business systems, such as accounting software and ERP systems, to streamline the invoice processing workflow?

Parseur: The best invoice data capture tool in 2026

Parseur is an AI data invoice extraction tool Parseur integrated with advanced technologies for data parsing. The invoice parser has a built-in AI-assisted template designed for invoices, purchase orders and receipts. Compared to other invoice parsers, it doesn't require any coding knowledge and parsing rules.

Process of digitizing an invoice with machine learning & OCR

Data can be extracted from invoices automatically in a few simple steps:

- Forward the scanned invoice or PDF invoice to the invoice OCR.

- List all the fields that you need.

- The AI tool will extract data automatically.

- Verify the parsed invoice data.

- Download the data or export it to another accounting tool via an invoice API.

I received every month 30 invoices. Every invoice I need to upload it to my app. It took me about 4 days every month. Now I create 1 email inbox for all incoming invoices, and Parseur sends me data to my webhook from PDF invoices.

- Shifra

The future of AI invoice data capture

"The issue of whether you should automate accounts payable really isn't up for debate anymore." - IOFM, Institute of Finance & Management.

While invoice data capture has already come a long way with the adoption of OCR technology and AP automation software, there are several emerging trends and technologies that are poised to transform the process even further.

With blockchain, for example, businesses can ensure the security and accuracy of their invoice data, while smart contracts can automate the entire invoicing process and eliminate the need for manual intervention. The IoT can enable businesses to capture and process invoice data in real time, enabling faster and more accurate decision-making.

Further learning

- Extract data from invoices with python

- Traditional invoicing vs AI invoicing

- How to automate AP process with AI?

- How to send invoice data to ERP?

Last updated on