What is mortgage contracts automation?

A mortgage contract is a legal agreement between a borrower and a lender that outlines the terms of a loan used to purchase or refinance real estate. These contracts detail essential terms, such as the loan amount, interest rate, repayment schedule, and property information. AI technologies speeds up the data extraction process which improve the efficiency and accuracy.

How to extract data from mortgage contracts with AI?

Set up your AI parser within minutes in 3 simple steps.

-

1. Simply upload your mortgage contracts

Send your mortgage contracts to Parseur via email or directly upload them.

-

2. AI data processing

The data is instantly extracted with our AI tool.

-

3. Automated export

The extracted data is then seamlessly integrated into your contract management system, or legal software.

Trusted by thousands of happy businesses

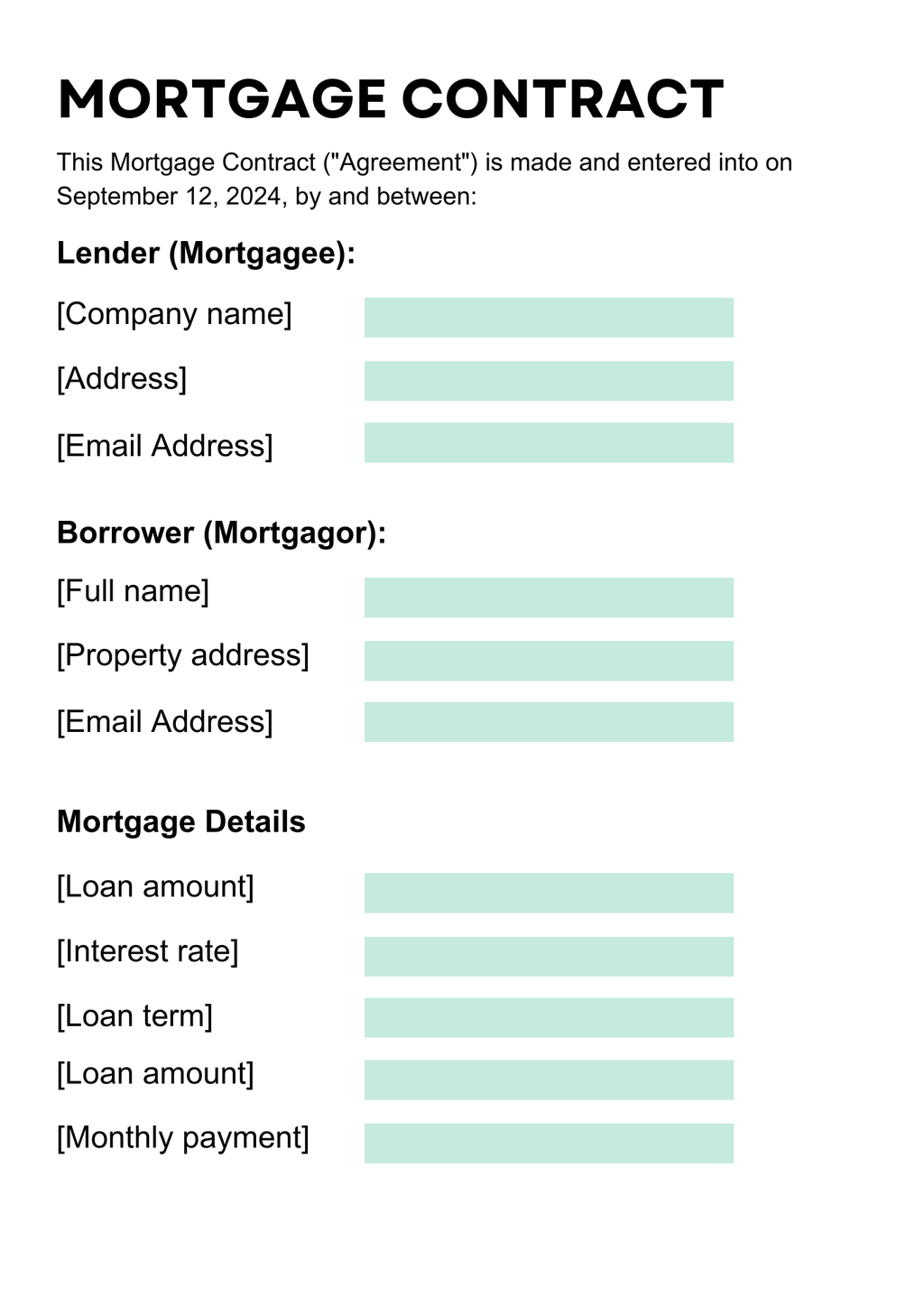

What fields can Parseur extract from mortgage contracts?

Below is a list of the most commonly extracted fields from mortgage contracts. With Parseur, you have the flexibility to customize this list by adding, renaming, or removing fields as needed.

Parseur is designed to support mortgage contracts automation in any language and format.

-

Sample value

-

Text (multi-lines)

CompanyName

The name of lender.

Sunrise Financial Services, Inc.

-

Text (multi-lines)

CompanyAddress

The address of the lender.

500 Capital Blvd, Suite 900, New York, NY 10001

-

Text (multi-lines)

Email

The email of the lender.

-

Text (multi-lines)

CompanyName

The name of the borrower.

James and Sarah Wilson

-

Text (multi-lines)

CompanyAddress

The address of the borrower.

789 Pinecrest Lane, Springfield, IL 62704

-

Text (multi-lines)

Email

The email of the borrower.

-

Text (multi-lines)

LoanAmount

The loan amount.

$350,000.00

-

Text (multi-lines)

InterestRate

The interest rate for the loan.

4.5%

-

Text (multi-lines)

LoanTerm

The term for the mortgage loan.

30 years

-

Text (multi-lines)

MonthlyPayment

The monthly payment of the loan.

$1,773.40

Why choose Parseur for data extraction from mortgage contracts?

Parseur sets your legal data management on autopilot, allowing you to focus on your core business.

-

Reduced Processing Time

Accelerates the process of reviewing and managing mortgage contracts helping you close deals faster.

-

Increased Accuracy

Ensure accurate capture of all important mortgage terms, minimizing risks of errors or missed details.

-

Cost Savings

Lower operational costs through automation of manual data entry tasks and reduce the need for additional staffing, even during peak periods.

-

Enhanced Data Security

Maintain accurate records and streamline the management of your legal obligations.

Parseur was the most complete, the one that got the best recognition text, and the one that seemed most professional.

FAQ about mortgage contracts automation

All your questions about our legal automation tool.

-

Parseur has native integrations with Zapier, Make and Power Automate that enable you to export data to Docusign or PandaDoc, for example.

-

No coding skills are required to use Parseur. Our AI and visual editor allows you to create custom templates and parsers with ease.

-

Our OCR engine was extensively trained to recognize text in more than 60 languages, including English, Spanish, French, German, Dutch, Russian, Japanese, Korean, Chinese, Hebrew, Arabic, Hindi, and more. Furthermore, it has experimental support for another 160+ languages.

-

Security is our top priority. Parseur uses advanced encryption standards to protect your data. We adhere to strict data privacy regulations and implement best practices to ensure your mortgage contracts information is secure and confidential.

-

Definitely! Parseur can process thousands of documents within minutes.

-

You can review our pricing plans here.

Related use cases and blog articles

40,000+ businesses can't be wrong

Thousands of companies from all around the world already trust Parseur with their data extraction processes. Join them today!