Key takeaways:

- Commercial health insurers have an average claims-processing error rate of 19.3%

- AI-based systems led to an increase of 73% in cost-effectiveness.

- Parseur extracts insurance data automatically with AI.

From automating mundane tasks to detecting fraud, AI is the sidekick every insurance agent dreams of. And the cherry on top? Parseur! The ultimate tool for extracting data from claims, making your life easier than ever.

The old school life of insurance agents

Don't get us wrong - we love a good old school life. Ah, the 80's music! But, traditional insurance processing doesn't seem fun.

What does the world of traditional insurance claim processing look like?

- Agents often find themselves buried under mountains of paperwork, trying to spot that one crucial piece of information.

- Different types of insurance have different processing times. Reviewing and entering data by hand takes time. For instance, a straightforward property damage claim might be resolved quicker than a complex liability claim in auto insurance.

- The speed of processing is also dependent on how quickly and thoroughly the claimant provides the necessary documentation and information.

- With manual entry comes the dreaded risk of errors.

If an insurance company is experiencing a high volume of claims, it may take longer to process each claim. - Voss Law Firm

According to the AMA's research, commercial health insurers have an average claims-processing error rate of 19.3 %.

AI for insurance claims in 2024

AI technologies, like machine learning and natural language processing, have transformed claim processing from a nightmare into a streamlined dream.

Benefits of AI insurance claims processing

In a use case study conducted by Accenture, it was found that AI-based systems led to an increase of 73% in cost-effectiveness

Faster processing time

AI can review, categorize, and process claims faster than humans, drastically reducing processing time.

Reduced or no errors

It's infrequent to find AI-trained models making mistakes while processing data. AI systems are known to provide high levels of accuracy.

Detecting fraudulent transactions

With AI's keen eye, spotting fraudulent claims is now easier, protecting companies from potential losses.

Why is Parseur the MVP in insurance claims?

We've talked about the traditional method vs using AI for more effectiveness. Now, the big question is who will support you in this new journey? Parseur, of course!

Parseur is the secret weapon in the world of insurance claims. Parseur is a powerful AI tool for extracting data from various insurance documents and converting unstructured data into actionable insights.

Parseur: The best AI parser in 2024

As you already know, Parseur has the brightest AI engine on the market which is making wonders.

- A high degree of accuracy: Say goodbye to human error.

- Fast like the Flash: Process claims in record time.

- Ease of use: Intuitive and user-friendly.

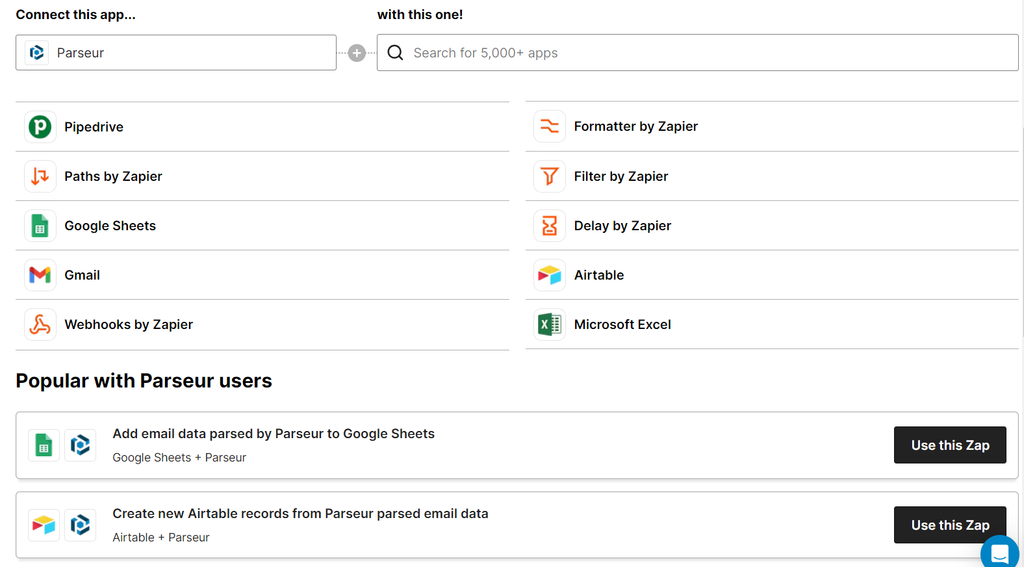

- Seamless integration with other apps: We sometimes party with Zapier and Make.

Knowing the sensitivity of insurance claim data, Parseur ensures that all data is handled with the utmost security, employing encryption and compliance with data protection regulations.

How to extract data from insurance claims with AI?

Insurance companies can leverage Parseur's capabilities for a more efficient and error-free claim.

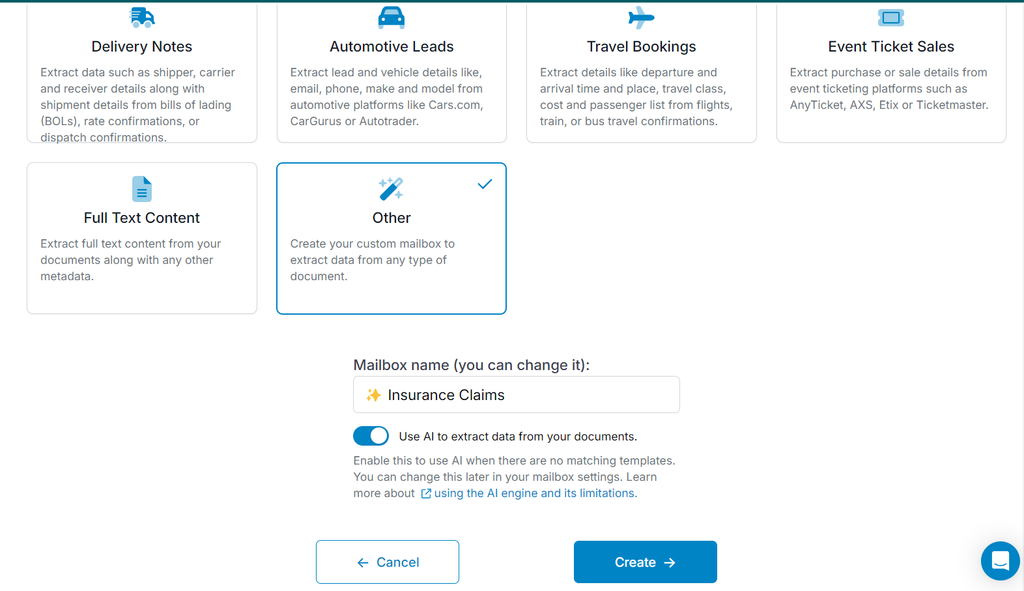

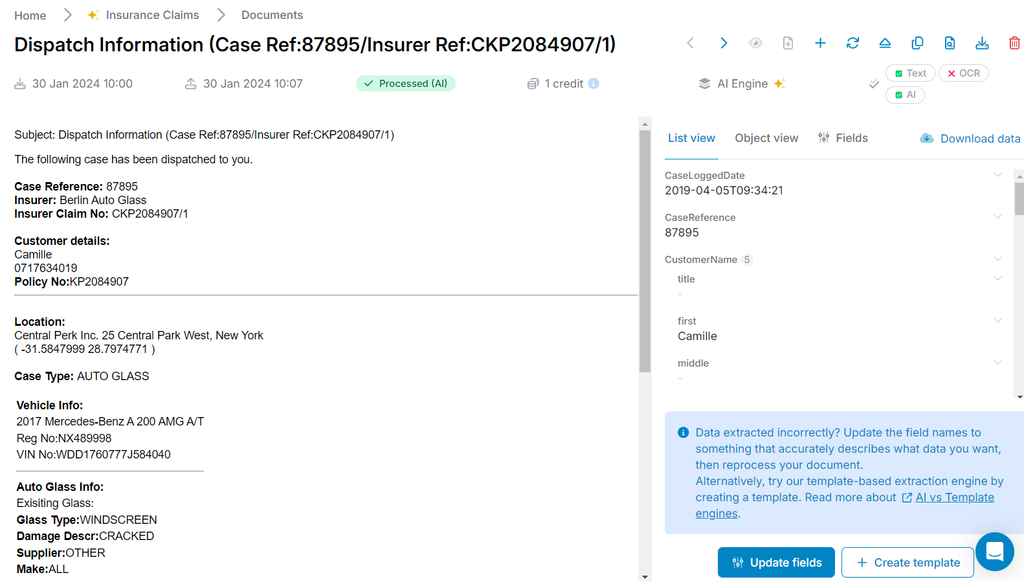

Step 1: Create an insurance parser

Simply log into your Parseur account and create an "insurance claims" mailbox.

Here, you can upload your claim documents directly. Whether they are scanned documents, PDFs, or digital formats, Parseur's AI engine is always ready to process them.

Step 2: Teach Parseur which fields to extract

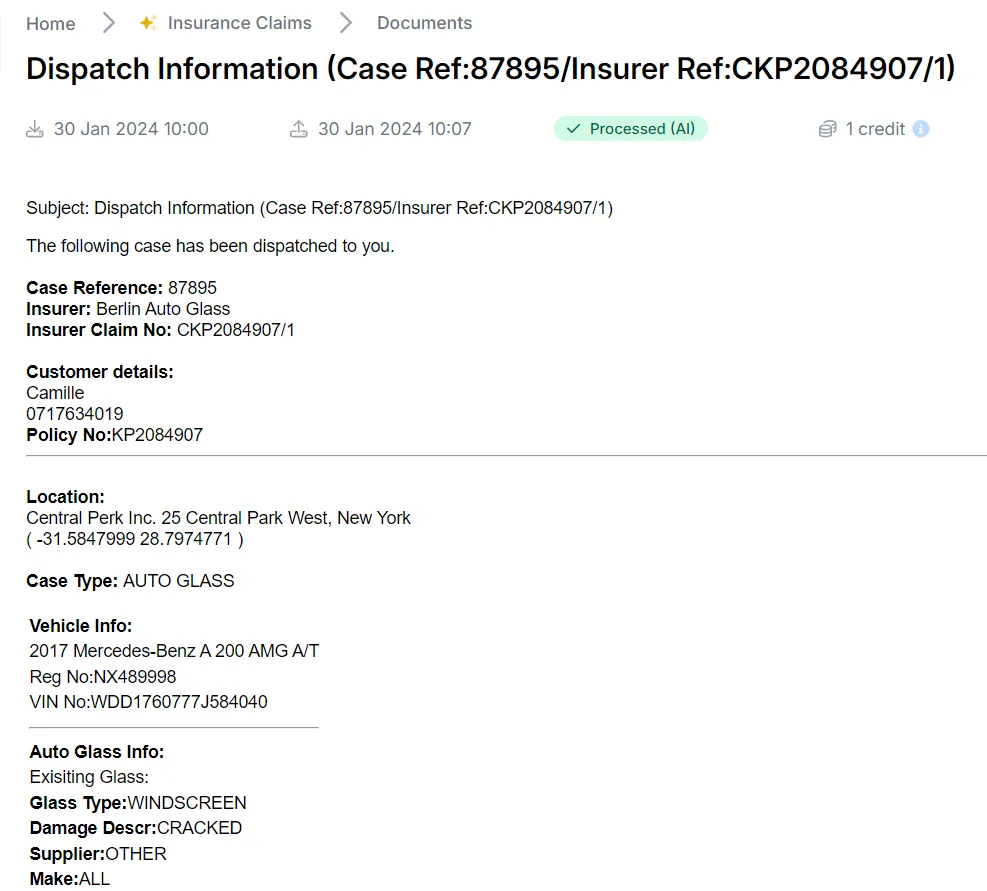

Once your documents are uploaded, create fields to tell Parseur what data to extract. Don't worry - our AI engine learns fast, like the flash!

Step 3: Sit back and relax while AI does your job

Let the magic of Parseur's AI engine kicks in.

From claimant details to claimed amounts, everything that you asked for will be extracted automatically.

Step 4: Send insurance data to other applications

Parseur allows you to export insurance data to your claims management system, a database, or even a spreadsheet.

The future of insurance claim processing is here, and it's powered by AI and Parseur

The insurance industry is already a stressful one and we don't have to complicate things more. Parseur not only saves time and reduces errors but also allows insurance agents to focus on more critical tasks, like evaluating claims and assisting policyholders.

Last updated on