What is claims processing?

It refers to the administrative handling of claims by individuals or insurance companies seeking payment or coverage for damages, injuries, medical treatments, or other financial compensations. This process is essential in healthcare, insurance, and finance industries, where accurate and efficient claims management directly impacts customer satisfaction, regulatory compliance, and financial stability.

Types of claims

There are different types of claims based on the industry and nature of the incident:

- Insurance claims: These include health, auto, home, and life insurance. They involve compensation for damages, loss, or treatments under the terms of an insurance policy.

- Healthcare claims: Medical professionals and hospitals submit healthcare claims to insurance providers to seek payment for services rendered to patients.

- Warranty claims: Customers file warranty claims for repairs or replacements of defective products covered under warranty.

- Workers’ compensation claims: Employers handle these claims for workers injured. They include compensation for medical treatment and lost wages.

Challenges of manual claims processing

Manual claim handling leads to an average delay of 7-10 days in claim settlement.

Manual data entry is labor-intensive and prone to several problems.

- Time-consuming: Verifying documentation and reviewing claims manually can lead to long processing times.

- Increased error rates: Human errors in data entry or claims review can result in incorrect payouts or rejections.

The healthcare industry wastes billions of dollars annually due to claims processing errors.

- Higher operational costs: Manual processing requires more human resources, increasing operational costs.

- Lack of scalability: As the volume of work increases, manual systems need help keeping up with the demand, leading to backlogs.

- Compliance issues: Regulatory changes often require businesses to adjust their claims processing procedures, and manual systems may need to be updated.

Benefits of claims processing automation

It uses AI and machine learning to streamline the entire workflow, from verifying documents to assessing the validity of claims. Automation solutions can reduce errors, lower costs, and speed up the process.

Automation can reduce the cost of a claims journey by as much as 30%. - McKinsey Report.

Automation and AI help businesses overcome the challenges of manual systems.

- Increased accuracy: Automation reduces errors by extracting data directly from submitted documents without manual intervention, ensuring that all data fields are accurately filled.

- Cost savings: Automation eliminates the need for large teams dedicated to processing unstructured data, lowering labor costs.

- Faster processing times: Automated systems can process claim forms in real time, reducing turnaround times from days to hours or minutes.

- Improved customer satisfaction: Faster processing and fewer errors lead to better customer experiences, increasing loyalty and satisfaction.

Parseur and claims processing Automation

At Parseur, our data extraction and automation capabilities help streamline the claims process by extracting data from claims and insurance documents.

Parseur’s automation ensures:

- Quick data extraction: There is no need to create manual templates. Our AI engine extracts and organizes claims data automatically.

- Easy integration: Parseur integrates with thousands of applications, ensuring the extracted data is easily exported to your CRM, ERP, or other systems.

- Enhanced efficiency: Parseur's automation tools can reduce claims processing times, increasing efficiency and productivity.

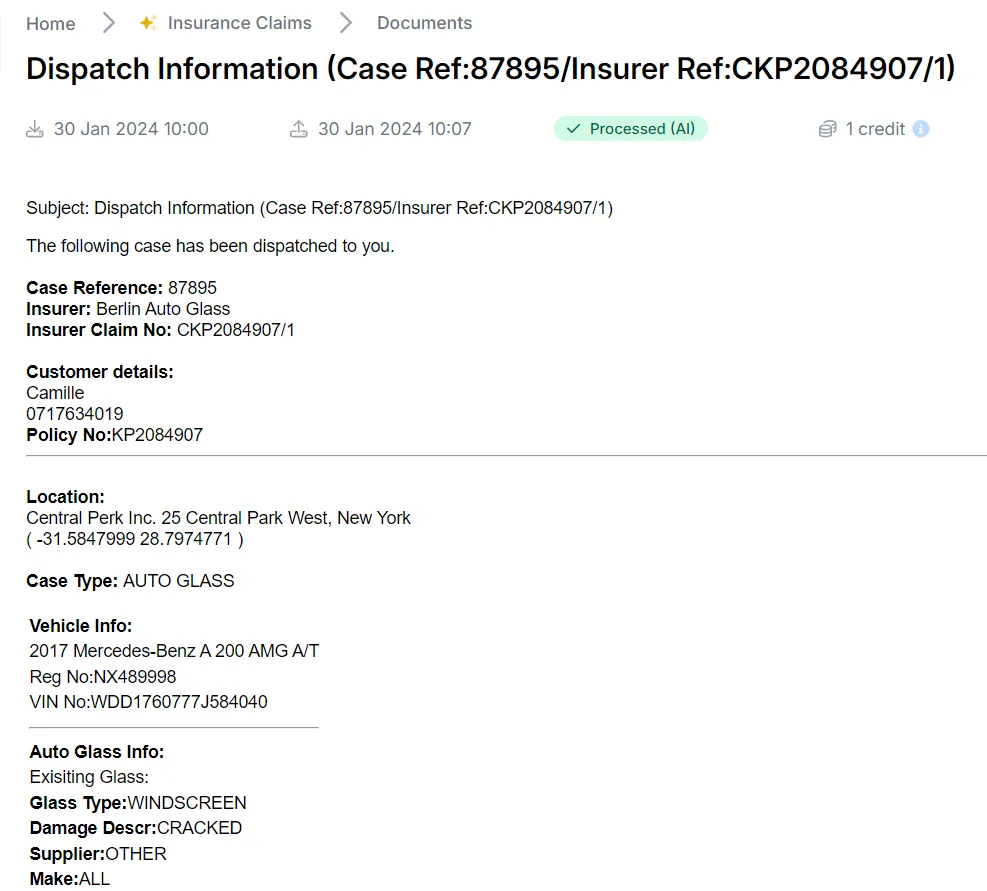

Here are step-by-step processes for data extraction from your insurance documents with AI.

- Create a free Parseur account where you get access to all the available features.

- Upload a claim processing document to the mailbox.

- The AI tool will process the PDF file automatically.

- You can review and refine extracted data to better match your business requirements.

- You can send the data to any application you choose, such as a claims management system or Google spreadsheet.

A 2021 study by PWC shows insurance leaders are investing in AI to enhance claims management and customer experience.

Frequently Asked Questions

All your questions answered about claims processing.

-

What is claims processing?

-

Claims processing is the review, assessment, and approval/denial of an insurance claim by an insurer.

-

How does automated claims processing work?

-

Automated claims processing uses AI and machine learning tools to verify, evaluate, and process claims without manual intervention.

-

What are the benefits of claims automation?

-

Automation can reduce costs, improve accuracy, speed processing times, and boost customer satisfaction.

-

What types of claims are there?

-

There are various types of claims, including health insurance claims, auto insurance claims, property insurance claims, and life insurance claims.

-

Can Parseur automate claims processing?

-

Yes, Parseur can extract claims data, automate workflows, and integrate with various systems to streamline the claims processing experience.

Last updated on