Key Takeaways

- Automating tax workflows isn’t just convenient, it’s now essential for staying competitive and scaling efficiently.

- AI-powered platforms like Parseur help accountants process W-2s, 1099s, and receipts faster and more accurately.

- Choosing the right accounting tool depends on your firm's document volume, integration needs, and compliance requirements.

Tax season is critical for accounting professionals, tax preparers, and businesses. The pressure to process hundreds of documents quickly and accurately can be overwhelming. From W-2s and 1099s to invoices and receipts, these documents often arrive in various formats, clogging inboxes and slowing down workflows.

PWC Case Study indicates that 60% of the time spent on tax compliance is dedicated to data extraction, cleansing, and analysis, with an additional 10% paid on internal administration, leaving little time for preparation and review.

That's where automation tools come in. Designed to reduce manual data entry and enhance document handling, these tools help tax professionals save time, lower the risk of errors, and focus more on strategic tasks. Whether you're a solo tax preparer or part of a large firm, adopting the right automation solution can dramatically transform your work during tax season.

This guide will explore some of the best tax automation tools. Each one offers unique features, from AI-powered data extraction to seamless integrations with accounting software. If you're looking to eliminate bottlenecks, speed up your processes, and improve data accuracy, you're in the right place.

Want to learn how automation can help you get through tax season faster? Read our guide to tax season automation to know more.

Selection Criteria For The Best Tax Data Extraction Tools

To help you find the right solution, we evaluated each tool based on the following criteria: accuracy, ease of use, integration capabilities, security, and scalability. These factors ensure that our recommended tools are powerful and practical for real-world tax workflows.

According to Wolters Kluwer, 27% of accounting firms already use AI tools in their workflows, and another 22% expect to adopt them within the following year. This highlights the growing demand for solutions that are both efficient and future-ready.

Accuracy

A good tax data extraction tool must reliably read forms. We prioritized platforms with strong OCR and AI capabilities that can accurately extract information from scanned documents like 1040s, W-2s, and invoices.

Ease of use

Whether you're a solo CPA (Certified Public Accountant) or part of a large team, your tool should be intuitive. We gave higher marks to non-technical setup platforms that require minimal process and training.

Integration with accounting/tax software

Smooth workflows matter. We looked for tools that connect easily with popular software like QuickBooks, Xero, Drake Tax, and UltraTax, allowing data to flow directly where needed.

Security & compliance

Handling financial and personal data requires secure tools. We favored platforms with strong data protection protocols and certifications, such as GDPR, SOC 2, and HIPAA (when applicable).

Scalability & pricing

Whether managing a few clients or hundreds, your solution should scale with you. We assessed whether tools offered fair pricing for small firms while still supporting the needs of larger organizations.

The Top 5 Tax Data Extraction Tools For 2026

Tax season is stressful enough; finding the right automation tool shouldn’t be. To help you find the right solution, we evaluated each tool based on its capabilities, reliability, and value during the busiest tax months. From solo practitioners to large firms, there’s a tool suited for every workflow and tax data challenge.

Parseur

Parseur is a powerful AI-driven document processing and email parsing platform built for speed and simplicity. Designed with accountants in mind, it intelligently extracts structured data from tax-related documents such as W-2s, 1099s, and receipts, whether they come as PDFs, scanned images, or email attachments.

With advanced parsing capabilities, Parseur ensures high accuracy even with complex or poorly scanned forms, reducing the risk of costly manual errors. It’s also built to support compliance needs and handle sensitive financial data with care, helping firms maintain accuracy and reduce the risk of manual errors. With reliability and security at its core, Parseur offers accountants peace of mind when managing confidential tax documents, especially during high-pressure filing seasons.

Key strengths for accountants:

- Processes PDFs, scans, and email attachments with high accuracy

- Automatically processes emails, PDFs, and scanned tax forms

- User-friendly, drag-and-drop setup for rapid onboarding

- Seamless export to Excel, Google Sheets, QuickBooks, Zapier, and other accounting tools.

Notable features for tax season:

- Bulk upload and batch processing

- Custom workflows and folder organization

- Auto-forwarding from inboxes for hands-free document intake

Best for: Small to mid-sized accounting firms or bookkeepers who handle multiple client documents and want to reduce manual entry.

Learn more about Parseur’s tax automation features.

Docparser

Docparser is a document parsing tool with advanced rule-based logic. It is ideal for users who need precision in extracting data from consistently formatted documents.

Key strengths for accountants:

- Great for forms with fixed layouts like W-2s or 1099s

- Highly customizable data extraction rules

Notable features for tax season:

- Data routing to accounting platforms

- PDF zoning for pinpoint accuracy

- Supports Zapier for workflow automation

Best for: Firms dealing with high volumes of standardized forms and needing control over parsing logic

Hubdoc

A cloud-based document and data capture tool that centralizes client receipts, invoices, and bank statements.

Key strengths for accountants:

- Syncs with Xero and QuickBooks Online

- Automatically fetches documents from banks and vendors

Notable features for tax season:

- Smart OCR categorization

- Audit-ready storage and export

- Mobile app for capturing receipts on the go

Pricing overview:

- Included with Xero Business Edition plans

- Also available as a standalone add-on

Best for: Accountants working with small business clients using Xero or QuickBooks

SurePrep by Thomson Reuters

SurePrep is a suite of 1040 tax automation tools designed to reduce manual data entry and improve accuracy.

Key strengths for accountants:

- Automatically extracts data from scanned documents and organizes it for tax prep

- Direct integration with UltraTax CS

Notable features for tax season:

- Source document verification and auto-tagging

- Improved client collaboration portal

- eSignature support

Pricing overview:

- Custom pricing based on firm size and software bundle

Best for: Mid-to-large tax firms that already use Thomson Reuters' ecosystem

ABBYY FlexiCapture

ABBYY FlexiCapture is a high-end data extraction platform built for scalability and precision. It uses AI and machine learning to handle various document types.

Key strengths for accountants:

- Handles both structured and unstructured documents

- Built-in validation workflows for compliance

Notable features for tax season:

- Intelligent document classification

- Data extraction from complex forms and handwritten notes

- Scalable server/cloud deployment

Pricing overview:

- Enterprise-level pricing upon request

Best for: Large firms and enterprise teams handling diverse tax documents at scale

How These Tools Compare

Choosing the right tax data extraction software means weighing key features, supported formats, and overall usability. Here’s a side-by-side comparison of the top tools to help you decide:

| Tool | Features | Supported Docs | Integrations | Ease of Use | Pricing Tiers |

|---|---|---|---|---|---|

| Parseur | Email & PDF parsing, auto-routing, AI-assisted layout detection | PDFs, scanned forms, emails | QuickBooks, Xero, Zapier, more | Very easy | Flexible, pay-as-you-go |

| Docparser | PDF parsing, data routing, webhook support | PDFs, image-based forms | Zapier, Google Sheets, Dropbox | Easy | Subscription-based |

| Hubdoc | Receipt capture, bank statement import, automatic sync | Receipts, bank docs, bills | Xero, QuickBooks Online | Moderate | Included in Xero plans |

| SurePrep | 1040 automation, workpapers, tax form extraction | 1040s, W-2s, 1099s | UltraTax CS, GoSystem Tax RS | Moderate | Custom quote |

| ABBYY FlexiCapture | Enterprise-level OCR, advanced AI, customizable extraction workflows | Scanned documents, PDFs. | SAP, Oracle, Microsoft Dynamics | Complex | Enterprise pricing |

Why Parseur stands out

Parseur strikes a rare balance between powerful AI capabilities and user-friendly design. Thanks to its ease of use, strong integration options, and scalable pricing, it's especially accountant-friendly, making it a top pick for small to midsize tax firms looking to boost efficiency without complexity.

On average, Parseur customers save 189 hours of manual data entry per month, equivalent to $7,557 in labor costs. This makes Parseur up to 98% more cost-effective than manual entry, with potential annual savings exceeding $90,000.

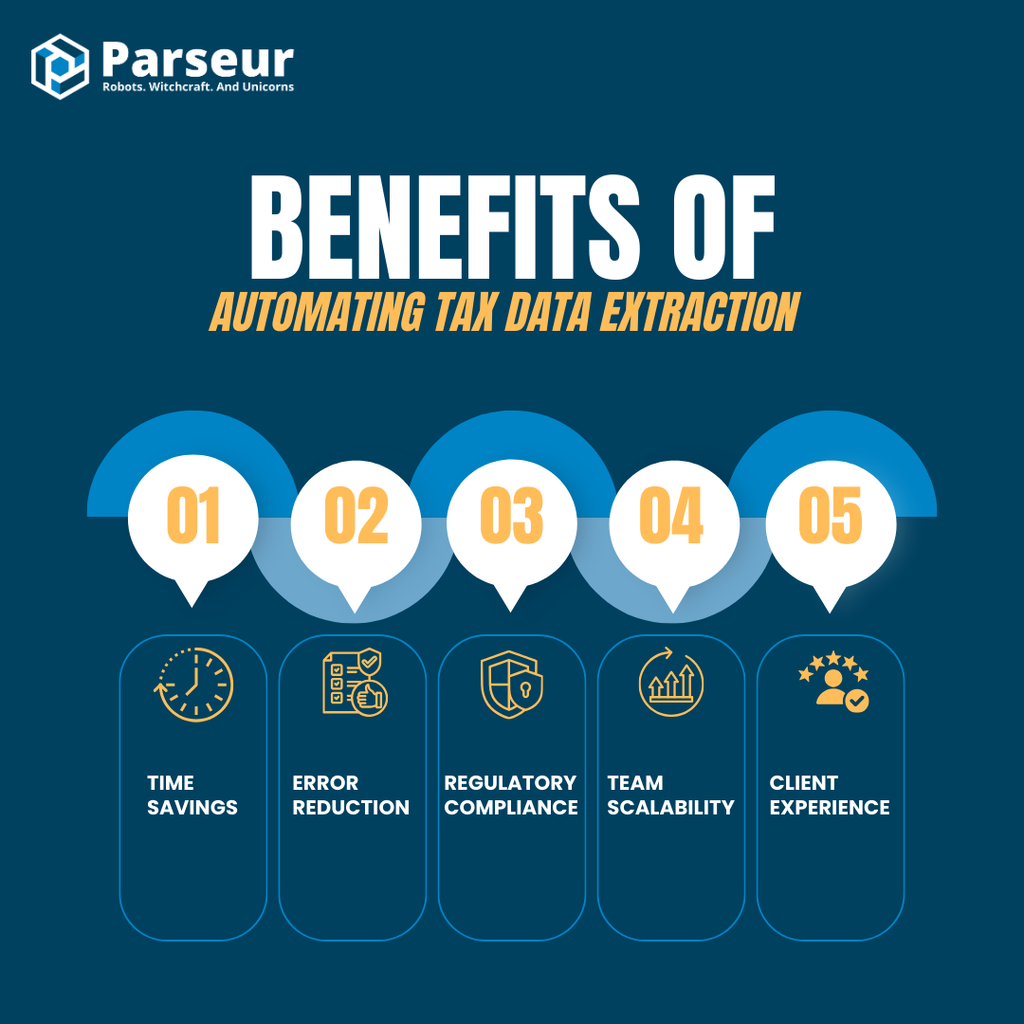

Key Benefits Of Automating Tax Data Extraction

Manual tax workflows can slow firms down, especially during peak filing periods. Automating data extraction brings measurable advantages for efficiency, accuracy, and growth.

According to McKinsey, up to 45% of work activities, especially repetitive tasks like data collection and entry, can be automated using existing technology. This enables professionals to focus on higher-value work and improve productivity.

Time savings

Automating the extraction process reclaims hours typically spent on manual data entry, especially during tax season crunch time.

Error reduction

Less human input means fewer chances for mistakes. Automation ensures consistent accuracy when pulling data from complex tax forms.

Compliance

Accurate data helps you stay audit-ready. Automation supports better alignment with IRS standards and improves documentation reliability.

Scalability

Grow your client base without growing your team. Automated workflows make it easy to handle increasing volumes of returns.

Client experience

Faster turnaround and fewer errors lead to happier clients and more referrals. Automation allows you to focus more on advisory and less on admin.

How To Choose The Right Accounting Tool For Your Firm

With many automation platforms available, finding the right fit depends on your firm's specific needs and priorities. Here's what to consider during your selection process:

Define your volume of documents

Estimate the number of tax documents your firm processes monthly or annually to ensure the tool can handle your scale efficiently.

Consider your integration needs

Select a solution that seamlessly integrates with your existing systems, such as accounting software, CRM systems, or cloud storage platforms.

Identify your compliance requirements

Ensure the tool meets industry data privacy and security standards, especially when handling sensitive financial or client information.

Test with free trials or pilots before committing

Many platforms offer trials; use them to assess performance, user experience, and how well the tool adapts to your workflow.

As tax season becomes increasingly demanding, accounting and finance professionals need smarter ways to handle growing volumes of documents with precision and speed. Manual data entry can’t keep up with current expectations, and that’s where automation steps in as a powerful ally.

Automating your tax document workflows doesn't just save time; it minimizes errors, ensures compliance, and allows your team to focus on higher-value tasks. Whether dealing with 1099s, W-2s, invoices, or client-submitted forms, using a document parser like Parseur gives you control, flexibility, and peace of mind.

Parseur is designed for accounting teams who need fast, accurate data extraction without the headache of manual input. With seamless integrations, easy setup, and scalability, it’s a leading choice for firms ready to enhance their operations and stay competitive.

Take the next step

Try Parseur for free and see how much smoother tax season can be with automation.

Frequently Asked Questions

Managing tax documents can be time-consuming and prone to errors, especially during peak seasons. Automation offers solutions to help reduce stress, save time, and improve accuracy. Here are some common questions about tax document automation.

-

What is tax document automation?

-

Tax document automation refers to using software or tools to extract, organize, and manage tax-related data without manual input. This includes processing receipts, invoices, forms like 1099s and W-2s, and organizing them into accounting systems or spreadsheets.

-

What are the benefits of automating tax document processing?

-

Automation saves time, reduces errors, improves compliance, and helps teams focus on higher-value tasks. Enhancing repetitive processes like data entry and categorization reduces tax season stress.

-

Is tax document automation secure?

-

Yes, most automation platforms follow strict security protocols, including data encryption, user permissions, and audit trails. However, choosing reputable tools that comply with financial and data protection regulations (like SOC 2 or GDPR) is essential.

-

Do I need to replace my accounting software to automate tax documents?

-

Not necessarily. Many automation tools are designed to integrate seamlessly with your existing accounting software, like QuickBooks, Xero, or even Google Sheets. Some tools use connectors like Zapier or API access to bridge the gap between systems.

-

Can small businesses benefit from tax document automation?

-

Absolutely. Small businesses often have limited resources and time. Automation can help them stay organized, avoid costly mistakes, and make tax season much more manageable, even without a full-time accountant.

Last updated on