Breathe Easier This Tax Season: How Tax Form Parsing is Revolutionizing Financial Workflows

For accountants, mortgage brokers, and finance professionals, tax season in the US is filled with long hours, tight deadlines, and an overwhelming influx of tax documents. From W-2s and 1099s to 1040 schedules, the sheer volume of paperwork can turn even the most organized office into a logistical nightmare.

The culprit? Manual data entry. This outdated process is time-consuming and prone to human error, creating workflow inefficiencies and increasing compliance risks. Research indicates that 60% of time spent on tax compliance is dedicated to data extraction, cleansing, and analysis, with an additional 10% paid on internal administration, leaving little time for preparation and review. (Source: PwC Case Study)

But what if there was a way to reclaim control over this chaotic process? Enter Tax Parsing Automation, a process that leverages artificial intelligence (AI) and optical character recognition (OCR) to extract critical data from tax documents quickly and precisely.

Let's transform the way you handle tax documents.

Understanding the 2026 Tax Season in the U.S.

The IRS expects over 140 million individual tax returns for the tax year 2024 to be filed by the federal deadline of April 15, 2025 (Source: IRS). This marks a critical period for accounting professionals and financial institutions as they navigate a high volume of filings and ensure compliance with evolving regulations.

Key Dates and Deadlines

- January: Start of the tax filing season.

- April: Deadline for individual tax returns (Form 1040).

- March: Deadline for S Corporations (Form 1120-S) and Partnerships (Form 1065) (Source: Bloomberg Tax).

What are the different tax forms?

Understanding these forms is crucial for accurate financial reporting and compliance, whether dealing with personal income taxes, business returns, or international tax obligations.

Personal Tax Documents:

- Form 1040: Essential U.S. individual income tax return that tracks your annual earnings, deductions, and credits and calculates your final tax obligation

- Form W-2: Annual wage and salary statement showing your earnings and tax withholdings - crucial for accurate income tax filing

- Form 1099-MISC: Records non-employee compensation, including freelance income, rental payments, and other miscellaneous earnings

- Form 1099-NEC: Tracks independent contractor earnings and self-employment income of $600 or more

Business Tax Documentation:

- Form 941: Quarterly employment tax form reporting payroll taxes, Medicare, and Social Security withholdings for employees

- Form 1120: Standard corporate tax return documenting business income, expenses, profits, and tax calculations

- Form 1065: Partnership information return detailing business profits, losses, and partner allocations

International Tax Forms:

- VAT Return: Critical document for businesses to report Value Added Tax collected from customers and paid to suppliers

- Form 8938: Foreign asset reporting form required for U.S. taxpayers with significant overseas financial interests

The Challenges of Manual Tax Data Extraction

Handling tax forms such as IRS 1040, W-2s, 1099s, 941s, and VAT returns involves repetitive data entry, which can lead to:

- Errors in financial reporting due to manual entry mistakes.

- Inefficiencies that slow down loan approvals and financial processing.

- Compliance risks when critical tax information is mishandled.

- Time-Consuming Process

The struggle with manual tax data entry errors is real. Manually entering data from hundreds or thousands of tax forms is incredibly labor-intensive. Staff hours are consumed by repetitive tasks that offer little strategic value. Industry surveys indicate that accountants spend an average of 50 to 60 hours per week during tax season on manual data entry alone (Source: Indeed).

- High Error Rates

Human error is inevitable, especially with repetitive tasks such as manual data entry from tax forms. Data entry mistakes can lead to inaccurate financial analysis, compliance issues, and costly rework.

In the context of tax filings, the IRS reported an error rate of 21% for paper returns compared to less than 1% for e-filed returns (Source: TurboTax). This stark contrast highlights the challenges associated with manual processing and underscores the need for automation.

- Scalability Issues

Manual processing struggles to scale during peak seasons like tax season or busy lending periods. Hiring temporary staff is costly, and training them on complex data entry procedures is inefficient. Many accounting firms report needing to increase temporary staffing by 30% during tax season to manage the workload (Source: Microsourcing).

- Increased Operational Costs

Labor costs associated with manual data entry directly impact financial professionals' bottom lines. In addition to wages, consider the costs of error correction, potential penalties, and delayed processes.

Research from Ernst & Young indicates that the average cost of a single manual data entry task has risen to $4.78. This figure encompasses labor and non-labor expenses involved in producing forms, double-checking accuracy, and transferring information into systems (Source: Paycom).

- Employee Frustration and Burnout

Repetitive data entry is demotivating for skilled professionals. It leads to decreased job satisfaction and potential employee turnover.

The impact of repetitive tasks extends beyond mere dissatisfaction; it can also stifle creativity and productivity. According to a report by Smartsheet, over 40% of workers spend at least a quarter of their workweek on manual, repetitive tasks, including data entry and email management (Source: Smartsheet). Such tasks drain employee motivation and hinder their ability to engage in more meaningful work.

- For Accountants

Tax season means long hours spent poring client documents and meticulously inputting figures into tax preparation software. This leaves less time for client consultations, tax planning, and strategic advisory services, where accountants add value.

Most tax professionals struggle with capacity during tax season—the capacity to get all tax returns filed by the deadlines. For most, if not all, tax pros, client tax returns will inevitably be extended. There is not enough time to complete all the work by March 15 or April 15. Completing business tax returns means relying on the company's financial statements. That means we must be relatively comfortable with accurate financial statements. - Melissa Pedigo, CPA - Owner of Your Accounting Hero

- For Mortgage Brokers

Income verification is part of the mortgage process. Manually extracting income details from tax forms delays loan approvals, impacting client satisfaction and potentially losing deals to faster competitors. Inaccurate income assessments due to data entry errors can also increase lending risk.

- For Finance Companies (Lenders, Wealth Management, etc.)

Tax forms are a constant data input source from loan applications to client onboarding and financial planning. Manual processing slows client service, increases operational overhead, and distracts from core financial analysis and client relationship management.

The solution? Automated tax parsing and tax form automation.

What is Tax Parsing?

Tax parsing or tax document automation automatically extracts, categorizes, and structures data from tax forms using advanced ML, OCR, and AI. This enables financial professionals to pull key information like:

- Taxpayer identification numbers (TIN, SSN, EIN).

- Income details, deductions, and credits.

- Employer information (W-2s, 1099s).

- Total tax owed or refunds due.

Benefits of AI Tax Data Extraction

Automating tax data extraction speeds up processing, reduces errors, and helps finance professionals handle high volumes smoothly while keeping clients satisfied.

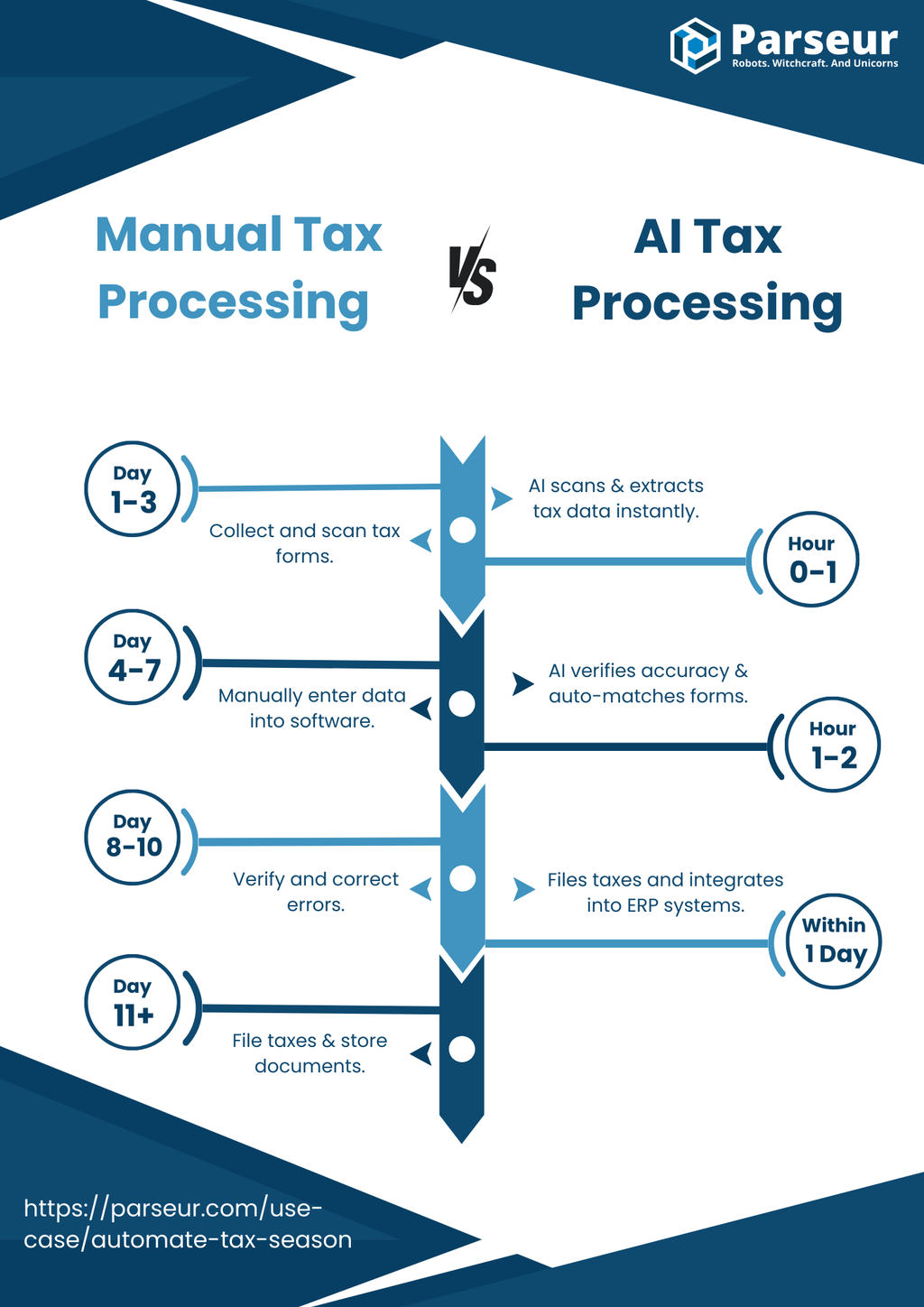

1. Faster tax preparation workflows

Manual data extraction from tax forms can take hours or even days, whereas automated solutions process forms in seconds.

2. Higher accuracy and compliance

AI-driven OCR tax extraction minimizes human errors, reducing the risk of IRS penalties due to incorrect filings.

3. Seamless integration with accounting software

Extracted tax data can be integrated directly into accounting platforms like QuickBooks, Xero, Zoho Books, and SAP.

4. Scalability for high-volume processing

Mortgage brokers and financial firms handling thousands of tax forms can scale their operations effortlessly.

5. Improved client satisfaction

Faster tax processing leads to quicker loan approvals, refunds, and assessments.

Comparison Table: Manual vs. Automated Tax Processing

| Factor | Manual Data Entry | AI-Powered Tax Parsing |

|---|---|---|

| Processing Time | 50+ hours per week | Process tax forms in seconds |

| Error Rate | 21% (paper returns) | <1% (e-filed tax data) |

| Scalability | Limited to human effort | Scales to thousands of forms automatically |

| Integration | Requires manual input | Connects to QuickBooks, Xero, SAP, etc. |

| Compliance Risk | High due to human error | Reduces penalties & tax filing errors |

Use Cases: Tax Data Extraction

Tax document processing doesn't have to be your firm's biggest bottleneck. From mortgage applications to tax prep services, financial institutions leverage automated tax parsing to process more documents in less time.

These different sectors of the finance industry are putting this technology to work.

1. Mortgage Brokers Automating Tax Returns

- Challenge: Mortgage lenders manually review tax returns to assess loan eligibility.

- Solution: Automating tax parsing reduces document review time from hours to minutes.

2. Accountants Automating IRS Filings

- Challenge: Processing thousands of IRS tax forms for multiple clients is error-prone.

- Solution: AI-powered tax data extraction ensures 99% accuracy in filings.

3. Financial Services Enhancing Compliance

- Challenge: Regulatory compliance requires consistent and error-free tax reporting.

- Solution: Automated tax data extraction ensures real-time validation of financial records.

Best tax data extraction software for accountants in 2026

Parseur is transforming tax document processing with AI-powered tax data extraction, enabling accountants to eliminate manual work, improve accuracy, and speed up tax return preparation.

Why Parseur is the best tax data extraction software for 2026

- Automates Tax Form Processing - Extracts key data from W-2s, 1099s, 1040s, and business tax forms with high accuracy.

- Eliminates Manual Data Entry - Instantly capturing tax data reduces the need for manual input and lowers the risk of human error.

- Seamless Integrations – Sends structured tax data directly to QuickBooks, Xero, Google Sheets, Excel, and other accounting platforms.

- Enhances Compliance and Accuracy – AI-powered OCR ensures data consistency, reducing IRS penalties caused by incorrect filings.

- Scalable for High-Volume Processing - It efficiently handles large batches of tax documents, reducing the need for additional seasonal staffing.

Modern OCR technology enables highly accurate text extraction from tax forms, eliminating the need for manual data entry. Advancements in AI, particularly with large language models (LLMs) like OpenAI’s and Gemini, have taken this further by automating the extraction of structured data. What once required hours of manual work can now be completed in seconds.- Sylvestre Dupont, Co-founder of Parseur.

Step 1: Create a Parseur account

Parseur supports tax form processing, and creating a mailbox with all the available features is free.

Step 2: Upload Tax Forms

Scan or upload your tax documents to the Parseur app. You can also forward the filled tax forms by email.

Step 3: Parseur uses AI for tax data extraction

Parseur can extract the following data from taxes:

- Full name

- Normalized address

- Adjusted gross income

- Taxable income

- Total payments

Step 4: Export Data to Accounting and ERP Systems

Send structured tax data directly into ERP, CRM, or accounting software for your reporting and compliance.

Cut Tax Season Workload by 70% Today!

AI tools are game changers for accountants, mortgage brokers, and financial firms looking to improve efficiency and compliance. By leveraging AI-powered tools, financial professionals can streamline tax workflows, eliminate manual errors, and focus on higher-value tasks.

Last updated on