Artificial intelligence is increasingly used in finance to automate data extraction, improve accuracy, and support faster decision-making. From processing financial documents to standardizing data across systems, AI helps reduce manual work while improving consistency and scalability. As adoption grows, understanding how AI is applied and its limitations has become essential for financial teams.

Key Takeaways

- AI in finance improves data integrity by automating the extraction, normalization, and processing of structured and unstructured financial documents.

- Powerful, raw AI and LLM-based systems have limitations in accuracy, consistency, and auditability when applied to financial data.

- Tools like Parseur apply AI to financial document processing in a controlled way, enabling structured extraction without training on customer data.

Imagine converting the tedious tasks of data extraction and financial analysis into a smooth, almost magical process. That's exactly what AI and Parseur are doing for financial professionals everywhere. Let's have a look at how!

What is AI in finance?

Imagine machines learning from financial documents, making sense of numbers and texts, and providing insights at the speed of light.

- Accuracy? Check.

- Efficiency? Double-check.

- Speed? Checkmate.

Artificial intelligence (AI) in finance refers to the application of AI technologies and algorithms to financial services and operations to improve efficiency, accuracy, decision-making, and customer experiences.

How is AI solving challenges in the financial industry?

Here are several key areas where AI is making a significant impact.

While fraud detection is often highlighted as a key AI use case in finance, many of the most impactful improvements happen earlier in the workflow. According to 2025 industry report, 31% of finance teams identify data integrity lapses as a core obstacle to timely and accurate financial reporting, ensuring that financial data is accurate, consistent, and usable across systems before it is ever analyzed.

Modern AI-driven document processing tools address several long-standing finance challenges that go beyond anomaly detection.

Beyond Fraud Detection: Data Integrity at Scale

Financial teams rely on clean, structured data to support reporting, reconciliation, forecasting, and compliance. Manual data entry and inconsistent document formats introduce errors that compound as data moves between systems. AI helps reduce these risks by extracting and structuring data consistently at the source.

Zero-Shot Extraction

AI can identify and extract relevant financial information without requiring predefined templates or extensive training. This approach, often referred to as zero-shot extraction, allows systems to recognize complex line items, totals, taxes, and metadata even when document layouts vary. As a result, finance teams can process new document formats immediately without redesigning extraction rules.

Unstructured Data Processing

Not all financial information arrives in neat tables or standardized forms. Emails, bank statements, and remittance advice often contain valuable data embedded in free text or inconsistent layouts. AI enables converting unstructured content into structured formats, such as JSON, that can be ingested directly by accounting software, ERPs, or analytics tools.

Data Normalization Across Systems

Global finance operations frequently deal with multiple currencies, date formats, and regional conventions. AI supports normalization by standardizing values during extraction, ensuring consistency across subsidiaries and systems. This reduces downstream reconciliation issues and simplifies consolidation and reporting.

By focusing on data integrity rather than isolated use cases, AI helps finance teams build more reliable, scalable, and automation-ready workflows.

The Reality of LLMs in Finance

Large Language Models (LLMs) have brought significant advances in text understanding and automation. However, when applied directly to financial data, their limitations become especially important to acknowledge.

Accuracy and Hallucination Risks

LLMs are probabilistic by design. They generate outputs based on patterns in language rather than deterministic rules or verified calculations. In financial contexts, this can lead to errors that are difficult to detect. Independent evaluations show that hallucination rates vary by model and task, with a Hallucination Leaderboard reporting that popular LLMs hallucinate between approximately 2.5% and as high as 15% of the time on certain factual and numerical tasks. This means models may produce values or interpretations that appear plausible but are incorrect.

In finance, even small inaccuracies can have outsized consequences. A misread invoice total, an incorrect tax amount, or a fabricated line item can propagate errors across reporting, reconciliation, and compliance workflows.

Lack of Determinism

Raw LLMs do not guarantee consistent results. The same document, processed multiple times, may yield slightly different outputs depending on the prompt structure, model version, or contextual weighting. This variability makes it difficult to rely on LLMs alone for repeatable, auditable financial processes.

Context vs. Structure

While LLMs excel at understanding natural language, financial documents require precise interpretation of structure: line items, totals, dates, currencies, and identifiers. LLMs may correctly summarize a document’s intent but misinterpret tabular relationships or numeric dependencies, particularly in complex invoices or statements.

Operational and Compliance Implications

In regulated environments, explainability and traceability matter. LLM-generated outputs can be difficult to audit, and correcting errors often requires manual review. This introduces operational risk, especially when financial data feeds directly into ERPs, accounting systems, or compliance reports.

For these reasons, LLMs are best used as supporting components in financial automation, rather than as standalone decision-makers or extraction engines.

Meet Parseur - Your AI-powered financial assistant

Parseur eliminates the pain of processing financial documents through AI extraction. Say goodbye to manual data entry, and welcome seamless integration into your financial tools or ERP systems.

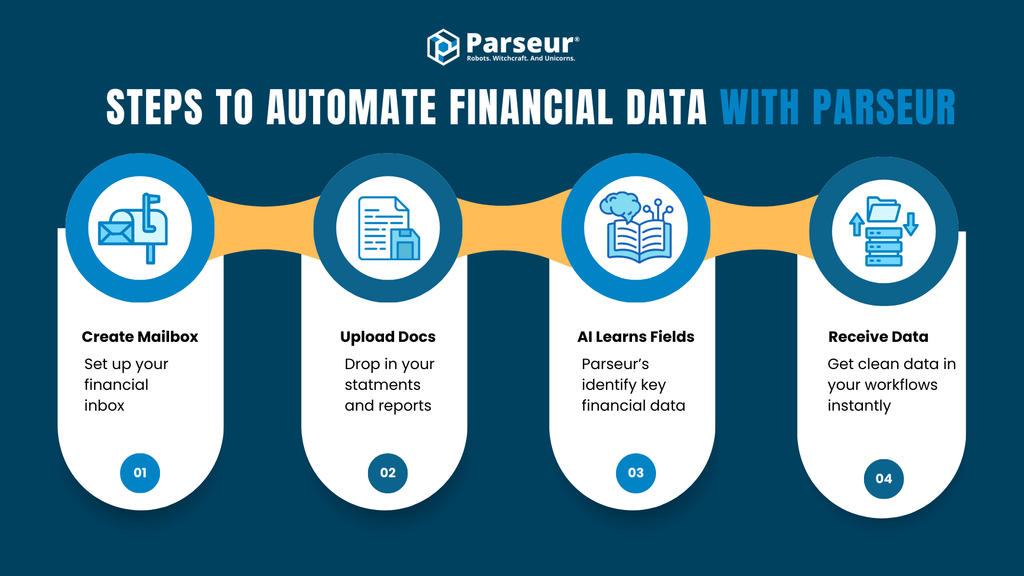

How to extract financial data with Parseur?

Parseur simplifies financial data extraction by centralizing all your financial documents in one place and automatically turning them into usable data. Once your statements are uploaded, AI identifies and captures the key financial fields you care about, with no complex setup or manual rules required.

As Parseur adapts to your documents, it continuously improves accuracy while seamlessly delivering clean, structured data into your existing tools and systems. The result is a hands-off process that eliminates repetitive work, reduces errors, and lets your financial data move reliably and effortlessly to exactly where it needs to go.

I have summarized the steps below to achieve financial bliss with Parseur.

- Create a financial mailbox.

- Drag and drop your financial statements into the mailbox.

- Teach Parseur which financial data you want to extract. (Our AI tool learns quickly!)

- Sit back and relax as your financial data flows automatically into your systems.

With Parseur, financial analysis no longer has to feel like a tedious, manual chore.** Gone are the days of painstakingly sifting through spreadsheets, PDFs, and emails. Instead, you can rely on a smart, automated process that extracts, organizes, and delivers your financial data accurately and efficiently. This transforms what used to be a stressful task into a streamlined, reliable, and even surprisingly enjoyable workflow.

By leveraging AI with Parseur, you’re giving your finance team the tools to work faster, smarter, and more confidently. It’s not just about automation; it’s about empowering your team to make better decisions, meet deadlines effortlessly, and eliminate the frustration of data errors.

It’s time to let AI and Parseur take the heavy lifting off your shoulders, freeing you to focus on strategy, insights, and growth and finally experience financial analysis the way it was meant to be: fast, accurate, and hassle-free.

Frequently Asked Questions

AI-driven financial automation often raises questions about accuracy, compliance, and data handling. As AI tools become more common in finance workflows, understanding how they process and protect sensitive data is essential. These FAQs address the most common concerns from finance and operations teams.

-

How does AI ensure GDPR compliance in financial data extraction?

-

GDPR compliance depends on limiting data usage, controlling retention, and ensuring data can be deleted on request. AI tools must process documents only for defined purposes and keep data isolated and auditable.

-

What is the difference between OCR and AI-driven document processing in 2026?

-

OCR converts documents into text, while AI-driven processing understands structure, relationships, and context. Modern AI systems can transform financial documents into structured, usable data for downstream systems.

-

How does Parseur extract data from financial statements?

-

Parseur uses pre-trained, context-aware AI and rule-based extraction to identify and structure financial data without training on customer documents. This allows consistent extraction across varying formats.

-

Can extracted financial data be integrated into accounting or ERP systems?

-

Yes, structured data produced by AI extraction tools can be exported in formats compatible with accounting software, ERPs, and analytics platforms.

Last updated on