Key Takeaways

- AI is revolutionizing invoice processing by cutting costs and speeding payments. Manual processing averages $22.75 per invoice.

- Adoption rates differ globally, with North America leading and APAC showing rapid growth. Technology sectors demonstrate the highest uptake.

- AI cuts processing time by 60%+, lowers fraud, and offers quick ROI.

- Challenges include privacy, legacy systems, and adoption, but AI platforms handle these well.

The global accounts payable (AP) landscape is rapidly transforming as organizations shift from manual and template-based workflows to AI-powered invoice processing.

Manual invoice handling is increasingly seen as inefficient: PR Wire reports that the average cost to process a single invoice manually is $22.75, reflecting high labor overhead and time burdens.

Businesses across industries are recognizing that AI technologies can significantly improve accuracy, reduce costs, and accelerate payment cycles while ensuring compliance with evolving regulations.

Recent market reports indicate that the adoption of AI in AP processes has surged in the past three years, driven by the need to handle growing invoice volumes efficiently and to integrate financial operations with digital transformation strategies. From multinational enterprises to small and mid-sized businesses, AI invoice processing is no longer a future consideration; it is becoming a competitive necessity.

Market US reported that the AI-driven invoice processing market is projected to grow dramatically, from USD 2.8 billion in 2024 to USD 47.1 billion by 2034, at a compound annual growth rate (CAGR) of 32.6 %.

This article examines the latest AI invoice processing trends, including global adoption rates, sector-specific usage, cost savings, ROI benchmarks, and emerging opportunities. By consolidating insights from leading research firms and industry analyses, we aim to provide decision-makers with an authoritative view of the market landscape and the strategic implications for their AP operations.

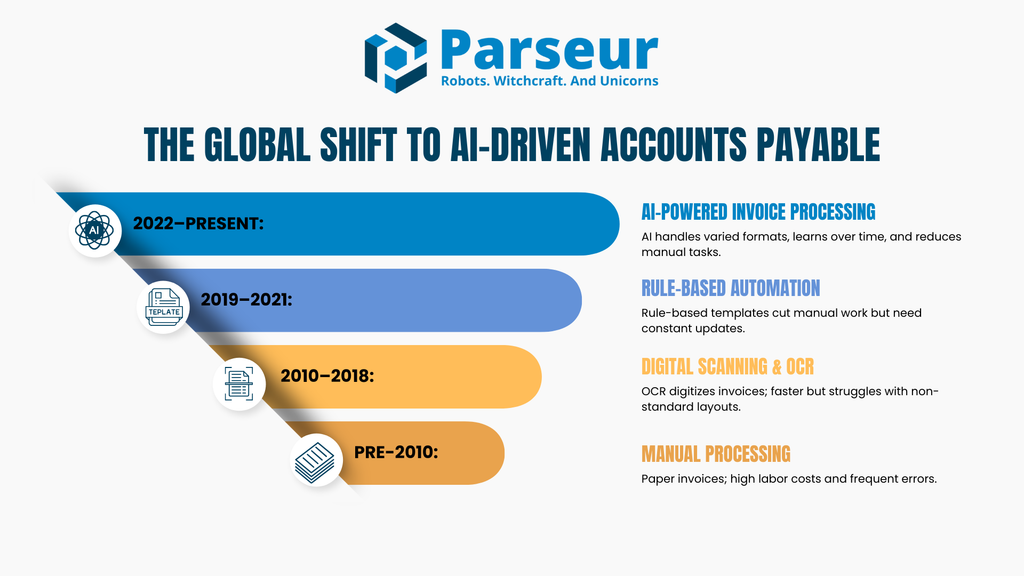

The Global Shift To AI-Driven Accounts Payable

Accounts payable (AP) processes have evolved significantly over the past decade, moving from paper-based systems to digital document management and, more recently, AI-powered invoice processing. Initially, many organizations adopted optical character recognition (OCR) to digitize invoices. While OCR improved speed and reduced manual data entry, it often struggled with unstructured formats and complex layouts.

In 2026, AI-driven AP solutions have made substantial inroads. Unlike traditional OCR, AI-based parsing engines can handle a variety of formats, adapt to different invoice designs, and improve accuracy over time through machine learning. This shift enables organizations to enhance operations without extensive technical intervention.

Industry data underscores this transformation:

- Medius reported that around 75% of AP departments now use some form of AI or automation, encompassing data extraction, classification, and workflow optimization.

- Ascend stated that high-performing teams are now achieving 60–80% touchless invoice processing, automated data extraction, and routing without human intervention.

These figures demonstrate that AI invoice processing is no longer on the horizon; it’s becoming a foundational capability in modern financial operations. By lifting the burden of manual tasks, AI enables AP teams to evolve from transactional support units into strategic contributors to business performance.

Adoption Rates By Region

AI invoice processing trends vary significantly across global markets, influenced by regional economic priorities, labor costs, and regulatory frameworks. While adoption is expanding worldwide, the pace and drivers of implementation differ from one region to another.

According to Verified Market Reports, here are the adoption rates by region:

North America

Holds the largest share, contributing approximately 40% of the global AP automation software market in 2023. This dominance is supported by strong technological infrastructure, early adoption of AI-driven tools, and a mature ecosystem of vendors and service providers. Businesses in the U.S. and Canada are also leveraging automation to meet growing demands for accuracy, speed, and compliance in financial operations.

Asia-Pacific (APAC)

Represents 30% of the 2023 market share and is the fastest-growing region. This rapid expansion is fueled by widespread digital transformation initiatives, government-backed technology adoption programs, and the increasing need for scalable, cloud-based solutions. Countries such as China, India, and Singapore are leading the charge, with SMEs and large enterprises embracing automation to stay competitive in a global market.

Europe

It will account for around 20% of the market in 2023, with adoption primarily driven by strict regulatory compliance requirements such as GDPR and the region’s strong emphasis on data security. European companies are integrating structured automation into finance workflows to improve efficiency while maintaining high standards for data governance. The region’s push toward sustainable, paperless operations is also accelerating adoption.

These figures underscore APAC’s rapid growth trajectory, while North America continues to lead in adoption volume and infrastructure strength.

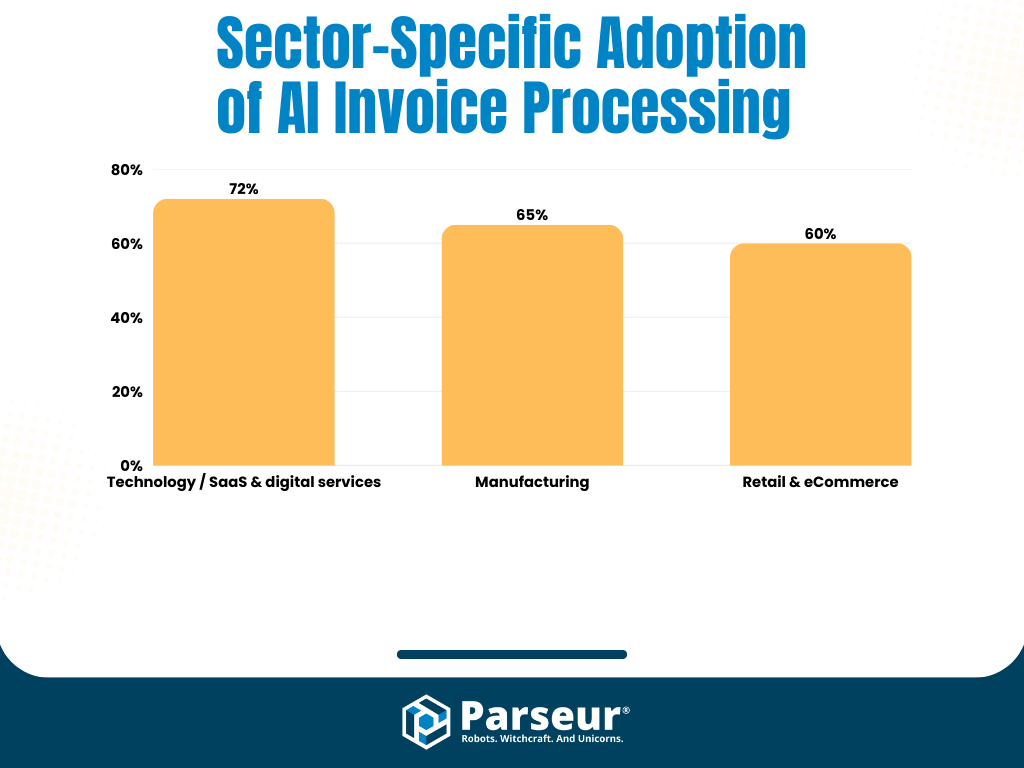

Sector-Specific Adoption of AI Invoice Processing

Adoption levels of AI invoice processing vary notably across industries, reflecting differences in transaction volumes, system complexity, and automation maturity.

According to PMarketResearch, here are the sectors leading in adoption rates:

Technology / SaaS & digital services

The technology sector drives AP automation adoption with 72% of tech companies implementing automated invoice processing tools. This leadership is rooted in a strong digital-first culture, leveraging scalable systems, cloud architecture, and API integrations to enable faster deployments and higher accuracy.

Manufacturing

Manufacturing closely follows, with 65% adoption in the sector. The complexity of supply chains and diverse supplier invoice formats necessitates intelligent parsing and ERP-ready automation capabilities.

Retail & eCommerce

Retail and eCommerce businesses report adoption rates near 60%. High invoice volumes and tight margins create a strong incentive for automation to reduce manual labor, cut processing delays, and minimize errors.

Average Costs & ROI Across Markets

AI invoice processing offers significant cost savings compared to manual workflows, making it a compelling investment for organizations of all sizes. According to Mosaic Corp, as of mid-2025, best-in-class AP departments using smart automation spend just $2–$4 per invoice, representing more than an 80% reduction compared to manual methods, which can cost $12–$15 per invoice.

Beyond cost reduction, automation also shortens processing times by up to 70%, helping businesses capture early payment discounts, improve cash flow, and reduce late payment penalties.

The return on investment (ROI) varies by organization size:

- Small and mid-sized businesses (SMBs) typically achieve payback within 6–9 months after implementation.

- Enterprises often see payback within 3–6 months, thanks to higher invoice volumes and greater operational scale.

These savings and efficiency gains position AI invoice processing as both a cost-control strategy and a driver of competitive advantage in financial operations.

Manual Invoicing Challenges In 2026

While AI invoice processing adoption continues to grow, organizations face several obstacles that can slow or complicate implementation.

In 2026, only 8% of finance teams are fully automated, while 60%-64% remain partially or significantly dependent on manual tasks. Leading challenges include budget limitations (29%), difficulty integrating AI with legacy ERP systems (28%), and a shortage of skilled talent (15%), as mentioned by Rillion.

Understanding these challenges is critical for designing effective AP automation strategies.

1. Data privacy and compliance

Global data protection regulations, such as GDPR in Europe and CCPA in California, require strict controls over financial information. Businesses must ensure that AI processing tools meet regulatory requirements for data storage, transfer, and access control.

2. Legacy ERP integration

Older enterprise resource planning (ERP) systems may lack the APIs or compatibility needed for seamless AI integration. Bridging this gap often requires middleware solutions or phased implementation plans.

3. Handling unstructured or non-standardized invoices

Invoices can vary widely in format, especially when dealing with international suppliers. Manual intervention may still be needed without an AI capable of interpreting diverse layouts.

4. Employee adoption resistance

Change management remains a significant factor. Some finance teams are hesitant to transition to AI-driven processes due to concerns over job displacement or perceived complexity.

Modern AI-powered invoice processing platforms are overcoming these challenges by combining adaptive machine learning with user-defined templates for edge cases. This dual approach enables accurate, compliant, and scalable automation without the heavy IT investment often associated with older automation methods.

Opportunities On The Horizon

Advancements in invoice processing technology and shifting market demands create new opportunities for efficiency and innovation in accounts payable operations. These advancements enhance back-office functions and transform AP into a strategic driver of business growth and resilience.

1. AI for fraud detection

AI-powered systems are redefining fraud detection in AP by scanning invoices and payment transactions to flag anomalies early (e.g., duplicate invoices, mismatched vendor data, or irregular amounts).

2. Predictive analytics for cash flow optimization

AI-driven predictive models can forecast payment trends, supplier behaviors, and seasonal invoice spikes. By anticipating cash flow needs, finance teams can make more informed decisions on payment scheduling, early-payment discounts, and working capital allocation.

3. Multi-currency, real-time processing for global supply chains

With cross-border trade increasing, businesses require systems to handle multiple currencies and process invoices in real time. AI can automate currency conversions, apply local tax rules, and ensure compliance with diverse regulatory environments.

For organizations looking to stay ahead, these opportunities represent more than incremental improvements; they offer strategic advantages in agility, transparency, and financial control.

What Does This Mean For Businesses?

The data from global reports highlights a clear shift toward automation in accounts payable. With adoption rates steadily increasing across regions and industries, organizations that delay implementation risk falling behind more agile competitors. The statistics also confirm that AI invoice processing delivers tangible cost savings, faster payment cycles, and improved accuracy; benefits that directly impact profitability and operational efficiency.

Market Growth Report’s study revealed that enterprises using accounts payable software reduce invoice processing time by an average of 62%, cutting the cycle from 20.8 days to just 7.9 days per invoice. Additionally, approximately 68% of businesses report a decrease in financial fraud risks after implementing automated AP solutions.

The most effective approach for decision-makers is to begin with low-risk, high-volume invoice categories. This allows AP teams to validate performance, measure ROI, and refine processes before expanding to more complex invoice types. Such a phased strategy minimizes disruption and ensures higher employee adoption.

Business leaders can reference industry benchmarks and performance metrics to further evaluate readiness and tool selection. Understanding the expected payback period, average cost per invoice, and integration capabilities can help align technology investments with organizational goals.

The global adoption of AI-driven invoice processing is no longer a trend; it has become the operational standard for accounts payable. Across regions and industries, businesses are leveraging automation to reduce costs, accelerate payment cycles, and improve compliance. With proven ROI and rapidly maturing technology, the case for implementation has never been stronger.

Organizations that start with targeted, high-volume invoice categories can achieve quick wins and build momentum for broader adoption. By staying informed about market developments and leveraging reliable benchmarking data, finance leaders can make strategic decisions that position their AP departments as value-adding partners within the business.

For those ready to implement these insights, Parseur offers a powerful and flexible solution. With its intuitive AI-based parsing engine, Parseur easily handles diverse invoice formats, integrates seamlessly into your tech stack, and requires no technical setup. Thousands of organizations rely on Parseur to automate data extraction and optimize AP workflows efficiently and securely.

Frequently Asked Questions

As adoption of AI invoice processing grows worldwide, many decision-makers still have practical questions about its capabilities, limitations, and applications. Below, we address some of the most common inquiries beyond the core market trends discussed in this article.

-

How does AI invoice processing work with multiple languages?

-

Many AI-powered invoice processing tools can recognize and extract data from invoices in different languages using machine learning and optical character recognition. This capability is especially useful for multinational companies handling cross-border transactions.

-

Can AI invoice processing handle handwritten invoices?

-

While accuracy rates for handwritten documents vary, advanced AI solutions can interpret legible handwriting, especially when paired with preprocessing techniques like image enhancement. However, typed or printed invoices generally yield higher accuracy.

-

Is AI invoice processing secure for sensitive financial data?

-

Yes. Leading providers follow strict data security protocols such as encryption, role-based access controls, and compliance with standards. Businesses should verify a vendor’s compliance credentials before implementation.

-

What industries benefit most from AI invoice processing?

-

Beyond retail, manufacturing, and SaaS, the healthcare, logistics, and hospitality sectors are increasingly adopting AI invoice processing to manage high transaction volumes and complex billing structures.

-

Can AI invoice processing integrate with existing accounting software?

-

Most modern solutions offer native integrations or API connections with popular accounting platforms like QuickBooks, Xero, and NetSuite, enabling a seamless transfer of extracted data into financial systems.

Last updated on