AI invoice processing - how to automate invoice extraction?

Are you ready to transform your accounts payable process from a manual burden into a streamlined, automated powerhouse? AI invoice processing is rapidly becoming essential for businesses looking to improve efficiency, reduce costs, and ensure compliance. This article will walk you through everything you need to know about AI-driven invoice processing, from how it works and the benefits it brings to common challenges and industry-specific applications.

Key takeaways:

- AI invoice processing can reduce processing time by up to 80%, streamlining workflows and increasing productivity.

- AI-powered tools such as Parseur reduce human error, ensure data accuracy and create a transparent audit trail, enhancing regulatory compliance.

- Innovations like blockchain and predictive analytics promise to further advance invoice processing, making it even more secure and insightful.

Traditional OCR has its limitations.

Regular OCR only converts data into plain text and cannot process invoices in different formats or layouts. Most invoices contain tabular data, and it may not be possible to read that data accurately.

Compare traditional OCR with AI OCR.

We are all humans; mistakes happen, even if we're careful. Unfortunately, errors are costly to the company and the client as well. One small mistake can cost billions of dollars to rectify.

If your company works with large amounts of data, you can expect anywhere from 0.5 to 4 errors per 10,000 entries with double entries.

Remember when a clerical error cost Citibank $900 million? Traditional AP (Accounts payable) workflows rely on manual data entry and are prone to delays and errors.

Manual invoice processing costs an average of $12 per invoice, while AI processing can reduce costs to $1.50-$2.00 per invoice.

AI reduces human error, which costs companies over $1 trillion annually across industries—IBM's Cost of Human Error report.

Applications of AI in invoice processing

AI-powered invoice processing does a lot more than just automate data entry. It simplifies workflows, boosts accuracy, and helps companies stay compliant across various industries. Here’s a closer look at how AI is making an impact.

Data extraction

Regardless of format, AI-based optical character recognition (OCR) automatically extracts key invoice data, such as vendor information, total amounts, and due dates. This saves time and helps prevent errors that often occur with manual data entry.

Streamlining approval workflows

With AI, invoices can be routed for approval based on customized rules, such as invoice amounts, departments, or specific vendors. This means less time chasing down approvals and more time for team members to focus on high-value work.

Fraud detection and compliance

AI can catch unusual patterns that might signal fraud or errors, such as duplicate invoices or mismatched vendor information. By learning from past transactions, AI tools can flag anything that looks wrong, helping companies stay compliant and protected.

Smooth integration with ERP and accounting systems

AI-powered invoice tools often integrate seamlessly with ERP and accounting software such as Quickbooks and Xero, so invoice data flows directly into financial systems. This reduces the need for manual data entry, keeps records accurate, and makes it easier to stay on top of accounts payable.

Predictive analytics and spending insights

AI can analyze invoice trends to provide insights into future spending and cash flow needs. This helps businesses better plan their budgets, optimize vendor relationships, and negotiate more favorable terms.

Real-time reporting

AI-driven dashboards offer a real-time view of invoice metrics, such as processing times, invoice volumes, and payment statuses. This transparency makes it easier for managers to make data-driven decisions and spot any process bottlenecks.

Benefits of AI Invoice Processing

Companies benefit from AI technology in several ways, such as boosting productivity and reducing costs.

High accuracy with reduced errors

The more you train the AI model, the more accurately it can process data. Automating invoices reduces labor costs, achieving 30-50% cost savings on AP operations.

Faster data processing

An AI invoice tool captures and processes invoice data within seconds. It can process invoices up to 80% faster than traditional methods.

Seamless integration with other applications

AI tools can easily extract data from different sources and export that data to other applications automatically.

Technologies involved in AI invoice processing

- Optical Character Recognition (OCR): Extracts text data from invoice images.

- Machine Learning: Identifies patterns and learns over time to improve data extraction accuracy.

- Natural Language Processing (NLP): Assists in interpreting unstructured data and classifying invoice information accurately.

Use Cases and Industry Applications

Manufacturing

Manufacturers handle large volumes of invoices, often from global suppliers. With AI, companies can standardize invoice processing, improve payment accuracy, and reduce delays, leading to stronger supplier relationships.

Retail and E-commerce

AI invoice processing ensures fast, error-free payment cycles, allowing retailers to keep up with high transaction volumes, especially during peak seasons.

Healthcare

Healthcare organizations process invoices for medical supplies and patient billing. AI-driven invoice processing ensures compliance with healthcare regulations, provides a reliable audit trail, and reduces manual work.

Logistics and Supply Chain

Logistics companies benefit from faster invoice reconciliation, reducing shipping delays, and better cash flow. AI automation minimizes administrative workload and speeds up dispute resolution for incorrect invoices.

How to extract invoice data with Parseur?

Parseur offers a comprehensive, user-friendly solution for AI invoice processing. It can handle high invoice volumes with speed, accuracy, and integration flexibility. With up to 50% cost savings, seamless integration, and industry-leading accuracy, Parseur is a top choice for businesses seeking efficient, scalable, and secure accounts payable automation.

How does AI invoice processing work?

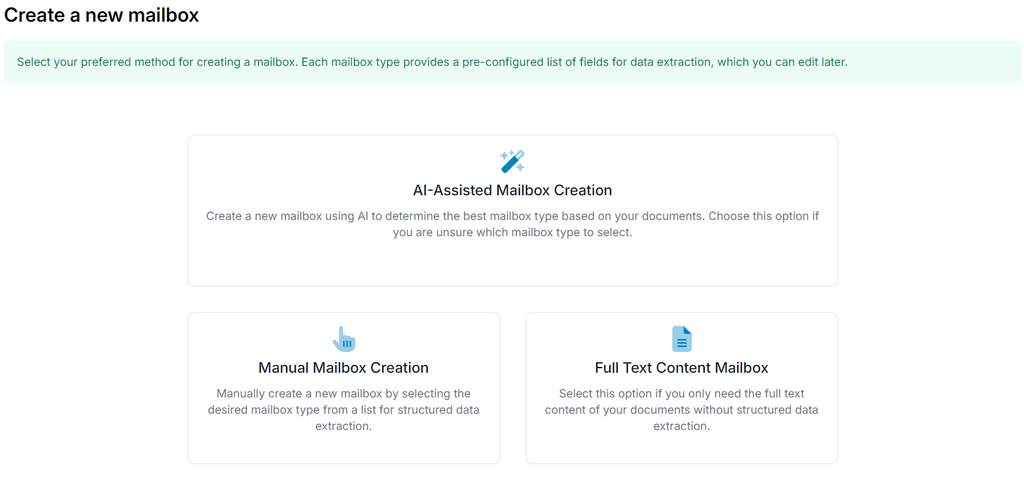

Step 1: Create an AI invoice mailbox

Parseur is easy to set up, and we have a free plan to test all the features.

Step 2: Use Parseur AI to process invoices

The invoices will be processed instantly like magic.

If you need specific data, then simply list the fields that you want to extract and the AI parser will understand.

Step 3: Send invoice data to any accounting software or ERP

You're free to manipulate the parsed data as per your requirements. Parseur makes it easy to integrate with other accounting apps via Zapier or Make. You can also download the invoice data into CSV or JSON format. Parseur’s AI-powered system performs each step precisely, providing accounts payable teams with a seamless experience by eliminating time-consuming manual data entry.

Happy Customers. Proven & Tested

In my case, I'm using it in combination with Zapier, mostly to parse mails and invoices. Besides a great piece of software to use, what I always want to get from a SaaS-Tool is an even more awesome support and that's exactly what you get from Sylvestre and his team.

- Sebastien Maier

Future trends in AI invoice processing

- Blockchain Integration: Blockchain may provide secure, decentralized record-keeping, enhancing invoice authenticity and compliance.

- Predictive Analytics: Using AI to forecast trends in AP, allowing businesses to manage cash flow better.

- Advancements in NLP: Improved NLP will lead to more precise data extraction from complex, unstructured invoices.

Parseur is committed to staying at the forefront of these advancements, continually updating its AI capabilities to provide clients with the most advanced solutions.

Frequently Asked Questions

Here are all of your questions answered about AI invoice processing.

-

What is AI invoice processing?

-

AI invoice processing uses technologies like OCR, NLP, and machine learning to automate and streamline the accounts payable process.

-

How does AI improve efficiency in invoice processing?

-

AI reduces data entry times by up to 80%, minimizes errors, and offers real-time insights into invoice status.

-

Is AI invoice processing secure?

-

Solutions like Parseur implement encryption and access controls to ensure data privacy and compliance.

-

Can AI invoice processing integrate with my current accounting software?

-

Parseur’s solution integrates with popular systems like SAP, QuickBooks, and others through APIs, making it adaptable for diverse business needs.

Last updated on