Financial statements are essential documents for understanding a company’s performance, position, and cash health. While the concepts are well defined, real-world analysis becomes challenging due to inconsistent formats, complex layouts, and the limitations of manual work or generic AI tools. Modern financial teams increasingly rely on specialized automation to turn these documents into reliable, structured data.

Key Takeaways

- Financial statements must be analyzed together to understand performance, liquidity, and financial position fully.

- Manual extraction and generic AI tools slow analysis and introduce risk due to inconsistent layouts and numerical accuracy issues.

- Parseur simplifies financial analysis by automatically turning complex financial documents into structured, integration-ready data.

What are financial statements?

Financial statements are written reports about an organization's financial conditions. Various stakeholders, such as investors, creditors, management, and regulatory agencies, use them to make economic decisions regarding the entity. These statements provide a formal record of the financial activities of an entity over a specific period, offering insights into its operational efficiency, profitability, and financial health.

There are two sets of guidelines that companies follow when they prepare financial statements:

- GAAP: Generally accepted accounting principles

- IFRS: International Financial Reporting Standards

Difference between GAAP and IFRS?

GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) are the two primary frameworks used for preparing financial statements worldwide, but they differ in structure and approach.

GAAP, used mainly in the United States, is a rule-based framework. It relies on detailed guidelines and specific standards for nearly every accounting scenario, which help ensure consistency and reduce ambiguity but can make reporting more complex and less flexible.

IFRS, adopted or permitted in around 120 nations for domestic listed companies and fully conformed with IFRS in about 90 countries worldwide, is principle-based rather than rule-based, focusing on broad accounting concepts and professional judgment to help make financial statements more comparable and flexible across international borders.

In practice, these differences can affect how revenue, expenses, assets, and liabilities are recognized and reported, making it important for analysts and investors to understand which standard a company follows when comparing financial results.

The Use of AI for Data Extraction from Financial Statements

AI has become a powerful tool for extracting data from financial statements, helping teams move beyond manual copy-and-paste workflows. Instead of reading documents line by line, AI systems can automatically identify tables, labels, and numerical values across balance sheets, income statements, and cash flow reports.

By combining optical character recognition (OCR) with layout and pattern recognition, AI can convert unstructured documents such as PDFs or scanned reports into structured formats like JSON, CSV, or spreadsheets. This makes financial data easier to analyze, compare across periods, and integrate into reporting or accounting systems.

However, accuracy and consistency remain critical in finance. While AI can significantly reduce processing time, the quality of results depends on how well the extraction method understands document structure, table relationships, and numerical context, especially when dealing with complex, multi-page financial statements.

Types of financial statements

Imagine if financial statements were characters at a party; each has its vibe, story, and dance moves. Let's roll out the red carpet and introduce the fabulous five.

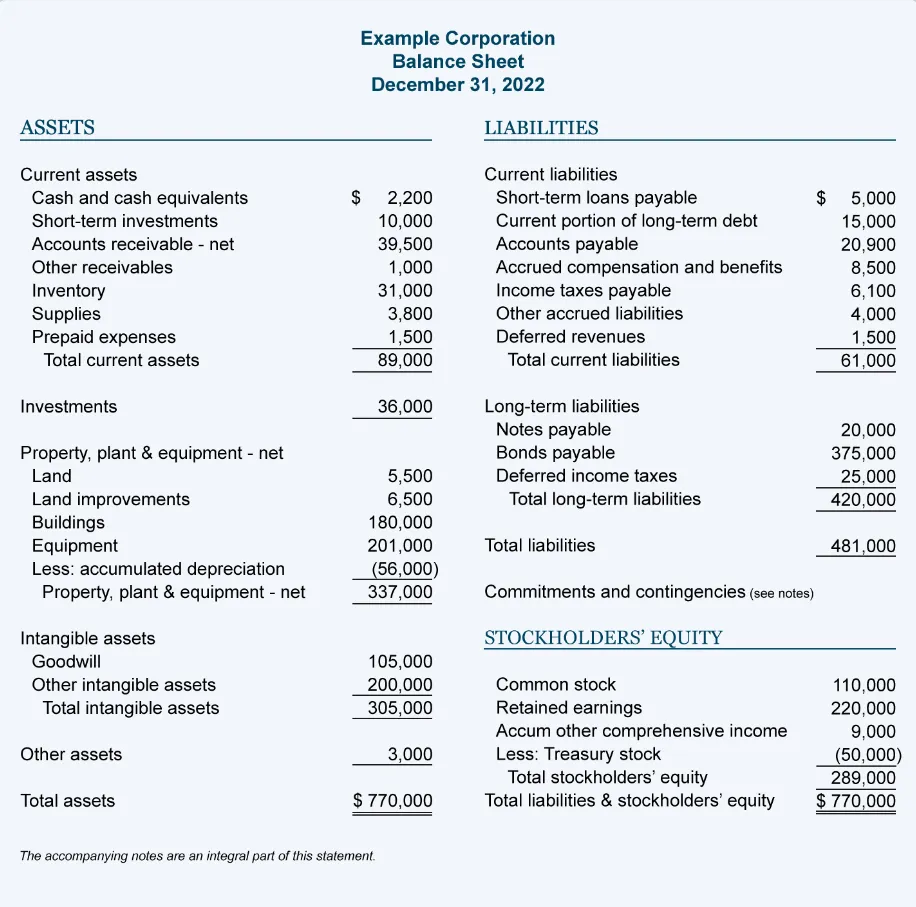

Balance sheet

A balance sheet summarizes the company's assets (what you own), liabilities (what you owe), and shareholders' equity. It's the ultimate measure of your financial health.

Examples of assets are cash and cash equivalents, inventory, accounts receivable, capital assets, and investments.

Examples of liabilities are accounts payable, dividends and long-term debts.

Assets = Liabilities + Shareholders' Equity

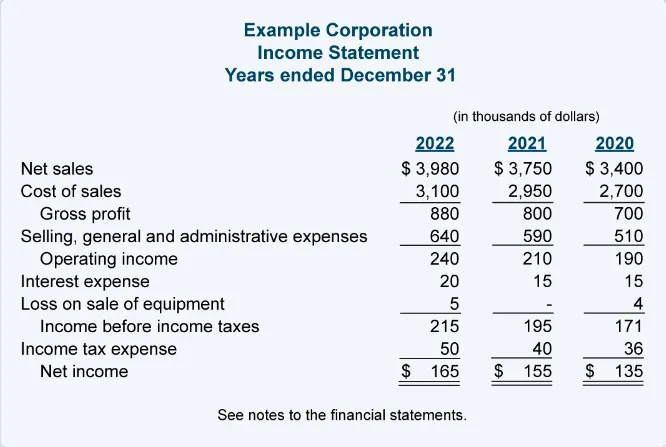

Income statement

The income statement, also known as the profit and loss statement, shows how much money you made (revenue), how much you spent (expenses), and what you're left with (profit or loss).

Cash flow statement

The cash flow statement (CFS) is the real MVP, tracking the cash flowing in and out of your business. This statement shows if you're making cash hand over fist or if your cash is just waving goodbye. It's crucial because, as we all know, "Cash is king."

Statement of changes in equity

The statement of changes in equity reveals the drama behind the scenes---how your ownership interest evolves. It tracks the total equity over time, showing investments, withdrawals, profits, or losses.

The Structural Challenges of Financial Extraction

Knowing what financial statements are is only half the battle. The real challenge begins when teams need to extract, compare, and analyze data across multiple reports, companies, and time periods. On paper, financial statements may follow common standards, but in practice, they are anything but uniform.

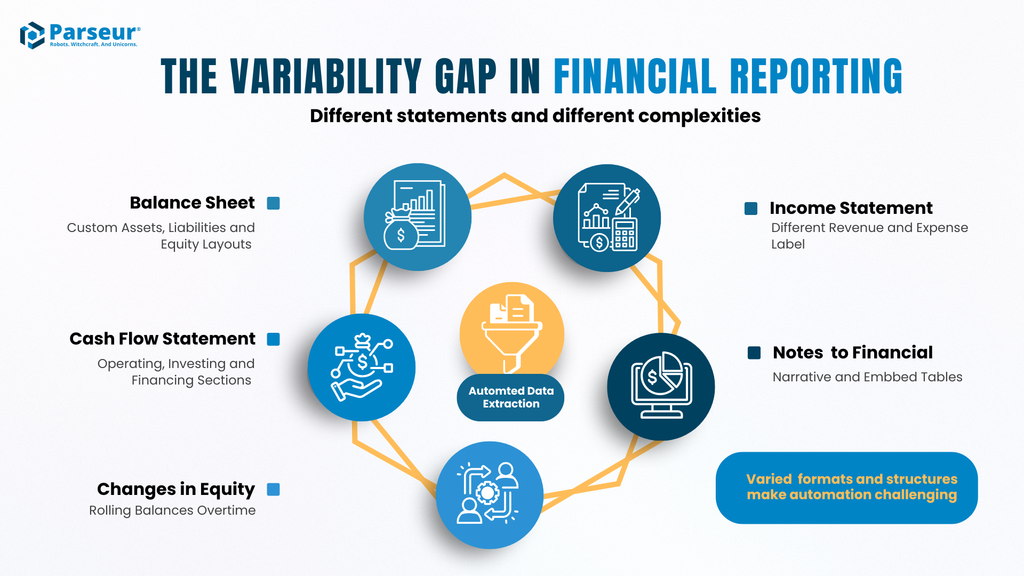

The Variability Gap

While financial reporting typically revolves around a familiar set of statements, each one introduces its own structural complexity:

Each statement serves a different purpose, and each comes with its own formatting quirks that make automated extraction difficult.

The Technical Pain Point: Why Extraction Is Hard

Even under standardized frameworks like GAAP and IFRS, financial statements are not inherently machine-friendly.

Non-standard layouts

Companies use different terminology and structures for the same concepts. One income statement may list “Revenue,” another “Net Sales,” and another “Operating Income,” all referring to similar metrics but labeled differently.

Multi-page tables

Balance sheets and cash flow statements often span multiple pages, with headers that repeat, shift, or disappear altogether. This breaks continuity and makes it difficult to capture rows, totals, and subtotals reliably.

Lack of spatial context in traditional OCR

Basic OCR tools can read text, but they don’t truly understand layout. They struggle to recognize which numbers belong to which rows or columns, leading to misaligned data, broken tables, and unreliable outputs, especially in dense financial reports.

These challenges are why manual extraction remains slow and error-prone, and why traditional OCR alone isn’t enough for modern financial analysis.

The Reality Check: LLMs Vs. Specialized Parsers

The LLM Hype vs. Reality

Large Language Models (LLMs) are impressive. They can read unfamiliar document layouts, adapt quickly, and perform “zero-shot” extraction without pre-training on specific templates. On the surface, this makes them appear to be the ultimate solution for financial document processing.

LLMs are probabilistic by design. They generate answers based on likelihood, not certainty, which is acceptable for text summarization, but dangerous when dealing with balance sheet totals, cash flow figures, or regulatory disclosures where precision is non-negotiable.

The Hallucination Problem in Financial Data

Research into LLM use in financial applications reveals that hallucination remains a serious risk: evaluations in 2025 showed that, on average, AI models hallucinate 13.8% of the time on financial data tasks,** meaning more than 1 in 8 numerical outputs could be inaccurate or fabricated.

In finance, where even a single incorrect number can invalidate a valuation model, distort forecasts, or create compliance risks, this isn’t a minor inconvenience; it’s a deal-breaker

Did you know that companies spend countless hours just preparing these documents? Recent McKinsey research shows workers still spend much of their week on data and information tasks, averaging 1.8 hours daily just searching for info.**

Let's not forget that errors are a no-go for financial analysts, given their responsibility for sensitive and confidential data. Themanual effort** of sifting through papers, the horror of data discrepancies, and the slow torture of time consumption are all part of the process.

The “Agentic AI” Bottleneck

To compensate for these errors, many teams turn to Agentic AI systems that add reasoning loops, validation steps, and self-correction mechanisms on top of LLMs.

While this improves accuracy, it introduces a new problem: latency.

Agentic workflows can take 8 to 40 seconds per page to process financial documents. That might work for a handful of reports, but it completely collapses under high-volume scenarios like quarterly reporting, portfolio analysis, or historical backfills involving thousands of pages.

Accuracy improves, but throughput dies.

Why Specialized Parsers Still Win?

Specialized parsers like Parseur are built for deterministic, layout-aware data extraction, prioritizing numerical accuracy over generative flexibility. In a 2026 Parseur-commissioned survey, 88% of professionals reported errors in document-derived data, often requiring 6+ hours per week of manual correction.

Parseur addresses this by delivering 99.9%+ uptime, processing millions of documents monthly, and helping teams reduce manual** data entry by up to 98%, saving an average of 152 hours per month.

The result is predictable performance, low latency, and scalable processing, exactly the traits financial teams need when working with large document volumes and tight deadlines. LLMs and generic OCR are powerful tools, but in financial data extraction, power without precision is a liability.

Interactive Utility: The Financial Sandbox

From Theory to Reality: Try It Yourself

Instead of asking you to trust how financial data extraction should work, we let you experience it.

Parseur takes a different approach: show, don’t tell.

Below is a live, ungated sandbox where you can upload a sample balance sheet and see exactly how our AI handles real financial documents, no sales form, no email gate, no setup friction.

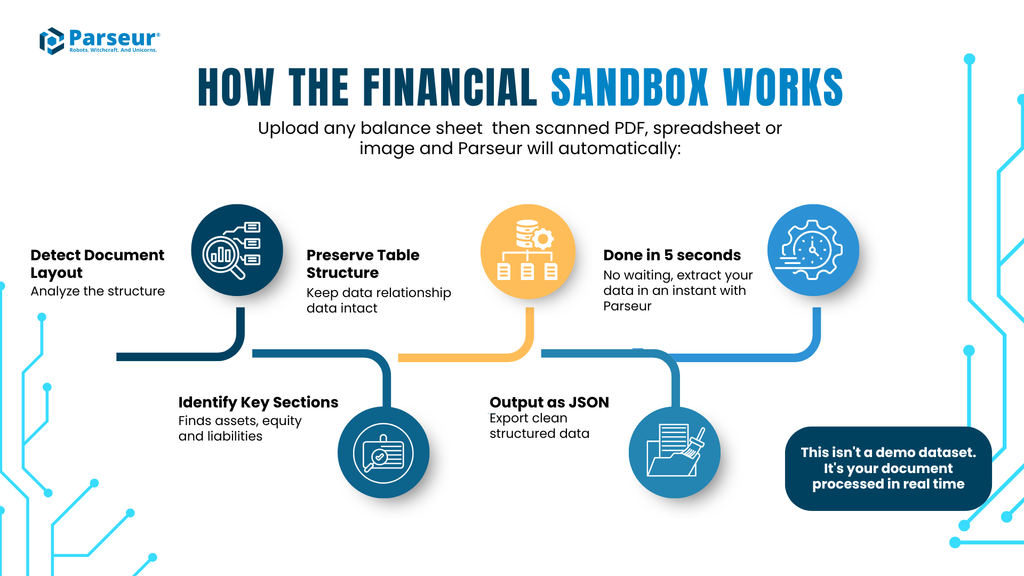

How the Financial Sandbox Works

- Upload any balance sheet scanned PDF, spreadsheet, or image, and Parseur will automatically:

- Detect the document layout

- Identify Assets, Liabilities, and Shareholders’ Equity

- Preserve table structure and numerical relationships

- Output clean, structured data as JSON

- Complete the process in under 5 seconds

This isn’t a demo dataset.

It’s your document, processed in real time.

Most financial extraction tools hide behind screenshots and claims. The Financial Sandbox removes that uncertainty by letting accuracy, speed, and structure speak for themselves.

If the data doesn’t map correctly, you’ll see it immediately.

If it does, you’ve just validated the workflow with zero commitment required. Try the Financial Sandbox and instantly transform your financial documents into accurate, structured data with zero setup or commitment.

Upload a sample balance sheet and watch Parseur map it to structured JSON in seconds.

ROI & Implementation: Turning Data Into Action

So what actually happens once financial data is extracted automatically?

The biggest shift isn’t just speed, it’s how teams work day to day. Instead of spending hours copying numbers from PDFs into spreadsheets, analysts can focus on what really matters: understanding the data and making decisions based on it.

What Teams Gain in Practice

Organizations that automate financial data extraction often see:

Significant efficiency improvements

Analysts can process far more documents in the same amount of time. Large accounting and advisory firms use automation to handle higher volumes without increasing manual workload.

Up to 90% less manual turnaround time Tasks that once took hours, downloading reports, reformatting tables, and double-checking entries, can be completed in minutes.

Fewer errors and more consistent data

Automated extraction reduces the risk of manual transcription errors and helps ensure numbers stay consistent across reports and periods.

The result is smoother reporting cycles, faster analysis, and less time spent on repetitive work.

From Extracted Data to Your Existing Tools

Extracting data is only useful if it fits into your current workflow.

That’s why Parseur connects directly with automation platforms like Power Automate, Make, and Zapier. These integrations make it easy to send extracted financial data straight into accounting systems such as NetSuite or Xero, as well as databases, spreadsheets, or reporting tools.

No manual imports.

No copying and pasting.

Just data moving automatically where it’s needed.

Easy to Set Up, Easy to Scale

Because extraction rules can be configured visually, teams don’t need complex scripts or long development cycles to get started. As document volumes grow, the same setup continues to work whether you’re processing a handful of reports or thousands.

In short, automation turns financial documents from static files into usable, structured data ready for analysis, reporting, and decision-making.

If you want to automate financial data extraction and reduce errors, try Parseur for free and see how fast, accurate, and structured your financial data can become.

Frequently Asked Questions

Before wrapping up, let’s address some of the most common technical questions teams ask when exploring AI-driven financial data extraction. These answers are designed to be practical, straightforward, and grounded in real-world use cases.

-

Can AI accurately extract nested tables from multi-page PDFs?

-

Yes, but accuracy depends on the technology used. Specialized parsers are built to understand table structure, repeated headers, and page breaks, while basic OCR or generic AI tools often lose context across pages.

-

What is the cost difference between LLM extraction and a dedicated parser?

-

LLM-based extraction can become expensive due to token usage, retries, and longer processing times. Dedicated parsers usually offer more predictable pricing and are better suited for high-volume financial documents.

-

How accurate is AI when extracting numerical financial data?

-

Accuracy varies by approach. LLMs can struggle with numerical precision, while dedicated parsers focus on deterministic extraction to reduce errors in financial figures.

-

How long does it take to extract data from a financial statement?

-

With specialized parsers, extraction typically takes only a few seconds per document. More complex AI workflows that rely on reasoning steps can take significantly longer.

Last updated on