Automating accounts payable (AP) streamlines invoice processing by transitioning from manual entry to an automated workflow that extracts, verifies, and exports invoice data into accounting systems. This reduces manual errors, shortens approval cycles, and lowers the cost of processing invoices.

Key takeaways:

- The cost of processing an invoice digitally is $2.36, compared to $15 for manual invoices.

- Automated AP gets your bills paid faster than traditional methods.

- Parseur helps to automate accounts payable automatically.

Welcome to the world where accounts payable doesn't mean piles of paper, endless hours of data entry, and the ever-looming risk of human error.

What is Accounts Payable?

Accounts payable (AP) refers to the amount of money that a company owes to its suppliers or creditors for goods or services purchased on credit. It represents a company's obligation to pay off short-term debts to its vendors or suppliers. Accounts payable is listed on the company's balance sheet under current liabilities, as these obligations are typically due to be paid off within a year.

Challenges With Traditional AP

Picture this: it’s month-end, your inbox is overflowing with invoices, and you’re buried in spreadsheets trying to match POs, vendor names, and amounts. Many finance teams are all too familiar with this situation.

Invoice overload:

When invoices arrive from multiple vendors and channels, such as PDFs, emails, and scanned copies, it becomes difficult to track what has been received and what’s still pending. Finance teams often spend hours just organizing and sorting documents before any real processing begins.

Late payments:

Delays in approvals and manual routing can easily cause payment bottlenecks. Missing due dates not only affects vendor relationships but can also lead to lost early payment discounts and cash flow strain. Over time, these delays impact financial forecasting and the credibility of financial forecasts with suppliers.

Data entry errors:

Manual data entry is time-consuming and error-prone. A misplaced digit or incorrect vendor code can delay reconciliation or trigger compliance issues. These small mistakes add up, requiring extra hours of review and rework, as well as potential financial discrepancies during audits.

In short, traditional AP processes create inefficiencies that drain productivity and increase operational costs, making automation not just a convenience but a necessity.

A Typical Day In An Accountant's Life

For many finance professionals, accounts payable is more than just a routine task; it’s a high-stakes responsibility. A single mistake in data entry or missed payment can lead to costly financial discrepancies and strained vendor relationships.

Each day often involves:

- Reviewing and verifying every incoming invoice for accuracy

- Manually extracting key invoice details like vendor names, dates, and amounts

- Entering data into accounting systems and double-checking for errors

- Managing approvals, payment schedules, and reconciliations, often under tight deadlines

While these tasks may seem straightforward, they require precision, focus, and time - three things that are often in short supply during busy accounting cycles.

The need for automation

As invoice volumes grow and deadlines tighten, even the most experienced accountants find it challenging to keep up with manual workflows. Data entry and verification hours could be better utilized on strategic tasks, such as financial analysis or forecasting. This is precisely where automation transforms repetitive, error-prone processes into simple, intelligent workflows.

This is where AP automation swoops in

The accounting software market size is estimated at USD 19.74 billion in 2024 and is expected to reach USD 30.66 billion by 2029.

The accounting market is a competitive one and chances are that your competition has already embraced technology for better efficiency.

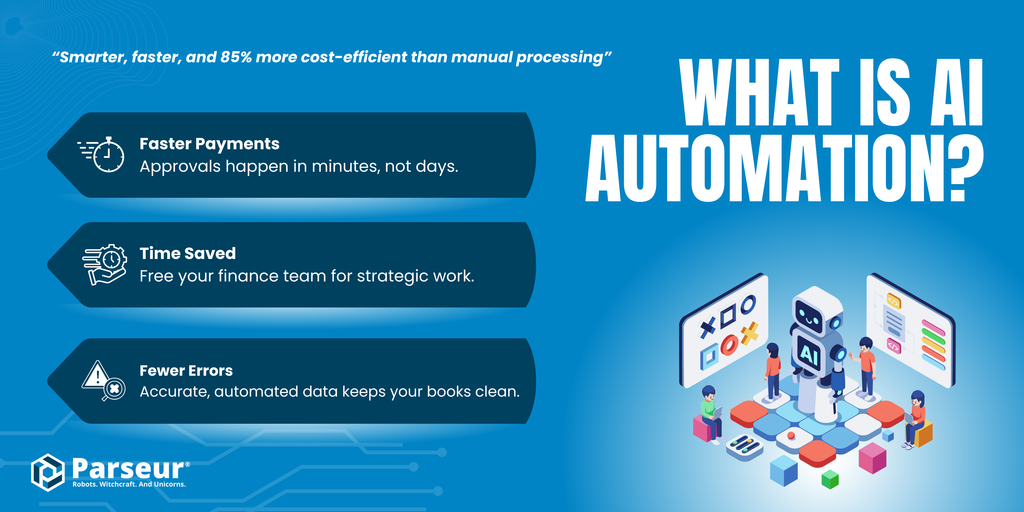

What is AP automation?

In such a competitive space, staying ahead means working smarter, not harder. That’s where accounts payable (AP) automation comes in. Instead of relying on manual entry, AP automation digitizes and simplifies every step from invoice capture to validation and export, minimizing human error and speeding up approvals.

Modern AP automation combines AI, OCR, and machine learning to extract data instantly, verify accuracy, and route invoices to the correct destinations, eliminating the need for spreadsheets or late-night data entry.

And the impact? Processing an invoice digitally costs just $2.36, compared to $15 for manual processing, proof that automation isn’t just faster; it’s also more cost-efficient.

Benefits of automating AP processes

With automation, invoices move faster through approvals, payments are made on time, and your team regains valuable hours. There is no more manual entry or chasing down missing details; the system handles it all.

- Faster payments: Approvals and processing happen in minutes, not days.

- More time saved: Free your finance team from repetitive tasks and focus on strategy.

- Fewer errors, more savings: Automation minimizes mistakes and keeps your books accurate.

How to automate accounts payable?

Enter Parseur, your sidekick in the AP adventure! It's like having a robotic assistant, but cooler.

Parseur stands at the forefront of AP automation, offering a robust solution that integrates seamlessly with your existing financial systems.

Parseur also speaks the language of invoices from all corners of the globe (more than 160 languages, to be precise).

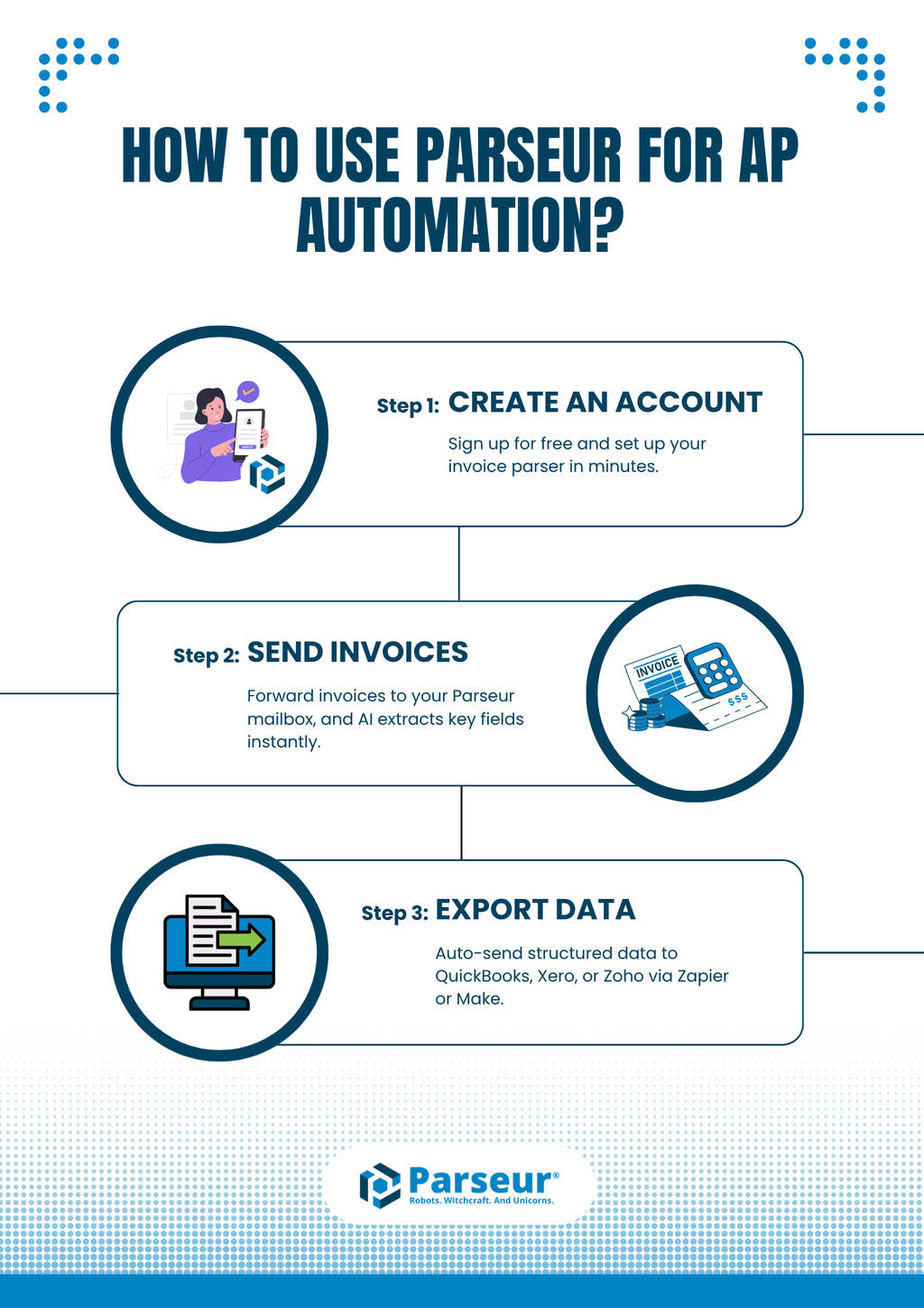

Step-by-step guide on using Parseur for AP

Step 1: Create Your Parseur Account

Start by signing up for a free Parseur account. Once your account is set up, you can establish an invoice parser within minutes.

Step 2: Send Your Invoices to Parseur

Forward your invoices directly to your Parseur mailbox. The platform's AI-powered parsing engine automatically detects invoice data and extracts key fields.

Step 3: Automate Data Export

After parsing, you can send your structured invoice data to any accounting platform, such as QuickBooks, Xero, or Zoho Invoice, through direct integrations or workflow tools like Zapier and Make.

The Quick Rundown

No more chasing missing details or spending hours on manual entry, Parseur takes care of it for you. It’s more than just a tool; it’s your reliable partner in transforming accounts payable from a manual process into a fully automated workflow. Embrace the power of automation and let Parseur simplify your AP process from start to finish.

Other invoice resources:

- Traditional invoicing vs AI invoicing

- How to automate invoice extraction?

- How to extract invoice data?

- What is invoice data capture?

- Extract data from invoices with python

- How to send invoice data to ERP?

Frequently Asked Questions

Managing invoices can be complex, but automating accounts payable doesn’t have to be. Below, we’ve answered the most common questions about AP automation and how Parseur helps finance teams simplify invoice processing, save time, and reduce manual effort.

-

What is AP automation?

-

Accounts Payable (AP) automation uses AI and OCR technology to automatically extract, verify, and organize invoice data before sending it to your accounting system. It eliminates manual data entry, reduces errors, and speeds up payment approvals.

-

How does Parseur help automate accounts payable?

-

Parseur extracts key invoice fields, including vendor name, date, amount, and payment details, from emails, PDFs, and scanned documents. It then sends that structured data directly to tools like QuickBooks, Xero, or Zoho Invoice, saving hours of manual input.

-

Does Parseur work with all invoice formats?

-

Yes. Parseur can handle invoices in multiple formats and layouts, including scanned PDFs, email attachments, and text-based files. Its AI-powered engine automatically adapts to new document structures without a complex setup.

-

Can I integrate Parseur with my existing accounting software?

-

Absolutely. Parseur seamlessly integrates with thousands of apps via Zapier and Make, enabling automatic data flow into your preferred accounting, ERP, or payment systems.

-

How accurate is Parseur’s data extraction?

-

Parseur’s AI engine achieves accuracy rates between 90-90%, significantly reducing human error and ensuring your financial data stays clean and compliant.

Last updated on