Key takeaways:

- Acord 125 is a standardized form essential for the commercial insurance industry.

- Traditional methods of processing Acord forms are time-consuming and prone to errors.

- AI tools like Parseur ensure over 95% accuracy in data extraction by adapting to variable layouts and recognizing handwriting.

Navigating the world of commercial insurance often involves extensive documentation, with Acord 125 being one of the most critical forms in the process. Known as the "Commercial Insurance Application," Acord 125 is a foundational document for underwriters to evaluate risks, coverage needs, and policyholder details. While these forms streamline the insurance process, their manual handling is labor-intensive, prone to errors, and costly for insurers and brokers alike.

With insurance data growing more complex, businesses are turning to advanced tools like AI-powered data extraction to simplify Acord form processing. In this article, we’ll explore what makes Acord 125 essential, the challenges of extracting its data, and how cutting-edge solutions like Parseur transform how the insurance industry handles these forms.

Understanding Acord forms

Acord forms are standardized documents used in the insurance industry to streamline communication between agents, brokers, and insurers. They ensure consistency in collecting and sharing critical data, reducing errors, and improving efficiency.

What is Acord 125?

Acord 125 is a pivotal form, commonly called the Commercial Insurance Application. It serves as the backbone for commercial insurance submissions, summarizing essential applicant details such as:

- Business information

- Coverage history

- Policyholder's prior loss information

Importance of Acord 125

The Acord 125 form is vital because it consolidates the core details required to evaluate an insurance application. Its standardized structure allows insurers to assess risks accurately and efficiently, making it indispensable for agents, brokers, and underwriters.

How to read an Acord 125 form?

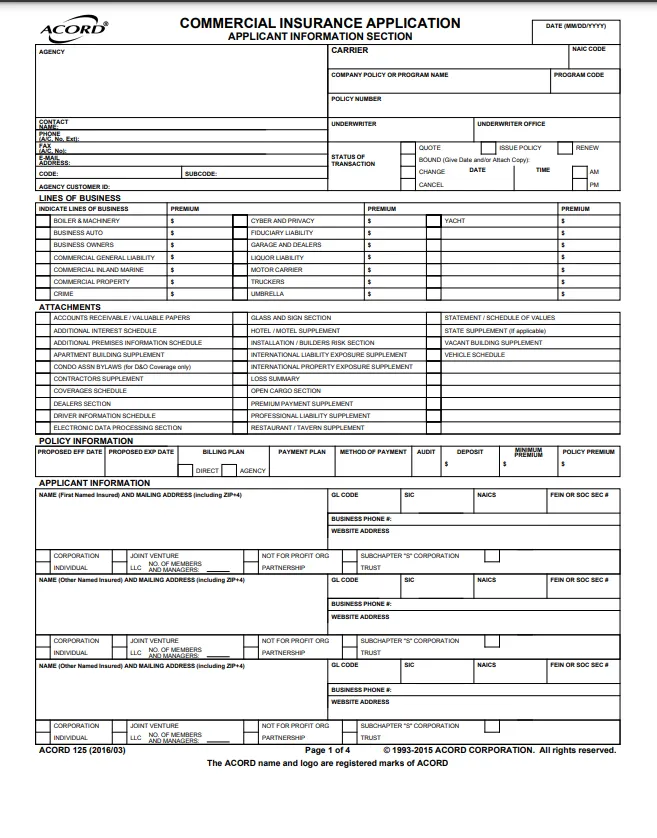

This is an example of the first page of an Acord 125 form.

The form is divided into multiple sections, each covering distinct aspects:

- Applicant Information: Captures the name, address, and business details.

- Type of business: (e.g., sole proprietorship, partnership, LLC, or corporation).

- General Liability Information: Details related to liability coverage.

- Prior Insurance History: Documents previous policies and carriers.

- Loss History: Lists past claims and incidents.

- Prior carrier information: Provides details on past insurance providers, offering insights into the applicant’s insurance relationships and consistency.

- Worker’s compensation: Captures information related to employee coverage

Why extract data from Acord 125 forms?

Extracting data from these forms is crucial for insurance agents and carriers, enabling efficient policy underwriting, risk assessment, and client servicing.

The role of data extraction in insurance

Extracting this data allows insurers to:

- Analyze the applicant’s business type, size, and operations.

- Assess prior claims and loss history to determine risk exposure.

- Calculate appropriate premiums based on detailed information, such as payroll figures, prior coverage, and general liability needs.

The data extracted from Acord 125 forms ensures compliance with industry standards and regulatory requirements. Accurate data entry minimizes errors leading to policy disputes, coverage gaps, or financial losses.

Insurance agents use the extracted information to populate multiple CRMs, policy management systems, or analytics platforms. With extracted and structured data, agents can respond quickly to client inquiries, provide tailored coverage options, and improve overall service efficiency. For example, businesses with extensive prior claims can use personalized risk management strategies.

Applications of the extracted data

Once extracted, the data is utilized in several ways:

- Risk Assessment: Insurers evaluate a business's potential liabilities and exposures.

- Policy Customization: Agents tailor insurance products to meet specific client needs, such as adjusting coverage limits or deductibles.

- Claims Management: Historical claims data from Acord 125 forms aids in determining claim validity and streamlining payouts.

- Market Insights: Aggregated data from multiple forms provides insights into industry trends, helping insurers refine their offerings.

Challenges with traditional OCR for Acord forms

Manual data entry from Acord 125 forms can be time-consuming, error-prone, and inefficient. In industries handling large volumes of applications, the lack of automation can lead to delays, client dissatisfaction, and even lost revenue opportunities.

Traditional OCR (Optical Character Recognition) methods can read scanned forms but often fail to deliver accurate results due to:

- Variability in handwriting styles.

- Poor scan quality.

- Complex layouts with checkboxes, tables, and free-form text.

These limitations require frequent human intervention, reducing efficiency.

The Solution: Automated data extraction with AI

AI-powered document parsing tools such as Parseur can overcome these challenges by:

- Improving accuracy: AI models can recognize handwriting, detect patterns, and process data from tables and forms more precisely.

- Scaling operations: AI handles large volumes of forms simultaneously, ensuring quicker turnaround times.

- Learning capabilities: Machine learning tools can adapt and improve over time, minimizing errors and enhancing performance.

A McKinsey report estimates that automation and AI could increase insurance industry efficiency by 60% by 2030.

How does Parseur automate Acord 125 processing?

Parseur offers a robust solution tailored to processing Acord forms. Here's how it stands out:

- Parseur uses advanced AI to understand the structure of Acord forms, eliminating the need for pre-defined templates.

- Parseur connects seamlessly with insurance CRMs and other tools via Zapier or APIs.

- It ensures precise data extraction from all parts of the Acord 125 form, including complex sections like loss history.

By automating this process, Parseur saves time, reduces errors, and enables insurers to focus on value-driven tasks like risk analysis and customer engagement.

Frequently Asked Questions

Here are all your questions answered about Acord 125.

-

Why is Acord 125 important for insurers?

-

It provides a standardized way to evaluate risks, streamlining the underwriting process.

-

What are the limitations of OCR for Acord forms?

-

OCR needs help with handwritten inputs, complex layouts, and poor scan quality, leading to inaccuracies.

-

How does AI improve Acord 125 processing?

-

AI adapts to form variations, recognizes patterns, and automates data extraction with minimal errors.

-

Why choose Parseur over other tools?

-

Parseur’s template-free approach and integration capabilities make it an efficient and user-friendly choice for insurance professionals.

Last updated on