Efficient invoice processing is critical for businesses aiming to streamline financial operations, maintain accurate financial records, and enhance vendor relationships. Traditionally, managing invoices involves tedious manual entry, verification, and approval steps, leading to increased operational costs, human errors, and slower processing times.

Let's see how Parseur can help your company reduce the time spent on invoice processing by by not 50%, not 75%, but a whopping 100 times; saving tens of thousands of dollars every month.

The average cost to process a single invoice is $22.75.. Manually processing invoices costs time, money, and labor, and does not come without its challenges. At the end of the day, you want to reduce labor expenditures and optimize your business in a more productive manner.

The global market is forecasted to encompass 550 billion invoices annually and is expected to quadruple in size by 2035.

What if we told you there's a golden ticket to automating your invoice processing, saving you a fortune and freeing up precious resources? That's right, we're bringing in the big guns - artificial intelligence, PDF parsing, and optical character recognition.

Key takeaways:

- Automated data extraction significantly reduces human error, ensuring accuracy and consistency across financial documents.

- Parseur offers extensive integration options, allowing automated invoice data to be instantly sent to financial applications, accounting software, or ERP systems, enhancing overall workflow automation.

Challenges of manual invoice data entry

In simple terms, invoice processing means entering invoice details into a system. Suppliers' invoices come in all shapes and forms, making invoice data entry difficult. The effort to input an invoice in an accounting software can take up more than a couple of minutes.

According to Business Insider, analog accounts payable processes can take 30 to 90 days.

Human errors

Manually processing a high volume of invoices leads to more human errors as well. For example, your employees might not spot line item errors or typos the find time they are processing an invoice. It's only after they have realized that the purchase order does not match the invoice, that the error will be discovered.

Moreover, mistakes and processing quality issues will happen when hand-keying invoices. Quality issues are solved by implementing spot checks (checks on a random pool of invoices). But that, of course, also costs time and effort.

Risk of fraud

Accounts payable departments are more susceptible to internal and external fraud. Your staff might not be able to detect fraud quickly if they are processing hundreds of invoices on a daily basis.

Payment delays and duplicate payments

Another common data entry error that can occur is double payment. Payment delays happen, especially during peak season such as Black Friday or Christmas, as manual data entry is time-consuming, and if you want to get things quicker, you'll have to hire more staff resulting in more business costs.

39% of businesses report that duplicate payments and overpayments represent more than 1 % of their payments

AP automation saves you a lot of your company's time while also improving processing quality and reliability. An automated workflow updates your systems in real-time and reduces spot checks to a minimum. Let your collaborators focus on your company's core business instead of spending time doing manual processing!

What is automated invoice processing?

In simple terms, automated invoice processing allows businesses to process invoices with zero human intervention. Incorporating invoice software into your business processes will automate mundane tasks.

Benefits of invoice automation

More firms are turning to automated accounts payable software so that they can cut down on costs and improve business efficiency in the long run. Here are just some of the ways it can help:

Increased efficiency

Automating invoicing means that you don't have to manually enter data into multiple systems or spend hours chasing down customers for their payment details. You can also design your invoices to include all the information you need in one place, so you don't have to go searching through multiple documents for details.

Time and cost savings

By automating invoicing, you can reduce the amount of time and money spent on processing payments and chasing down overdue invoices - allowing you to focus on other important tasks in your business. This could include increasing sales by offering new products or services, or reducing costs by outsourcing certain aspects of your business.

A benchmark made at Parseur in June 2024, concluded that on average a customer of Parseur document processing tool saves about 150 hours of manual data entry and about $6,413 every month.

- Parseur statistics, June 2024

Improved customer service and retention rates

Customers value good customer service and are more likely to use companies they trust and feel comfortable dealing with - which is why automated invoicing helps provide better support for them throughout the entire payment process.

How to automate invoice processing?

Invoice data capture can be automated in three ways:

- Gathering and scanning the PDF invoices

- Extracting data from the invoices as per specific requirements

- Sending the invoice data to an ERP or other accounting software

Parseur: The best AI invoice automation tool

Parseur is an invoice extractor that has a powerful AI engine. Use the PDF parsing tool to extract data from invoices received as emails, PDFs, CSVs, or other text-based attachments.

What Parseur does best as an AI invoice tool?

- You don't need to train the AI model compared to other AI tools.

- Parseur has predefined mailboxes for specific industries. In this case, Parseur has an invoice mailbox whereby data is extracted automatically.

- It can easily extract data from tables irrespective of the number of items in an invoice, which is a must-have when processing invoice line items.

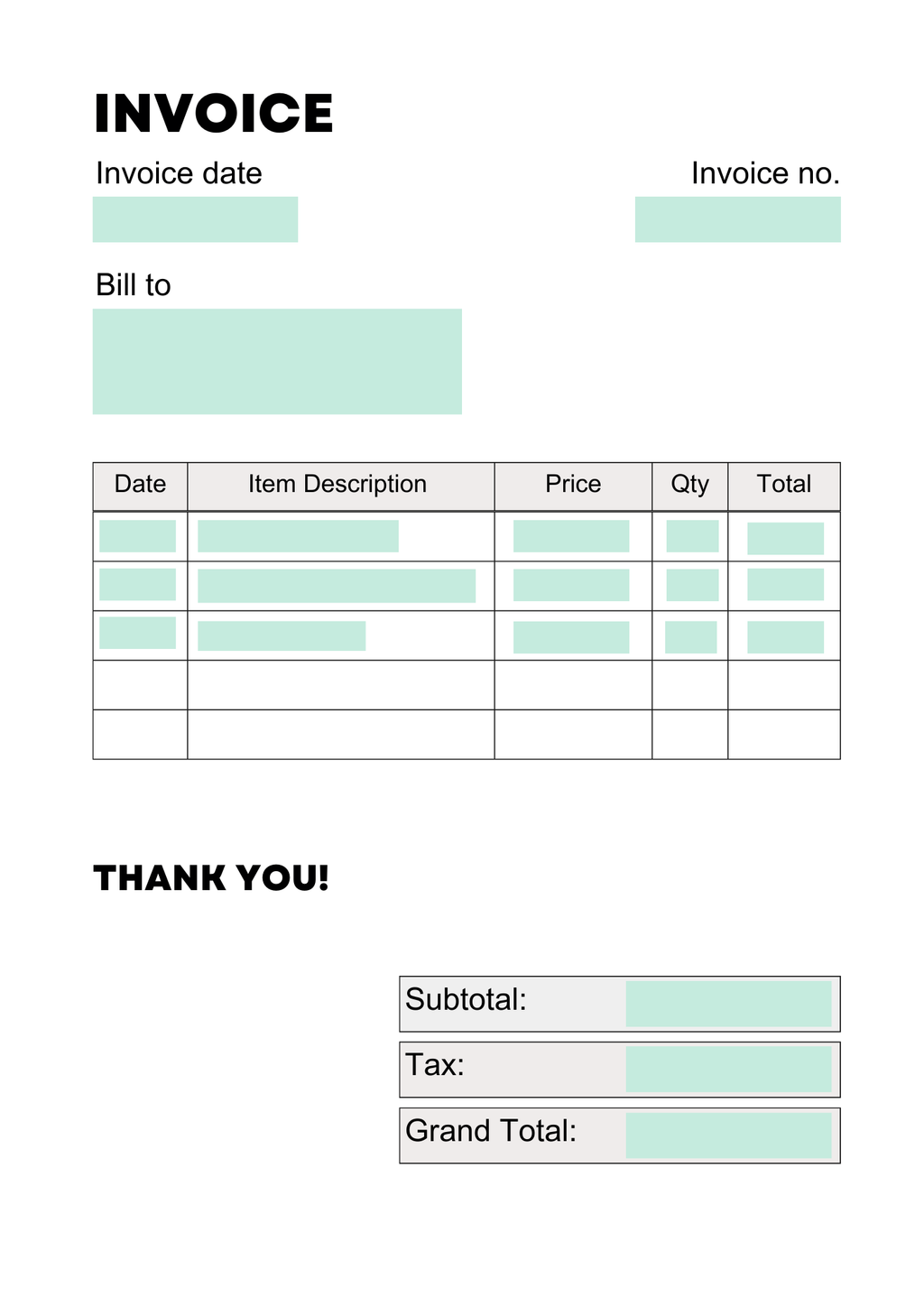

What data fields to capture in an invoice?

Fields to capture will depend on your type of business and the local legislation.

The following fields are usually common on an invoice, and you will want to capture them most of the time:

- Invoice date

- Invoice number (usually a unique sequential number identifying the invoice)

- Supplier name

- Supplier address

- Customer name

- Customer address

- Line items containing a description and quantity of goods (or services rendered)

- Price excluding Tax

- Tax rate applied

- Tax amount

- Total price (including Tax)

The following fields are usually optional, and you may or may not be required for your invoice processing:

- Invoice due date

- Supplier tax identification number

- Customer tax identification number

- Unit price of goods and services

- Shipping address

- Purchase order number (PO number)

- Any other required legal mention, terms and conditions, reference to applicable legislation, legal mentions related to the type of invoice (reverse charge, margin scheme, self-billing, etc.)

How to create your own AI invoice automation tool?

Parseur is free to start with all the features available.

An invoice processing workflow with Parseur has the following steps:

The invoice is sent to the invoice automation software

This can be done by forwarding the invoice to your Parseur mailbox or uploading invoices directly to the Parseur app.

Data is extracted from the invoice automatically

If you need specific data to be parsed, then you need to list the correct data fields so that the AI parser can pick it up.

Export your parsed invoice data

Now that your mailbox is up and running, you can send your data extracted from your documents wherever you want it to be:

- In a live Google Sheet that will update every time a new email is processed by Parseur

- To hundreds of accounting applications and CRMs through our integration with Zapier, Make, and Power Automate

- To your custom application through an HTTP webhook or invoice API

Automating AP invoice processing with AI

Invoice processing is a fundamental yet complex aspect of financial management, often burdened by manual inefficiencies and prone to costly errors. By implementing Parseur's advanced AI-powered solution, businesses can transition from manual, error-prone processes to streamlined, automated operations that enhance efficiency, accuracy, and compliance. Automating invoice processing with Parseur not only boosts operational effectiveness and reduces costs but also empowers finance teams to focus on strategic growth initiatives. As businesses continue to embrace digital transformation, adopting solutions like Parseur ensures long-term sustainability, competitiveness, and financial excellence.

Last updated on