What is Form 1040?

Form 1040 is the standard U.S. federal income tax return form used by individuals to report their income, deductions, and credits to the Internal Revenue Service (IRS). It is essential for determining the amount of taxes owed or refunds due for taxpayers in the United States.

Processing Form 1040 manually is time-consuming and prone to errors. Automating data extraction with AI-powered OCR helps accountants, tax professionals, and businesses streamline tax filing and compliance processes.

How does Parseur extract data from Form 1040?

Set up your AI parser in minutes and automate data extraction from tax return forms in three simple steps.

-

1. Upload your tax return form

Send your tax return form via email or directly upload it to your Parseur mailbox.

-

2. AI data processing

Parseur’s AI recognizes and extracts key fields from your form, such as taxpayer details, income, deductions, and credits, and more, with high accuracy.

-

3. Automated export

Export the extracted data into structured formats like CSV, Excel, or integrate directly with your accounting software for seamless integration.

Trusted by thousands of happy businesses

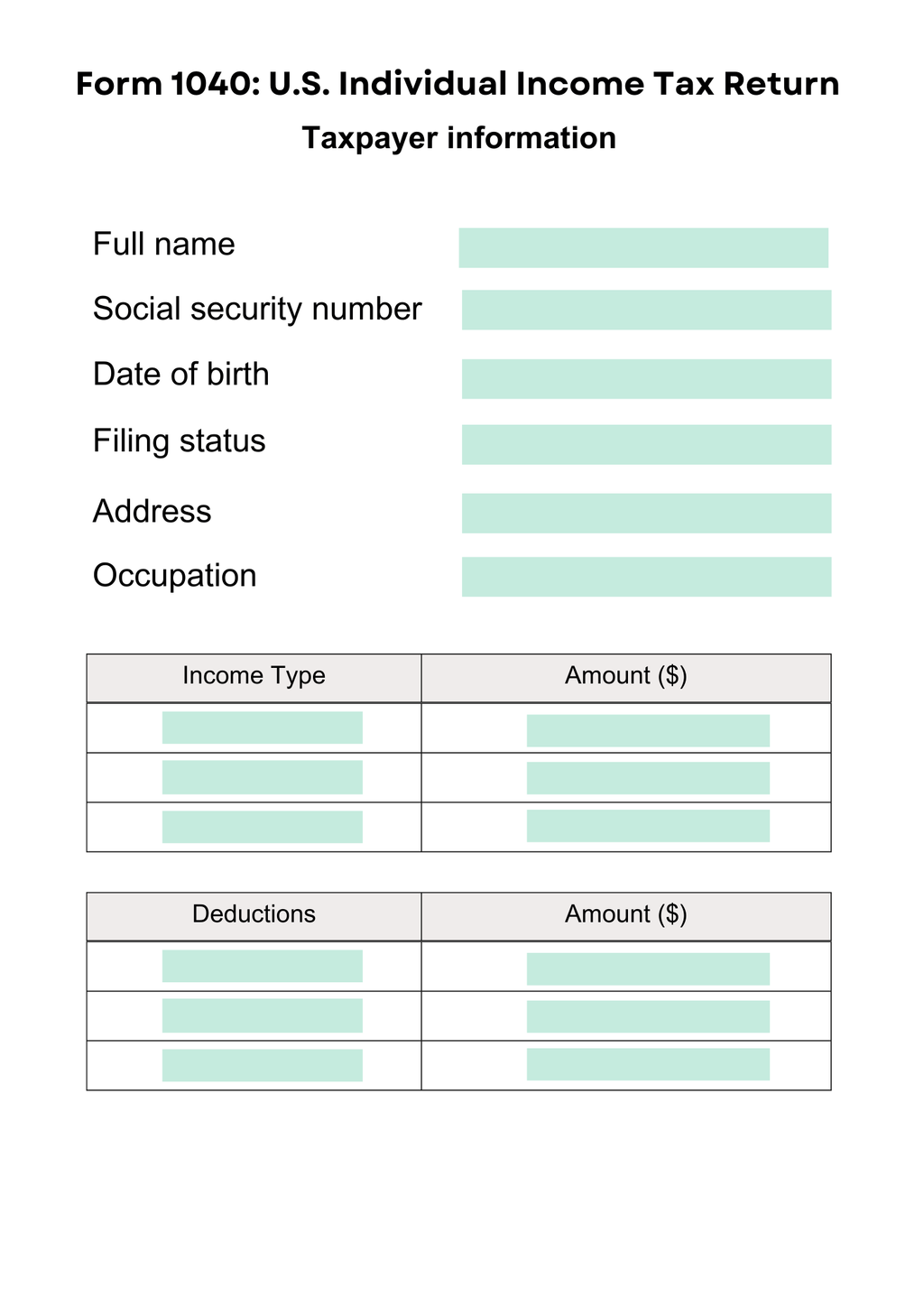

What fields can Parseur extract from U.S. Individual Income Tax Return Forms?

Here are the most commonly extracted fields from the form 1040. Parseur also allows you to tailor the extraction to suit your specific needs, including custom fields.

-

Sample value

-

Text (multi-lines)

TaxPayerName

The full name of the primary filer.

John Doe

-

Text (multi-lines)

SSN

The taxpayer's Social Security Number.

12-3456789

-

Date

DateOfBirth

The date of birth of the tax payer.

1992-12-31

-

Text (multi-lines)

FilingStatus

The tax filing status.

Single

-

Text (multi-lines)

Address

The address of the tax payer.

456 Elm Street, Chicago, IL 60616

-

Text (multi-lines)

Occupation

The current occupation of the tax payer.

Growth Coffee Manager at Espresso Ltd

-

Table (list of items)

Income

A list of income type and amount.

Income type Amount Wages, Salaries, Tips (W-2) $72,500 Taxable Interest $500 Unemployment Compensation $1,200 Total Income $74,200 -

Table (list of items)

Deductions

A list of deductions and the amount.

Deduction Amount Standard Deduction (Single) $13,850

Why use Parseur for U.S. Individual Income Tax Return?

Automating the extraction of data from tax forms brings numerous benefits to insurance providers and brokers, improving both speed and accuracy.

-

Speed and Efficiency

Parseur allows for immediate data extraction from Form 1040, cutting down the processing time and ensuring quicker decision-making.

-

High Accuracy

Reduce human error in data entry with Parseur’s AI-powered OCR technology that ensures high-quality extraction of complex data fields.

-

Seamless Integration

Integrate the extracted data directly into your insurance management system, CRM, or export to other platforms for smooth operations.

-

Cost Reduction

By automating tax processing, you can reduce operational costs and increase productivity by eliminating the need for manual data entry.

I'm very impressed with the AI engine.

FAQ about AI tax processing

All your questions about tax automation answered.

-

Parseur integrates seamlessly with platforms like Zapier and Make, enabling easy exports to your accounting tools.

-

Yes, Parseur allows you to customize the parsing rules and extract fields beyond the standard tax form fields.

-

Parseur follows industry-standard encryption and security practices to protect your sensitive data at every step of the process.

-

Setup is fast and simple. You can be extracting data from tax forms in less than an hour.

-

Yes, Parseur is built for high-volume processing, handling thousands of tax forms efficiently without compromising accuracy.

-

Parseur supports over 60 languages, so it can easily process tax forms in languages such as Spanish, French, German, and more.

40,000+ businesses can't be wrong

Thousands of companies from all around the world already trust Parseur with their data extraction processes. Join them today!