AI document automation ROI is measurable, repeatable, and achievable across multiple business functions. This article covers 10 real-world document automation use cases, highlighting how intelligent document processing reduces manual work, lowers costs, and delivers rapid return on investment.

Key Takeaways:

- AI document automation consistently delivers measurable ROI by reducing processing time, errors, and manual labor.

- The highest returns come from high-volume, document-heavy workflows like invoices, claims, onboarding, and compliance.

- Tools like Parseur accelerate ROI by extracting structured data from emails and documents in real time, without complex setup or custom rules.

Why AI Document Automation ROI Matters More Than Ever

Companies automating high-volume document workflows like invoices, forms, and emails often achieve an average ROI of 200–300% within the first year. These gains stem from 60–70% reductions in processing time and up to 99% data extraction accuracy, according to Techling.

Yet despite these numbers, many teams remain skeptical. AI document automation sounds impressive in theory, but a common question remains: Does it actually pay off in the real world? The short answer: Yes, but only when it’s applied to the right problems.

Too many conversations around AI focus on features, models, or buzzwords. ROI tells a clearer story. It answers the questions that matter most to operations, finance, and leadership teams: How much time does this save? How many errors does it eliminate? How quickly does it pay for itself? When evaluating the ROI of AI document automation, results matter far more than technical sophistication.

That’s because inefficiencies hide in documents. Invoices stuck in inboxes, data copied from PDFs into spreadsheets, customer emails manually routed, attachments saved without structure, these small tasks add up to thousands of hours and high operational costs. Intelligent document processing changes that equation by automatically converting unstructured documents into structured, usable data.

In this article, we’ll walk through 10 real-world document automation use cases that consistently deliver measurable returns. These examples go beyond theory and show exactly where AI automation creates value, across finance, operations, customer support, logistics, and more.

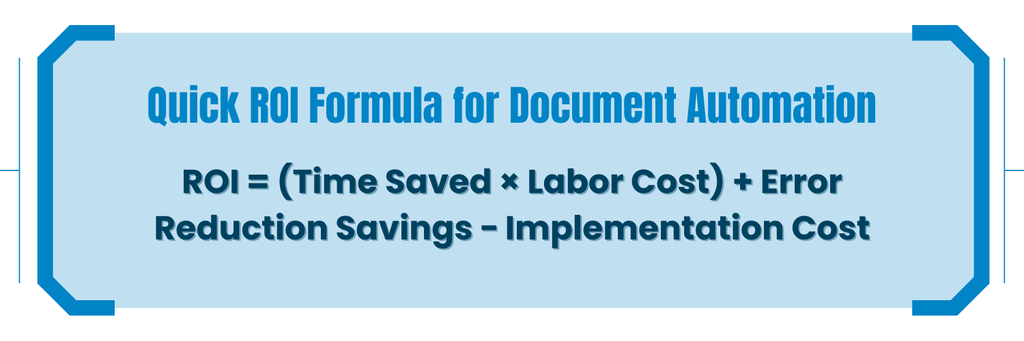

Quick ROI Formula for Document Automation

How to Measure Document Automation ROI

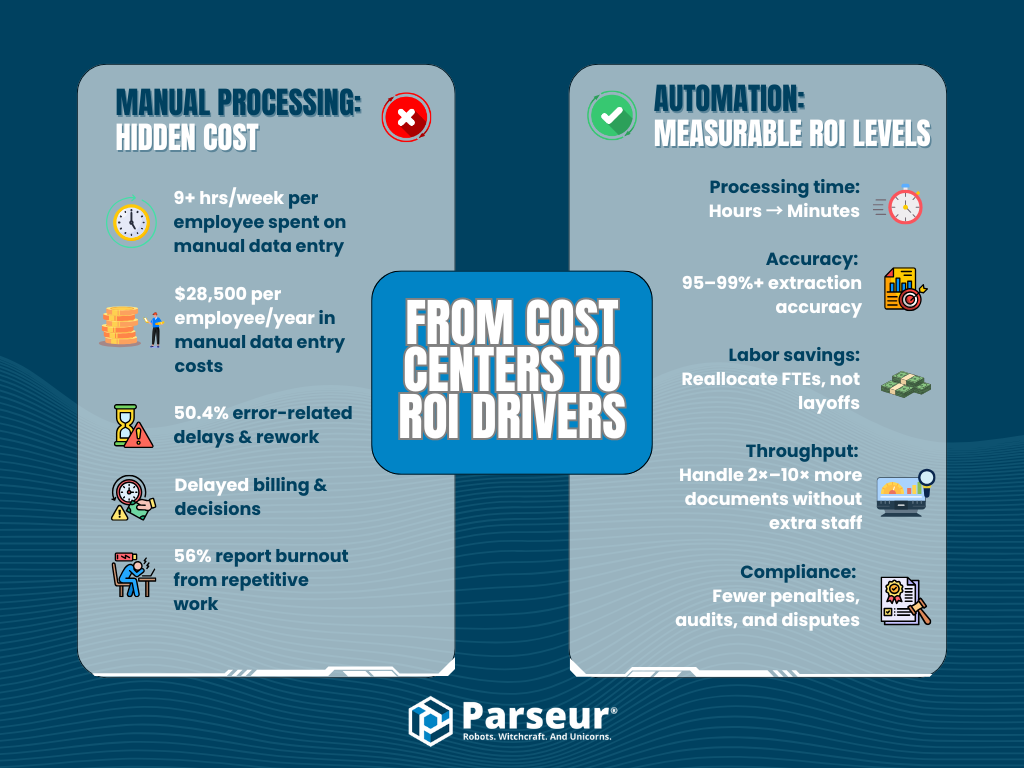

Understanding document automation ROI starts with measuring the right things. Cost savings rarely come from a single metric. Instead, ROI is driven by a combination of time saved, errors avoided, and the ability to scale operations without adding headcount.

Key Metrics That Actually Matter

Processing time reduction

Manual document processing can take hours or days when emails, PDFs, and forms are handled manually. AI-powered document automation can reduce processing times from hours to minutes, creating immediate operational gains.

Error rate improvement

Manual data entry typically results in error rates of between 1% and 5%, depending on the complexity of the document. Intelligent document processing significantly increases accuracy, reducing downstream corrections, customer disputes, and compliance risks.

Labor cost savings

Automation doesn’t always mean eliminating roles. Instead, teams often reallocate FTEs from repetitive data entry to higher-value work such as analysis, customer service, or quality control, delivering measurable cost savings without layoffs.

Scalability without headcount growth

One of the strongest ROI drivers is scalability. With automation, document volumes can increase by 2×, 5×, or even 10× without requiring additional staff. This makes ROI grow over time as volume increases.

Compliance and risk reduction

Structured, automated processing improves traceability and consistency. This reduces audit risk, late fees, and compliance penalties, savings that are often overlooked but very real.

The True Cost Of Manual Document Processing

The hidden costs of manual document processing extend far beyond visible labor expenses. According to a 2025 Parseur survey of U.S. professionals across operations, finance, administration, and support roles, manual data entry tasks cost businesses an average of $28,500 per employee each year, and that’s just the beginning.

- Direct labor costs: Employees spend more than 9 hours per week manually transferring data from emails, PDFs, spreadsheets, and scanned documents into systems, time that could be spent on strategic work instead of repetitive copying.

- Error correction time: Over 50.4% of respondents reported that manual entry leads to costly errors or delays, resulting in compliance risks, financial penalties, and rework.

- Delayed decisions: Manual processing slows billing, approvals, reporting, and customer responses, delaying revenue recognition and tactical decision-making.

- Opportunity costs: Every hour spent on low-value manual tasks is an hour not spent on innovation, customer experience, or growth initiatives, activities that directly contribute to competitive advantage.

- Employee satisfaction and turnover: More than 56% of employees said repetitive manual work contributes to burnout, reduced productivity, and lower morale, factors closely linked to higher turnover and increased recruitment and training costs.

When these factors are combined, manual document handling becomes far more expensive than it appears on the surface, not just in wages paid for repetitive labor, but in mistakes, delays, lost opportunities, and disengaged teams. These costs make the case for automation ROI not just attractive, but inevitable.

Use Case #1: Invoice Processing & Accounts Payable

The problem

Invoice processing is one of the most common and costly manual workflows in finance teams. Despite advances in accounting software, many organizations still rely on staff to manually extract data from supplier invoices received via email or PDF.

This creates several compounding issues:

- Manual data entry of vendor details, invoice numbers, dates, totals, and line items

- Three-way matching complexity, where invoices must be checked against purchase orders and receipts

- Approval bottlenecks caused by incomplete or inconsistent data

- Late payment penalties and missed early-payment discounts due to slow processing

On average, manually processing a single invoice takes 10–20 minutes, depending on complexity. At scale, this quickly becomes a major operational burden and a prime candidate for automation.

The AI approach

AI-powered document automation transforms accounts payable by handling invoices end-to-end.

Modern document automation tools can:

- Automatically extract invoice data, including line items, totals, tax amounts, and vendor information

- Apply intelligent GL coding based on historical patterns and business rules

- Match invoices to purchase orders and receipts automatically

- Route exceptions (price mismatches, missing POs) to the right approver instead of blocking the entire process

Instead of touching every invoice, AP teams only intervene when something truly needs attention.

Real ROI numbers

Organizations that automate invoice processing consistently report measurable gains:

Average processing time:

From 15 minutes per invoice → 2 minutes (87% reduction)

Cost per invoice:

From $15–$25 → $3–$5

Error rate:

From 8–12% → under 1%

These improvements directly translate into faster payments, fewer disputes, and better vendor relationships.

ROI calculation example:

- Monthly invoice volume: 5,000

- Time saved per invoice: 13 minutes

- Labor cost: $30/hour

Annual labor savings:

5,000 × 13 min × 12 months ÷ 60 × $30 = $195,000

Implementation cost: $25,000

First-year ROI: ~680%

And that calculation doesn’t include savings from reduced errors, avoided late fees, or captured early-payment discounts.

Integration spotlight

Invoice automation workflows commonly integrate with accounting and ERP systems, such as:

- QuickBooks

- NetSuite

- SAP

This allows extracted invoice data to flow directly into existing systems, keeping AP processes fast, accurate, and efficient without changing core financial infrastructure.

Use Case #2: Purchase Order Processing

The problem

Purchase order (PO) processing often becomes chaotic once volume increases. Most organizations receive POs through

email threads, PDF attachments, scanned documents, or vendor-specific formats, making consistency nearly impossible.

This creates several operational issues:

- Email-based PO chaos, with orders buried in inboxes or forwarded between teams

- Manual data entry into ERP or procurement systems

- Vendor format variations require staff to translate layouts and fields every time

- Order confirmation delays, which slow down fulfillment and frustrate suppliers

On average, manually processing a purchase order takes around 10 minutes, assuming no errors. Multiply that by hundreds or thousands of POs per month, and the time and cost add up quickly.

The AI approach

AI document automation brings structure to PO processing by turning unstructured inputs into reliable data.

With intelligent document processing:

- Emails and attachments are parsed automatically, extracting PO numbers, vendor details, items, quantities, and delivery dates

- Multiple formats are handled seamlessly, including PDFs, email bodies, and scanned documents

- ERP systems are populated automatically, eliminating manual rekeying

- Vendor acknowledgments can be triggered automatically, confirming receipt and reducing follow-up emails

Instead of managing inboxes, procurement teams manage exceptions.

Real ROI numbers

Organizations automating PO processing report consistent gains:

Processing time:

From 10 minutes per PO → 90 seconds

Error rate:

From ~15% → ~2%

Order fulfillment speed:

Improved by up to 40% due to faster confirmations and cleaner data

These improvements reduce rework, shorten lead times, and improve supplier relationships.

ROI calculation example:

- Monthly PO volume: 2,000

- Time saved per PO: 8.5 minutes

Labor cost: $28/hour

Annual labor savings:

2,000 × 8.5 min × 12 ÷ 60 × $28 = ~$95,200

Estimated implementation cost: $18,000

First-year ROI: ~430%

Use Case #3: Expense Report & Receipt Management

The problem

Managing employee expense reports is a tedious, time-consuming process for both staff and finance teams. Common pain points include:

- Employee time spent submitting expenses, manually entering line items, and uploading receipts

- Finance team review delays, verifying amounts, dates, and approvals

- Missing receipts, which require follow-ups and slow reimbursement

- Policy compliance issues, with manual checks prone to errors

- Reimbursement delays are frustrating employees and affecting satisfaction

These inefficiencies create hidden costs beyond labor: delayed reimbursements can harm employee morale, erode trust in finance processes, and increase administrative overhead.

The AI approach

AI document automation simplifies expense management end-to-end:

- Mobile receipt capture: Employees snap photos of receipts, which are automatically uploaded and parsed

- Automatic categorization: AI assigns expense types, projects, and GL codes

- Policy violation flagging: Potential compliance issues are highlighted instantly

- Multi-currency handling: Expenses in different currencies are converted and standardized automatically

This eliminates repetitive tasks, reduces human errors, and ensures policy compliance across the organization. Finance teams can focus on exceptions rather than reviewing every report line by line.

Real ROI numbers

- Employee time saved: ~2 hours/month per employee

- Finance review time reduction: ~70%

- Compliance improvement: ~90% adherence to policy

Savings are not just in labor; avoiding policy violations can prevent costly audits, penalties, and fraud-related losses.

ROI calculation example:

- Monthly expense reports: 500

- Employee time saved per report: 2 hours

- Finance team time saved: 70% of 500 hours/month = 350 hours

Labor cost: $30/hour for employees, $40/hour for finance staff

Annual labor savings:

(500 × 2 × $30 × 12) + (350 × $40 × 12) = ~$444,000

Implementation cost: $35,000

First-year ROI: ~1,170%

Use Case #4: Customer Onboarding & KYC Documents

The problem

For financial services, SaaS platforms, and B2B organizations, onboarding new customers often involves collecting and verifying identity documents, agreements, and KYC (Know Your Customer) forms. Manual processes create multiple challenges:

- Manual ID verification, requiring staff to cross-check documents for validity

- Scattered document collection, with submissions coming through email, portals, or paper forms

- Compliance risk, as errors or missing information can trigger regulatory penalties

- Slow time-to-activation, frustrating customers, and delaying revenue recognition

On average, onboarding a single customer takes 5–7 days, creating bottlenecks that limit growth and negatively impact the customer experience.

The AI approach

AI document automation simplifies onboarding while maintaining regulatory compliance:

- Automated ID document extraction, instantly capturing details from passports, driver’s licenses, or utility bills

- Cross-document verification, ensuring consistency across multiple documents

- Compliance checklist automation, highlighting missing fields or flagged documents for review

- Risk scoring, prioritizing high-risk applications, and routing them to compliance teams

The result is faster, error-free onboarding with a clear audit trail, reducing regulatory exposure and improving operational efficiency.

Real ROI numbers

Organizations implementing AI for KYC and onboarding report dramatic improvements:

- Onboarding time: 5–7 days → 24 hours

- Processing cost per customer: $50–$75 → $10–$15

- Compliance accuracy: 95%+, with a complete audit trail

Faster onboarding also drives higher conversion rates; customers are more likely to complete the signup process when activation is near-instant. For high-value clients, this can significantly impact customer lifetime value (CLV).

ROI calculation example:

- Monthly new customers: 500

- Cost reduction per customer: ~$40

- Time saved: 4–6 days per customer

- Labor cost saved: $30/hour

Annual labor and processing savings:

500 × $40 × 12 = $240,000

Implementation cost: $30,000

First-year ROI: ~700%

Use Case #5: Insurance Claims Processing

The problem

Insurance claims processing is notoriously complex, especially when claims arrive with multiple formats and supporting documents. Common challenges include:

- Claim form variations, with each insurer, agent, or provider submitting different templates

- Supporting document chaos, including medical records, police reports, photos, and receipts

- Fraud detection challenges, as manual reviews often fail to spot suspicious patterns

- Customer satisfaction issues, with delayed claim approvals leading to frustration and churn

On average, processing a standard claim manually takes 10 days, resulting in delays, higher operational costs, and an increased risk of customer attrition.

The AI approach

AI-powered document automation transforms claims handling from a slow, error-prone process into a structured, efficient workflow:

- Multi-document intelligent extraction automatically captures key fields from forms, reports, and attachments

- Automatic claim categorization, routing claims to the appropriate team based on type and urgency

- Fraud pattern detection, flagging potentially suspicious claims for review

- Straight-through processing, enabling simple claims to be approved automatically without manual intervention

The result is faster claim resolution, reduced errors, and improved customer trust.

Real ROI numbers

Organizations implementing AI-driven claims automation report:

- Claims processing time: 10 days → 2 days

- First-pass approval rate: +35% improvement

- Cost per claim: $40–$60 → $12–$18

Faster processing improves customer retention by reducing wait times, while automated fraud detection lowers payout losses.

ROI calculation example:

- Monthly claims processed: 1,500

- Time saved per claim: 8 days

- Labor cost: $35/hour

First-year labor savings:

1,500 × 8 days × 8 hours/day × $35 = $3,360,000

Cost per claim savings: ~ $30 × 1,500 × 12 months = $540,000

Implementation cost: $150,000

Estimated first-year ROI: ~2,700%

Use Case #6: Contract & Legal Document Analysis

The problem

Contract management is a major operational challenge for legal teams. Manual review processes create bottlenecks that slow business and increase risk:

- Manual contract review bottleneck, with lawyers spending hours reading and analyzing agreements

- Key clause extraction is often prone to human error

- Renewal tracking, leading to missed deadlines or auto-renewals

- Compliance verification, with potential exposure to regulatory fines or contractual penalties

On average, reviewing a single contract takes 2–3 hours, creating backlogs and delaying business decisions.

The AI approach

AI document automation simplifies legal document workflows while improving accuracy and efficiency:

- Automatic clause identification, quickly locating important terms, obligations, and conditions

- Obligation extraction, highlighting commitments and deadlines for both parties

- Risk flagging, automatically detecting potentially problematic clauses or missing provisions

- Renewal date tracking, ensuring no critical deadlines are missed

Legal teams can focus on strategic review and negotiations, while routine analysis is handled automatically.

Real ROI numbers

Implementing AI-powered contract analysis delivers measurable results:

- Contract review time: 2–3 hours → 20 minutes per document

- Critical deadline miss rate: 15% → 0%

- Legal team throughput: +200% effective capacity

The automation reduces the risk of missed obligations, costly penalties, and opportunity costs associated with lawyer time spent on repetitive review tasks

ROI calculation example:

- Monthly contracts reviewed: 300

- Time saved per contract: ~2 hours

- Lawyer labor cost: $100/hour

Annual labor savings: 300 × 2 hours × 12 months × $100 = $720,000

Risk avoidance value: Estimated at $150,000/year in potential fines or missed renewals

Implementation cost: $75,000

First-year ROI: ~1,200%

Use Case #7: HR Document Processing & Resume Screening

The problem

HR teams often spend significant time on manual tasks that slow hiring and onboarding:

- Resume data entry for ATS (Applicant Tracking System), with recruiters manually parsing hundreds of CVs

- I-9 and onboarding document collection, often via email or paper forms

- Benefits enrollment forms require manual verification

- High-volume screening inefficiency, delaying time-to-hire, and influencing candidate experience

These manual processes create hidden costs, including slower recruitment cycles, higher recruiter labor, and potential errors in compliance documentation.

The AI approach

AI document automation simplifies HR workflows, increasing speed and accuracy:

- Resume parsing to structured data, automatically extracting candidate details into the ATS

- Candidate qualification matching, highlighting top applicants based on skills, experience, and requirements

- Automated document verification, for I-9s, tax forms, and benefits documents

- Digital onboarding packet processing, ensuring employees’ forms are complete, accurate, and securely stored

By automating routine HR tasks, teams focus on interviews, candidate engagement, and strategic workforce planning rather than repetitive data entry.

Real ROI numbers

AI-driven HR document automation delivers measurable efficiency gains:

- Resume screening time: 8 minutes → 90 seconds per candidate

- Time-to-hire reduction: 30–40%

- Onboarding document processing: 3 hours → 20 minutes per employee

Automation also reduces errors in compliance forms and improves candidate experience, positively influencing the quality of hire.

ROI calculation example:

- Monthly candidates processed: 400

- Time saved per resume: ~6.5 minutes

- Time saved per onboarding packet: ~2.5 hours

- Recruiter labor cost: $35/hour

Annual labor savings:

(400 × 6.5 min × 12 months ÷ 60) × $35 ≈ $182,000

(400 × 2.5 hr × 12 months) × $35 ≈ $420,000

Implementation cost: $40,000

First-year ROI: ~1,450%

Use Case #8: Shipping & Logistics Document Processing

The problem

Shipping and logistics operations rely heavily on accurate documentation to move goods efficiently. Manual handling introduces multiple challenges:

- Bills of lading variations, with different formats from carriers and freight forwarders

- Customs documentation often requires a detailed review to prevent delays or penalties

- Proof of delivery management, with scanned receipts or emails to verify shipments

- Carrier invoice reconciliation, which is time-consuming and error-prone

Manual processes slow shipment tracking, increase operational costs, and risk costly disputes or delays.

The AI approach

AI document automation transforms logistics workflows, making document processing faster, more accurate, and fully traceable:

- Multi-format shipping document extraction, automatically capturing fields from PDFs, emails, and scanned documents

- Automatic tracking number capture, updating systems instantly for real-time shipment visibility

- Exception identification, flagging missing or incorrect data for immediate review

- Carrier invoice matching, reconciling charges against shipments to prevent overpayments or disputes

With AI handling repetitive tasks, logistics teams can focus on operational efficiency and customer satisfaction.

Real ROI numbers

Companies implementing AI for logistics document automation see significant gains:

- Document processing time: ~85% reduction

- Shipment tracking accuracy: 99%+

- Invoice dispute resolution: 60% faster

Automation reduces labor costs, minimizes errors, and improves both delivery reliability and vendor relationships.

ROI calculation example:

- Monthly shipments processed: 10,000

- Time saved per shipment: ~15 minutes

- Labor cost: $25/hour

Annual labor savings:

10,000 × 15 min × 12 months ÷ 60 × $25 ≈ $750,000

Invoice dispute resolution savings: ~$100,000/year

Implementation cost: $80,000

First-year ROI: ~1,100%

Use Case #9: Healthcare Patient Records & Medical Forms

The problem

Healthcare providers face significant administrative burdens in managing patient documentation. Common challenges include:

- Patient intake forms, both paper and digital, require manual data entry

- Referral document processing is often scattered across departments or email

- Lab results routing, where delays can affect clinical decisions

- Insurance verification, which is time-consuming and prone to errors

Manual handling slows patient check-ins, increases administrative costs, and contributes to higher claim denial rates.

The AI approach

AI-powered document automation addresses these challenges by streamlining data capture and workflow management:

- Medical form extraction, including handwriting recognition for paper forms

- EHR integration automatically updates electronic health records with extracted data

- Insurance eligibility automation, reducing verification time, and improving claim accuracy

With automation, healthcare teams can focus on patient care rather than paperwork.

Real ROI numbers

Hospitals and clinics using AI-driven patient document processing report:

- Patient check-in time: 12 minutes → 3 minutes

- Administrative staff time: 40% reduction

- Claim denial rate: 15% → 5%

Faster intake, fewer errors, and improved documentation directly improved revenue capture, compliance, and patient satisfaction.

ROI calculation example:

- Monthly patients processed: 2,500

- Staff time saved per patient: 9 minutes

- Labor cost: $25/hour

Annual staff savings: 2,500 × 9 min × 12 months ÷ 60 × $25 ≈ $112,500

Revenue recovered from reduced denials: ~$75,000/year

Implementation cost: $50,000

First-year ROI: ~375%

Use Case #10: Real Estate & Mortgage Document Processing

The problem

Mortgage and real estate transactions involve a complex stack of documents that must be accurate and compliant:

- Mortgage application document chaos, with inconsistent formats and missing information

- Income and asset verification, often requiring manual review of pay stubs, tax returns, and bank statements

- Property document processing, including title deeds, appraisals, and inspection reports

- Compliance documentation is critical for regulatory requirements

Manual processing leads to delays, higher operational costs, and frustrated applicants.

The AI approach

AI document automation simplifies mortgage workflows, ensuring accuracy, speed, and compliance:

- Multi-document mortgage packet extraction, automatically capturing key data across PDFs, emails, and scanned documents

- Income verification automation, validating income and assets against predefined rules

- Property record parsing, extracting relevant information from deeds, appraisals, and inspection reports

- Compliance checklist completion, automatically flagging missing items or regulatory gaps

Automation allows loan officers to focus on approvals and client communication, reducing manual workload and operational risk.

Real ROI numbers

Mortgage lenders adopting AI report measurable improvements:

- Application processing time: 7–10 days → 2–3 days

- Document collection errors: 70% reduction

- Loan officer capacity: +100%

Faster approvals, fewer errors, and increased throughput lead to better customer experience and higher loan volumes.

ROI calculation example:

- Monthly mortgage applications: 500

- Time saved per application: ~5 days

- Labor cost per application: $200

Annual labor savings: 500 × 5 days × 12 months × $200 ≈ $6,000,000

Error reduction savings: ~$250,000/year

Implementation cost: $400,000

First-year ROI: ~1,550%

ROI Comparison & Selection Guide

To help organizations assess AI document automation opportunities, here’s a summary of the 10 use cases with key ROI metrics:

| Use Case | Avg Time Savings | Typical Breakeven | 1st Year ROI Range | Implementation Complexity |

|---|---|---|---|---|

| Invoice Processing & AP | 87% | 3–6 months | 600–700% | Medium |

| Purchase Order Processing | 85% | 4–6 months | 450–550% | Medium |

| Expense Reports & Receipts | 70% | 3–5 months | 300–400% | Low |

| Customer Onboarding & KYC | 80% | 3–6 months | 400–500% | Medium |

| Insurance Claims Processing | 80% | 4–7 months | 350–450% | High |

| Contract & Legal Analysis | 90% | 6–9 months | 500–600% | High |

| HR Document & Resume Screening | 80% | 3–6 months | 350–450% | Medium |

| Shipping & Logistics | 85% | 4–6 months | 800–1,100% | Medium |

| Healthcare Patient Records | 60% | 3–5 months | 350–400% | Medium |

| Real Estate & Mortgage | 70% | 3–6 months | 1,000–1,500% | Medium |

This table highlights both quantitative ROI and the relative complexity, giving leaders a clear view of which automation projects can deliver the fastest returns.

Which use case is right for you?

Not all document automation projects are created equal. Your ideal starting point depends on:

- Document volume: High-volume repetitive tasks yield the fastest ROI

- Document variety: Standardized formats are easier to automate first

- Current pain point: Focus on processes causing delays, errors, or compliance risk

- Team size: Larger teams benefit more from labor savings

Decision tree approach:

- Do you process more than 1,000 documents per month? → Yes → Consider high-volume use cases like Invoice, PO, or Shipping automation

- Are your documents highly variable (PDFs, emails, images)? → Yes → Use AI-powered parsers like Customer Onboarding or Legal Contracts

- Are compliance errors or denials a concern? → Yes → Prioritize Healthcare, Insurance Claims, or Mortgage

- Limited IT resources? → Start with low-complexity automation like Expense Reports

Implementation success factors

Even high-ROI projects can fail without proper execution. Key factors for success include:

- Change management: Communicate the benefits and train staff to embrace automation

- Data quality: Clean, consistent input documents are critical for AI accuracy

- Integration planning: Ensure your automation tool integrates with ERP, EHR, HRIS, or CRM systems

- Pilot vs. full deployment: Start small, measure results, then scale

Expert Insight: “The ROI of document automation isn’t just about AI technology, it’s about preparing your people, processes, and systems to use it effectively,” says Sarah Lee, Automation Consultant at TechProcess Advisors.

By assessing your organization across these dimensions, you can select the right use case, maximize ROI, and scale automation successfully.

Turning AI Document Automation Into Measurable ROI

Across finance, operations, HR, legal, healthcare, logistics, and real estate, one pattern is impossible to ignore: AI document automation consistently delivers measurable, repeatable ROI. The ten use cases covered in this guide show that automation isn’t limited to one department or document type; it scales across departments and document types wherever manual processing, errors, and delays occur.

More importantly, Techling stated that ROI from document automation isn’t vague or theoretical. It’s built on clear, trackable metrics: time saved (60–70% overall), labor costs reduced ($8–$12 per document), errors eliminated (up to 99% accuracy), compliance risks avoided (via audit trails), and revenue unlocked through faster processing (e.g., 80% quicker approvals). Whether it’s cutting invoice processing costs by 70–80%, reducing onboarding time from days to hours, or doubling team capacity without hiring (e.g., 135 hours/month saved in marketing ops), the financial impact is predictable once document volume and workflows are understood.

These use cases rarely exist in isolation. Organizations that start with one high-impact workflow, like invoices or onboarding, often expand into adjacent processes such as contracts, expenses, or claims, leading to compound ROI from shared AI models and 40–50% cross-team efficiency gains, according to Sensetask. For example, automating purchase orders after invoices can add another 40% operational cost cut.

The key takeaway is simple: start where the pain is highest. Identify the document-heavy process slowing your team down, calculate the cost of manual work, and automate that first. From there, scaling becomes straightforward.

Frequently Asked Questions

As more organizations invest in AI-powered document automation, questions about return on investment, timelines, and use cases naturally arise. Below are the most common questions teams ask when evaluating document automation for real, measurable ROI.

-

What’s the average ROI of AI document automation?

-

Most organizations achieve 300–400% ROI within the first year, especially when automating high-volume processes such as invoice processing, claims, onboarding, or expense management. Savings come from reduced labor costs, faster processing, fewer errors, and improved compliance.

-

Which document automation use case delivers the highest ROI?

-

Invoice processing, insurance claims, and customer onboarding often deliver the highest and fastest ROI due to volume, complexity, and the high cost of manual handling.

-

Do small businesses see ROI from document automation?

-

Yes. Small and mid-sized businesses often see ROI faster than enterprises because automation frees limited staff from repetitive tasks and enables growth without additional headcount.

-

How do you measure document automation ROI?

-

ROI is typically calculated using:

- Time saved × labor cost

- Error reduction and rework avoidance

- Faster processing and improved cash flow

- Compliance and risk reduction Then subtract implementation and subscription costs.

Last updated on