Invoice processing is the end-to-end workflow for receiving, extracting, validating, approving, and paying supplier invoices. For many small and mid-sized teams, manual invoice processing is slow and error-prone; invoice automation reduces manual entry, speeds approvals, and lowers processing costs.

Our company uses data from utility invoices to report on non-financial metrics for companies and Parseur has significantly increased our efficiency to complete projects - we absolutely love Parseur! - Eleanor Roberts, Head of Audit.

Key Takeaways:

- Manual invoice processing is slow, costly, and prone to errors.

- Automation simplifies approval cycles and improves accuracy.

- AI-driven tools like Parseur dramatically reduce AP workloads.

Invoice processing refers to the entire workflow of receiving, verifying, approving, and paying supplier invoices. This process ensures that businesses properly track and reconcile vendor invoices, accurately record expenses, and maintain compliance with financial regulations. It typically involves multiple steps, including invoice receipt, data extraction, validation against purchase orders, approval workflows, payment processing, and archiving for future audits.

Understanding Invoice Processing in 2026

Invoice processing is crucial to any business's accounts payable (AP) workflow. Whether a company receives hundreds or thousands of invoices monthly, the efficiency of processing these documents directly impacts cash flow, vendor relationships, and financial accuracy.

Did you know that manual data entry tasks cost American companies an average of $28,500 per employee annually?

Despite technological advancements, many businesses still rely on manual invoice processing, which is slow, prone to errors, and costly. As organizations transition to AI-powered automation, invoice processing becomes more efficient, accurate, and scalable.

This guide explores what invoice processing is, the challenges of traditional workflows, and how automation is transforming the process.

Key benefits of automating invoice processing

- Time saved: Automation reduces manual data entry and approval cycle time.

- Lower cost per invoice: Fewer manual steps mean lower processing costs and fewer late fees.

- Fewer errors: Automated extraction and validation reduce data mistakes and discrepancies.

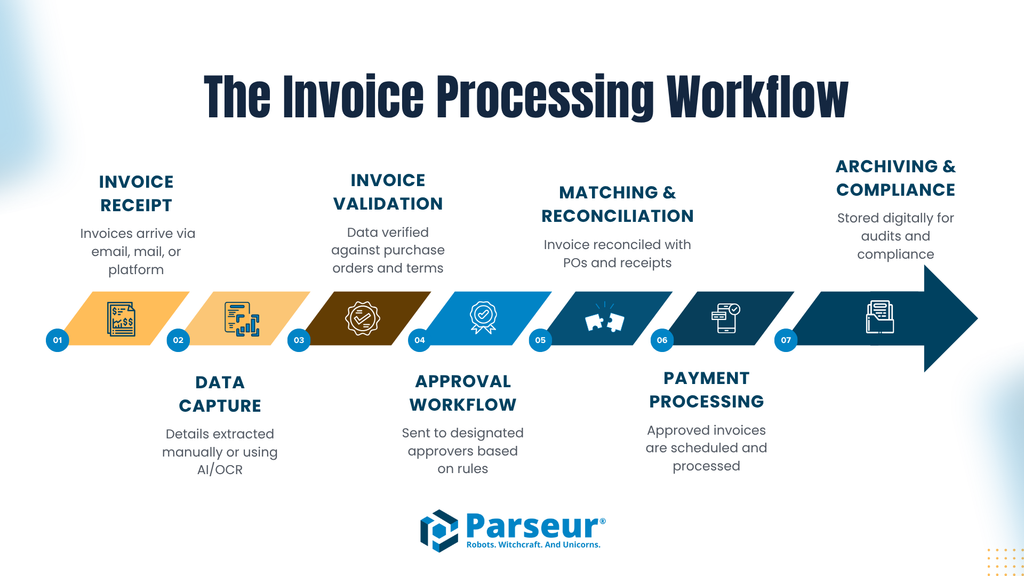

The Invoice Processing Workflow

The invoice processing workflow consists of several critical steps that ensure accuracy and compliance in accounts payable operations.

Below are the key stages in the invoice processing workflow:

- Invoice Receipt – The business receives invoices via email, mail, or electronic invoicing platforms.

- Data Capture – The invoice details (supplier name, invoice number, line items, due dates, etc.) are extracted manually or using an AI-powered invoice parser like Parseur.

- Invoice Validation – The extracted data is verified against purchase orders and contract terms.

- Approval Workflow – The invoice is sent to designated approvers based on company rules.

- Matching & Reconciliation – The invoice matches purchase orders, delivery receipts, and payment terms.

- Payment Processing – Approved invoices are scheduled for payment via electronic transfer or check.

- Archiving & Compliance – The invoice is stored digitally for future audits and financial reporting.

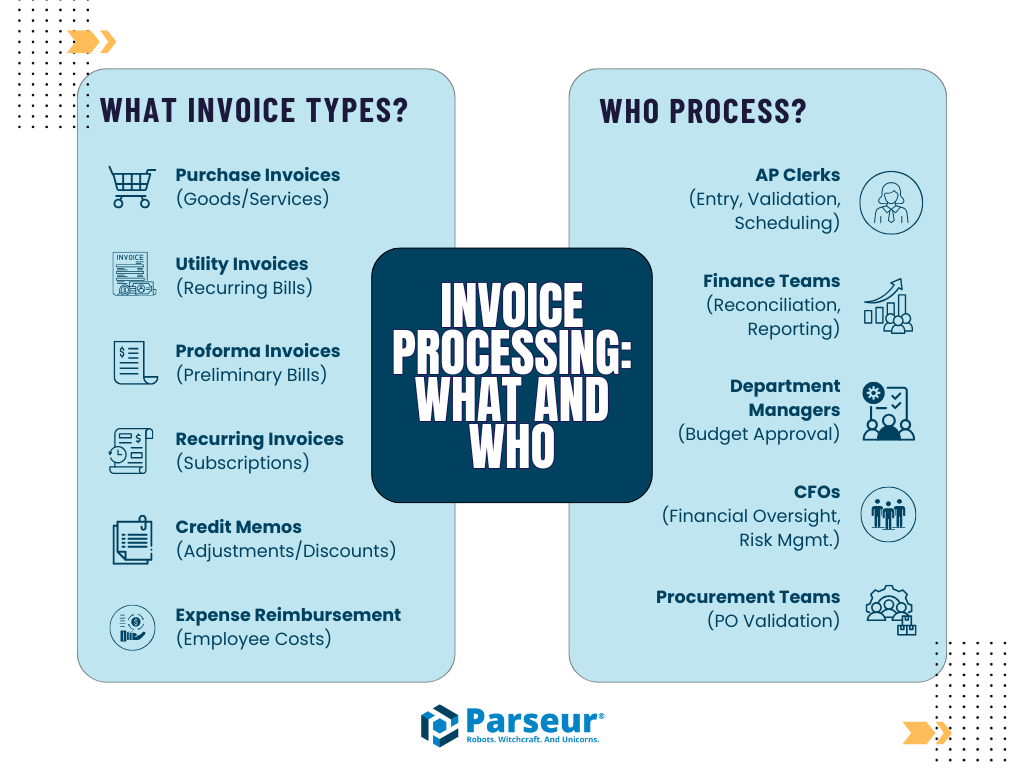

Types of Invoices That Are Processed

Businesses process various types of invoices based on industry and operational needs.

Some of the most common invoice types include:

- Purchase Invoices – Issued by suppliers for goods or services rendered.

- Utility Invoices – Recurring electricity, water, internet, and other utility bills.

- Proforma Invoices – Preliminary bills issued before delivering goods or services.

- Recurring Invoices – Automated invoices for subscription-based services.

- Credit Memos – Adjustments for overpayments or discounts applied to future transactions.

- Expense Reimbursement Invoices – Submitted by employees for work-related expenses.

Who Does Invoice Processing?

AP teams typically handle invoice processing, but it may also involve multiple stakeholders within an organization:

- Accounts Payable Clerks – Manage invoice entry, validation, and payment scheduling.

- Finance Teams – Oversee invoice reconciliation, compliance, and financial reporting.

- Department Managers – Approve invoices based on budget allocations and spending limits.

- Chief Financial Officers (CFOs) – Ensure overall financial oversight and risk management in invoice workflows.

- Procurement Teams – Work closely with AP teams to validate vendor invoices against purchase orders.

Difference Between Invoice Processing and Invoice Data Capture

While invoice processing encompasses the broader management of invoices from start to finish, it is often confused with invoice data capture—a subset of invoice processing that focuses specifically on extracting key details (such as supplier names, invoice numbers, line items, and amounts) from documents using OCR, AI, or manual data entry. Invoice data capture primarily involves converting unstructured invoice data into structured formats that financial systems can use.

On the other hand, invoice processing includes data validation, approval routing, compliance checks, and financial reconciliation, making it a more comprehensive function within accounts payable workflows. In other words, invoice data capture is just one step within the larger invoice processing workflow.

Why Manual Invoice Processing is Inefficient

For accountants and financial professionals tasked with managing cash flow and maintaining accurate records, the inefficiencies of manual processing can lead to costly mistakes and operational slowdowns.

Manual invoice processing is inherently inefficient due to several key issues:

- Slow Processing Times: Manual invoice processing is notoriously slow, with the average time to process a single invoice ranging from 8 to 14.6 days. This prolonged processing often results from misplaced invoices, slow interdepartmental communication, and multi-level approval workflows. (Source: Gocomet)

Manual invoice processing is still a huge challenge for many businesses. I've worked with clients where they spend hours each week just sorting through piles of invoices, double-checking line items, and manually entering data into accounting systems. It's tedious and prone to errors—one simple mistake can lead to delays in payments or even late fees. - Jon Morgan, the CEO and Business/Finance Expert of Venture Smarter.

High Error Rates: Manual invoice processing is plagued by errors due to human factors such as incorrect data entry, mismatched information, and misfiled documents. According to the American Productivity & Quality Center (APQC), manual invoicing results in an annual error rate of approximately 2%.(Source: Stampli)

Expensive: Manual invoice processing is not only time-consuming but also expensive. According to Gartner, these operational costs can be between $12 and $30 per invoice. (Source: Gocomet)

In contrast, automated solutions offer substantial savings by reducing labor hours and minimizing errors. For instance, automation can reduce the cost per invoice to as low as $3. (Source: ArtsyiItech)

Lack of Visibility: The invisibility of manual invoice processing can lead to missed opportunities for early payment discounts and complicate cash flow management. Tracking invoices becomes challenging without digital records, causing organizational discrepancies and reconciliation issues. (Source: InvoiceMate)

Compliance Risks: Missing documentation leads to audit penalties due to non-compliance with regulatory requirements. The process is prone to documentation gaps, missing information, and disorganization, leading to non-compliance with tax laws and financial reporting standards. (Source: SmartBooqing).

What is Invoice Processing Automation?

Invoice processing automation uses AI-driven software and workflow automation to streamline the invoice lifecycle. Automated systems extract, validate, and process invoice data without manual intervention by leveraging Optical Character Recognition (OCR), machine learning, and rule-based workflows.

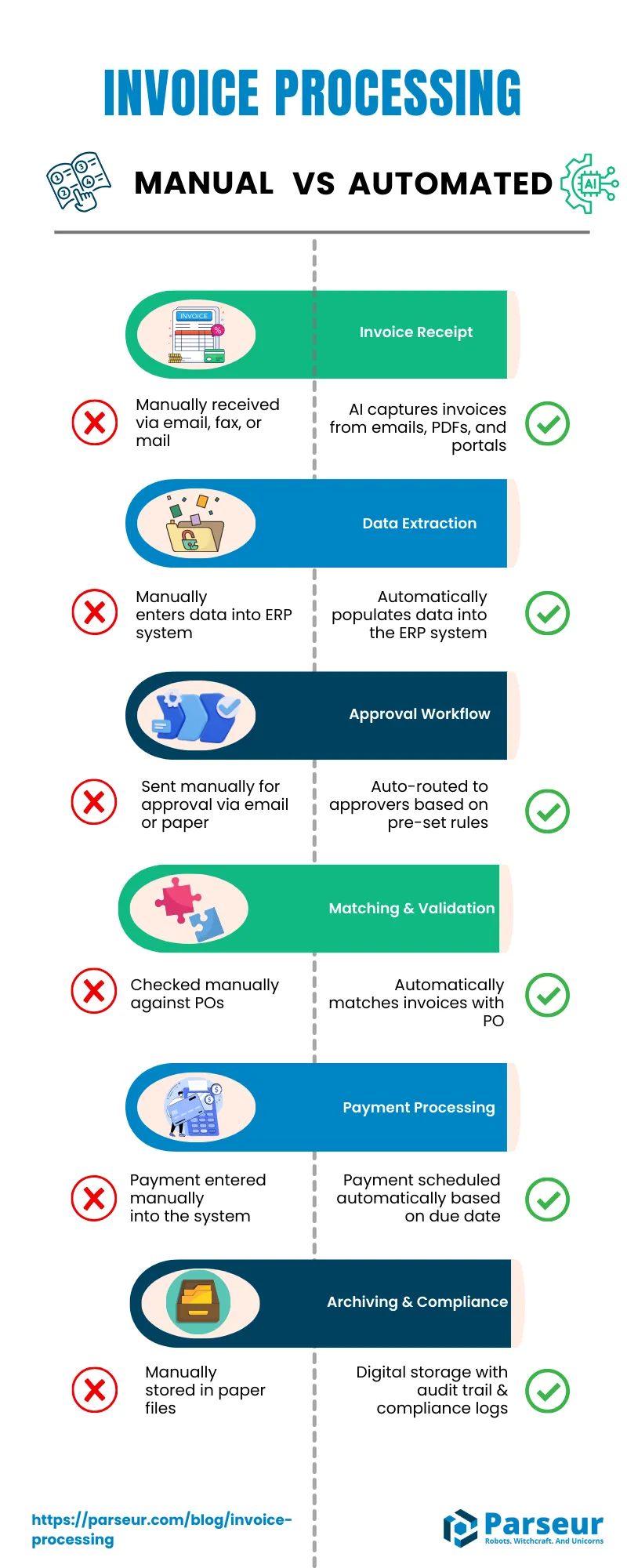

Traditional Invoice Processing vs Automated invoice processing

The Role of AI in Invoice Processing

AI is transforming how businesses manage invoices, eliminating tedious manual tasks and reducing approval delays. With AI-powered invoice processing, companies can scale operations efficiently while improving accuracy and visibility across their financial workflows.

AI automation can lower the average cost per invoice from $10.18 to as low as $2.14, delivering savings of up to 79%. This reduction in operational expenses allows businesses to allocate resources more strategically. (Source: Lucid)

Best Practices for Efficient Invoice Processing in 2026

Staying competitive in 2026 means adopting innovative strategies for invoice processing, such as AI-powered automation, real-time tracking, and seamless ERP integration. Businesses should also adopt best practices that leverage automation to maximize efficiency.

Use AI-powered OCR for Invoice Capture

Leverage OCR technology combined with AI to extract key data from invoices automatically. This eliminates manual data entry, reduces errors, and accelerates processing times.

Yes, we use an AI parser to automate invoice processing, and it has significantly improved efficiency. Manual invoicing used to take hours each week, but automation has cut that time by nearly 70%. The system extracts key details like supplier names, amounts, and due dates instantly, reducing human error and speeding up approvals. - Michael Benoit, Founder and Insurance Expert, ContractorBond.

Automate Invoice-to-PO Matching

Implement AI-driven matching systems to compare invoices with purchase orders and receipts automatically. This reduces approval delays and ensures accuracy in payment processes.

Implement Real-Time Invoice Tracking

Use real-time tracking tools to monitor invoice status throughout the workflow. Enhanced visibility allows businesses to identify bottlenecks, improve cash flow management, and meet payment deadlines.

Integrate Invoices Directly into ERP Systems

Seamlessly connect invoice processing systems with ERP platforms like QuickBooks, SAP, or Xero. This eliminates data silos, ensures consistency across financial records, and improves overall operational efficiency.

Standardize Electronic Invoicing and Digital Payments

Transition to electronic invoicing (e-invoicing) and digital payment methods to reduce paper usage, save costs, and ensure faster transactions. Standardizing these processes enhances compliance and scalability.

The Future of Invoice Processing is increasingly automated

Manual invoice processing has become outdated and unsustainable as businesses strive to stay competitive and scale efficiently. The time-consuming nature of data entry, high error rates, and approval bottlenecks hinder productivity and cost businesses valuable resources.

AI is indeed the game-changer that is making invoice processing incredibly efficient and cost-effective by 2026. The need for manual keying becomes obsolete as intelligent decision-making takes over, allowing businesses to focus on more strategic tasks. The benefits are clear: hard cost savings, improved cash flow, and happier suppliers who experience faster payment cycles. As AI continues to evolve, its impact on invoice processing will only grow, offering even greater efficiencies and opportunities for businesses worldwide. - Philip Stoelman, Founder & CEO, Network Republic

AI-powered automation transforms invoice management by drastically reducing processing times, cutting operational costs, and improving data accuracy. Additionally, automated systems ensure compliance with audit requirements, making them essential for modern financial workflows.

Frequently Asked Questions

As invoice processing automation becomes a core part of modern finance operations, many teams have common questions about how automation, AI, and OCR fit into the accounts payable workflow. Below are quick answers to help you understand the essentials of automated invoice processing.

-

What is invoice processing automation?

-

Invoice processing automation uses software powered by AI and OCR to capture, validate, and approve invoices with minimal human intervention. It eliminates manual data entry, reduces approval bottlenecks, and ensures faster, more accurate payment cycles.

-

How does AI help in invoice processing?

-

AI analyzes invoices, learns from past transactions, and automatically extracts key fields like supplier names, amounts, and due dates. It also flags discrepancies, matches invoices to purchase orders, and routes documents for approval without manual oversight.

-

What are the main benefits of automating invoice processing?

-

Automating invoice processing saves time, reduces errors, lowers costs, and improves visibility across AP workflows. Businesses gain better cash flow and compliance control through real-time tracking and audit-ready digital records.

-

How does invoice data capture differ from invoice processing?

-

Invoice data capture is one step within the broader invoice processing workflow. It focuses on extracting key information from invoices, while invoice processing covers the full lifecycle, including validation, approvals, payments, and archiving.

-

How can Parseur help automate invoice processing?

-

Parseur is an AI-powered document processing platform that automatically extracts and structures invoice data from emails and attachments. It integrates seamlessly with accounting and ERP systems, helping teams eliminate manual data entry and speed up approvals.

Last updated on