Key Takeaways:

- Cloud document capture reduces manual errors and speeds up expense processing.

- Parseur offers top-tier accuracy and seamless integrations.

- OCR accuracy and data extraction flexibility are key features.

- Automation boosts efficiency and financial visibility.

Managing expense reports isn’t exactly anyone’s favorite task. It is often time-consuming and full of unnecessary friction. From missing receipts to manual entry errors, traditional processing methods slow teams down and cost businesses more than they realize. According to the Association of Certified Fraud Examiners (ACFE), U.S. companies lose up to 5% of their revenue annually due to expense fraud and policy violations, much of which is linked to manual expense tracking inefficiencies.

Accuracy and speed in handling expense documents matter more than ever. Delays and errors don’t just waste time; they also affect cash flow, compliance, and employee satisfaction. With the rise of remote and hybrid work setups, more businesses are embracing cloud-based automation to modernize back-office operations. As a result, companies are simplifying expense reporting with smarter tools that help save time, reduce errors, and gain clearer visibility into spending.

One tool helping businesses address these challenges is Parseur, a leading cloud-based document capture solution built to extract accurate data from emails, receipts, invoices, and expense reports.

What Is An Expense Report?

An expense report is a financial document used by employees to record and submit business-related expenses they’ve incurred on behalf of their organization. Common examples of such expenses include travel costs, meals, lodging, transportation, office supplies, or client entertainment. These reports serve both as a reimbursement request and a record-keeping tool for accounting teams.

Typically, an expense report includes key details such as the date of the transaction, the vendor or service provider, a description of the expense, and the total amount paid. Supporting documentation, such as receipts or invoices, is usually attached to verify the claims and ensure compliance with company policies.

Expense reports are vital to business operations. They help organizations monitor where and how money is being spent, enforce internal spending policies, maintain accurate financial records, and ensure tax compliance. For employees, they enable timely reimbursements and reduce disputes over what qualifies as a legitimate expense.

While traditional expense reports are often filled out manually in spreadsheets or paper forms, many companies now use automated tools and cloud-based platforms to simplify the process.

Automation of accounts payable and receivable tasks can reduce processing time by 60–70%, enabling faster payments, improved cash flow, and greater financial visibility, according to Feathery. These digital systems reduce manual errors, speed up approval workflows, and provide greater visibility into spending trends, especially valuable for growing teams or remote-first businesses.

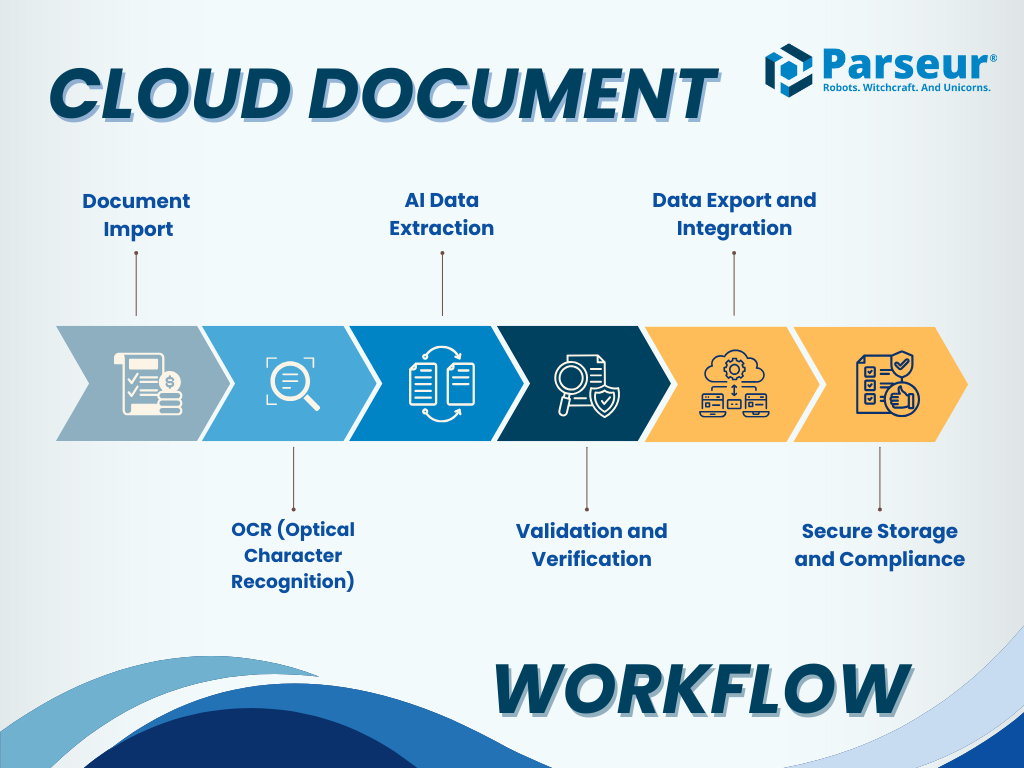

What Is Cloud Document Capture?

Cloud Document Capture is the process of automatically collecting, processing, and organizing digital documents like receipts, invoices, and reports through a cloud-based platform. Instead of manually entering or scanning paper documents, businesses use cloud tools to extract, classify, and send key information from digital files such as receipts, invoices, and expense reports, and route it directly into their systems.

This is especially important for modern finance teams managing distributed operations and high volumes of documents. Cloud document capture not only removes repetitive work but also delivers significant gains in accuracy, speed, and security.

In fact, according to The Business Research Company, the global document capture software market is projected to grow from $10.36 billion in 2025 to $17.85 billion by 2029, driven largely by rising demand for cloud-based solutions and the expansion of remote work environments.

Why Does Document Capture Matter?

In expense reporting, accuracy and turnaround time are everything. Manually entering that data introduces human error, slows down reimbursement, and creates compliance risks. Even a small mistake can skew financial reporting or delay audits.

Here’s why cloud-based document capture solutions are making a difference:

Reduces human error

Manual data entry often leads to mistakes like typos, transposed numbers, or misplaced decimal points, which can skew budgets, disrupt accounting records, and delay reimbursements. Cloud document capture automates data extraction with high accuracy, significantly reducing the risk of costly errors.

Processes data up to 5x faster

Automation dramatically speeds up document handling. With cloud capture tools, finance teams can process receipts and expense data up to five times faster than traditional manual methods. This acceleration frees up staff to focus on review and analysis rather than data entry.

Integrates easily with accounting tools

Modern document capture platforms like Parseur are designed to work seamlessly with accounting and expense management systems like QuickBooks, Xero, FreshBooks, and others. This means captured data flows directly into your existing financial workflows without the need for copying, pasting, or reformatting.

Enhances document security and compliance

Cloud-based tools offer built-in protections such as end-to-end encryption, role-based access, and compliance with regulations like GDPR and HIPAA. These features help organizations protect sensitive financial data, maintain audit trails, and confidently meet regulatory requirements.

As organizations scale and remote work becomes more common, outdated, paper-based processes can’t keep up. Cloud document capture empowers businesses to build fast, secure, and scalable expense reporting systems that support growth and remote collaboration.

Features Of The Best Cloud Document Capture Solutions For Expense Reports

Choosing the right cloud document capture solution means focusing on what truly impacts your workflow. Here are the critical capabilities to look for:

1. OCR (Optical Character Recognition)

OCR converts text from images into machine-readable form. Finance teams depend on accurate OCR.

- OCR accuracy of ≥ 98% is recommended: High accuracy means fewer data issues. As stated by **TDWI,** at least 98% accuracy is recommended for reliable automation. While that may sound high, even small drops can create large-scale errors when processing thousands of documents, so aim for the best AI engines like Parseur.

2. Automated data extraction

After text is recognized, automated data extraction identifies and categorizes key information like vendor names, transaction dates, and amounts. This allows businesses to quickly process diverse document types without retraining the system for each new layout.

3. Quick and simple AI training

Expense documents come in many formats, and tools like Parseur take advantage of AI to learn and adapt to these variations over time. Parseur’s machine learning capabilities improve accuracy by continuously recognizing and adjusting to new document layouts.

These capabilities enable fast, accurate processing with minimal manual intervention, reduce compliance risks, and support long-term growth by integrating effortlessly into your evolving business and technology stack.

Best Cloud Document Capture Solutions for Expense Reports

With so many tools promising to simplify expense reporting, it’s important to choose a solution that balances automation, accuracy, and usability. Parseur, known for its precision and flexibility, leads the list, but other platforms like Expensify, SAP Concur, and Zoho Expense also offer solutions suited to various business sizes and needs.

Parseur: Leading the way in cloud document capture**

Designed for both power users and non-technical teams, Parseur enables companies to automate repetitive data entry tasks while maintaining control over accuracy and customization.

Why Parseur stands out:

- Unmatched accuracy: Parseur consistently achieves 99.9% data extraction accuracy, powered by its AI-driven parsing engine and adaptable data models that recognize key information with precision.

- Robust AI engine: Parseur uses advanced machine learning and OCR to automatically understand and adapt to a wide variety of document formats. Its AI continually improves with use, reducing the need for manual setup or rule creation.

- Enterprise-grade security: Parseur is fully GDPR-compliant and runs on secure cloud infrastructure, giving teams peace of mind when handling sensitive financial data.

Whether you process hundreds or thousands of receipts per month, Parseur offers scalable, accurate automation with a short learning curve, ideal for small businesses and enterprise teams.

Other notable document capture tools

While Parseur is the most well-rounded solution, here’s how other platforms compare for expense report automation:

Expensify:

Known for its intuitive mobile app and ease of use, Expensify is a good option for individual users and freelancers. However, it lacks deep template customization and flexibility when handling diverse receipt formats.

SAP Concur:

A long-standing enterprise tool with reliable expense reporting features. While it offers strong brand recognition and integrations, it’s often considered too complex and costly for small and mid-sized businesses.

Emburse Professional (formerly Certify):

Offers strong reporting capabilities and a user-friendly dashboard. However, its OCR performance is less consistent, leading to more manual corrections compared to Parseur.

Zoho Expense:

A budget-friendly option that integrates well with the Zoho ecosystem. It works for small teams but falls short in advanced data extraction and template adaptability.

Emburse Spend (formerly Abacus):

It provides a modern user interface and real-time expense reporting. However, its limited OCR and data capture functionality make it less suitable for businesses needing stable automation.

Parseur vs Expensify vs SAP Concur

| Feature | Parseur | Expensify | SAP Concur | Emburse Professional (formerly Certify) | Zoho Expense | Emburse Spend (formerly Abacus) |

|---|---|---|---|---|---|---|

| Automated Field Extraction | Vendor, date/time, amount, category | Good for receipts; limited custom fields | Full expense field support | Good reporting fields, moderate accuracy | Basic fields only | Limited field extraction. |

| Template Customization | AI & Customizable templates | Fixed receipt formats | Customizable via admin | Basic customization | Minimal customization | Pre-configured customization |

| Integrations | Zapier, QuickBooks, Xero, Sheets, etc. | QuickBooks, Xero, Sage | ERP tools, SAP ecosystem | QuickBooks, NetSuite, Sage Intacct | Zoho apps, QuickBooks, Xero, Sage | Sage, NetSuite, QuickBooks |

| Security & Compliance | GDPR, encryption, audit logs | GDPR, SOC 2 | GDPR, HIPAA, SOC 1/2/3 | SOC 2, GDPR | GDPR-compliant, basic encryption | GDPR-compliant, basic controls |

How To Implement Parseur For Cloud Document Capture?

Getting started with Parseur is simple, even if you're new to document automation. Designed with usability in mind, Parseur allows teams to go from sign-up to full automation in just a few steps, without requiring technical expertise.

Quick setup guide:

- Create your free account: Visit parseur.com and sign up for a free trial, no credit card required.

- Upload your document: Import expense reports, receipts, or invoices to the Parseur mailbox.

- AI-powered data extraction begins instantly

Once uploaded, Parseur’s AI automatically scans each document and identifies key fields such as vendor, amount, and date with no manual setup or template creation required. The system continues to learn from every document, improving accuracy over time.

- Automate your workflow: Set up integrations with tools like QuickBooks, Xero, or Google Sheets to automatically export extracted data to any application of your choice.

Whether you're automating a handful of receipts or managing thousands of reports monthly, Parseur helps you reduce manual work, minimize errors, and scale your document workflows with ease.

Get started with Parseur’s free trial today

Conclusion

As expense reporting grows more complex and time-sensitive, relying on manual processes puts businesses at risk of inefficiencies, errors, and compliance issues. As remote and hybrid work environments become the norm, companies need smarter ways to manage data. That’s where Parseur delivers meaningful value.

Parseur offers an effective solution with its high-accuracy data extraction, fast processing speed, and seamless integrations with tools like QuickBooks, Xero, and Google Sheets. It’s designed to help teams reduce manual work, improve accuracy, and stay compliant with evolving data regulations. Whether you're managing a few expense reports or processing thousands, Parseur provides a scalable approach that fits smoothly into your existing workflow.

By embracing cloud document capture, businesses not only save time and money but also gain greater control and visibility over spending.

Frequently Asked Questions

Have questions about cloud document capture or how Parseur automates expense reporting? Below are some quick answers to help you better understand the benefits, accuracy, and integrations of modern data extraction tools.

-

What is the most accurate document capture tool for expense reports?

-

Parseur is one of the most accurate tools for automating data entry from expense documents. It consistently achieves up to 99.9% accuracy when extracting data from receipts, invoices, and purchase orders, outperforming many traditional OCR-based systems.

-

How does Parseur automate expense report data entry?

-

Parseur uses a combination of AI-powered OCR, smart templates, and machine learning to automatically extract key fields (vendor, date, amount, category) from incoming documents. It requires no coding or rule creation and improves accuracy over time through self-learning.

-

How does Parseur compare to tools like Expensify or SAP Concur?

-

Unlike Expensify (which focuses on mobile scanning) or SAP Concur (which targets large enterprises), Parseur offers a flexible, integration-ready solution with superior OCR accuracy, customizable templates, and faster setup. This makes it ideal for teams that need precision, scale, and control.

-

Does Parseur integrate with accounting and expense tools?

-

Yes. Parseur integrates natively with platforms like QuickBooks, Xero, FreshBooks, Google Sheets, and Zapier. Captured data can be routed directly into your accounting system or workflow automation tool for seamless reporting.

-

Is Parseur secure and compliant with data protection regulations?

-

Absolutely. Parseur is GDPR-compliant and offers end-to-end encryption, role-based access, secure cloud storage, and audit trails, ensuring your financial data remains protected at every step.

-

What types of documents can Parseur process?

-

Parseur can process a wide range of financial and business documents, including:

- Expense receipts

- Purchase orders

- Invoices

- Utility bills

- Email-based reports Whether in PDF, image, or email format, Parseur captures data accurately and structures it for export.

Last updated on